Investor Gary Black, the managing director of The Future Fund LLC, thinks there's a good reason behind legacy automakers' refusal to work with Tesla Inc. (NASDAQ:TSLA) on autonomous driving.

EVs And Autonomy Are ‘Table Stakes,' Says Gary Black

In a post on the social media platform X on Tuesday, the investor shared his thoughts on Tesla collaborating with automakers on self-driving cars, saying that while car companies would allow their EVs to charge at Tesla Superchargers, they will "never allow" the EV giant to take control of "their full-self driving capabilities."

"EVs and unsupervised autonomy are table stakes for remaining in the automotive business," the investor said, adding that companies would prefer to develop their own EVs and autonomous driving tech instead.

Adding to his thread, Black also said that autonomous driving was "too important strategically for any auto manufacturer to just cede to TSLA" despite predicting that some companies could sign agreements with the EV giant to deploy FSD.

He outlined that this was why automakers "will continue to invest in autonomous vehicles," and shared that companies continue to "invest in EVs" despite profitability concerns.

FSD Licensing, European Debut

The comments follow the Tesla CEO's claims that the EV giant offered legacy automakers licensing opportunities for the Full Self-Driving (FSD) technology, but the companies either refused or suggested deployment programs that would've been "pointless" for the company, according to Musk.

FSD has also been in the news as Tesla is eyeing expanding the technology in Europe. The RDW (Netherlands Vehicle Authority) also confirmed that it has been working with Tesla over FSD testing procedures, eyeing a February 2026 timeline for the technology.

Tesla's Falling European Sales

The company also recorded a decline in sales in the European market during October, reporting an almost 50% decline in new registrations. The decline coincides with rival BYD Co. Ltd. (OTC:BYDDY) (OTC:BYDDF) recording more than a 200% surge in registrations in the region.

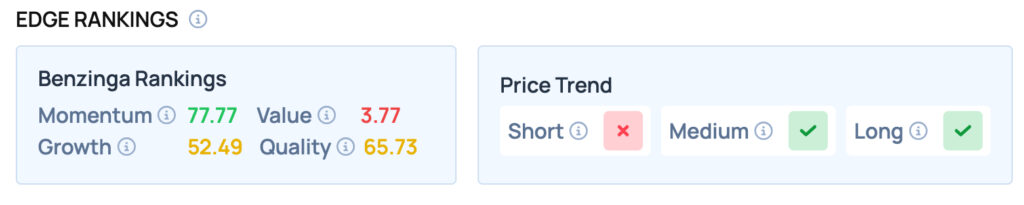

Tesla scores well on the Momentum metric, while offering satisfactory Quality and Growth, but poor Value. Tesla also has a favourable price trend in the Medium and Long term. For more such insights, sign up for Benzinga Edge Stock Rankings today!

Price Action: TSLA surged 0.39% to $419.40 at market close, but slipped 0.07% to $419.10 during after-hours trading, according to Benzinga Pro data.

Check out more of Benzinga's Future Of Mobility coverage by following this link.

Read Next:

Photo courtesy: Shutterstock