With a market cap of $89.7 billion, American Tower Corporation (AMT) is one of the largest global REITs and a leading independent owner, operator, and developer of multitenant communications real estate. With a portfolio of nearly 150,000 communications sites and a growing network of U.S. data center facilities, the company supports connectivity through towers, in-building systems, and distributed antenna solutions across multiple countries.

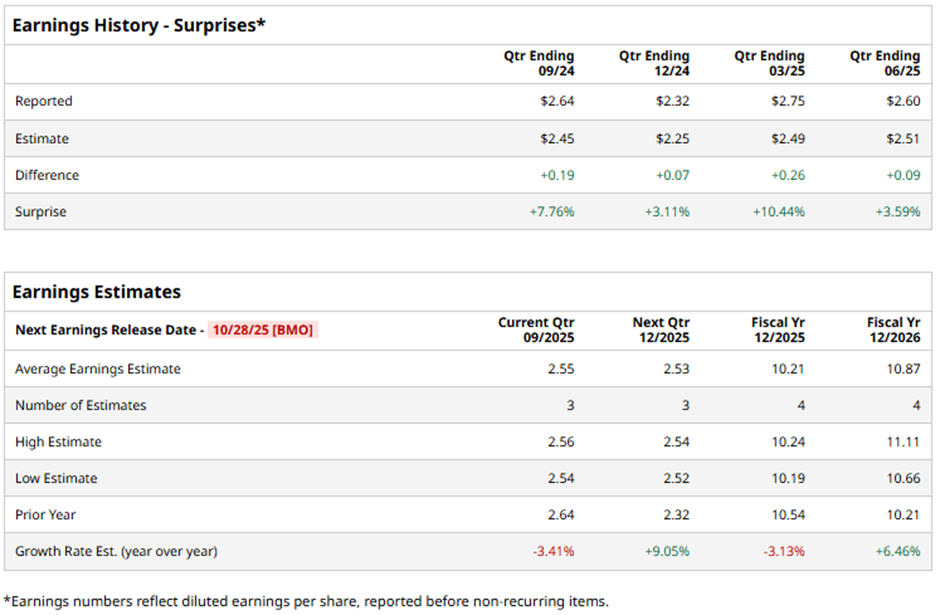

The Boston, Massachusetts-based company is expected to release its fiscal Q3 2025 results before the market opens on Tuesday, Oct. 28. Ahead of this event, analysts project American Tower to report an AFFO of $2.55 per share, a 3.4% decrease from $2.64 per share in the year-ago quarter. However, it holds a solid track record of consistently surpassing Wall Street's bottom-line estimates in the last four quarterly reports.

For fiscal 2025, analysts forecast the wireless infrastructure provider to report an AFFO of $10.21 per share, down 3.1% from $10.54 per share in fiscal 2024. Nevertheless, AFFO is expected to grow 6.5% year-over-year to $10.87 per share in fiscal 2026.

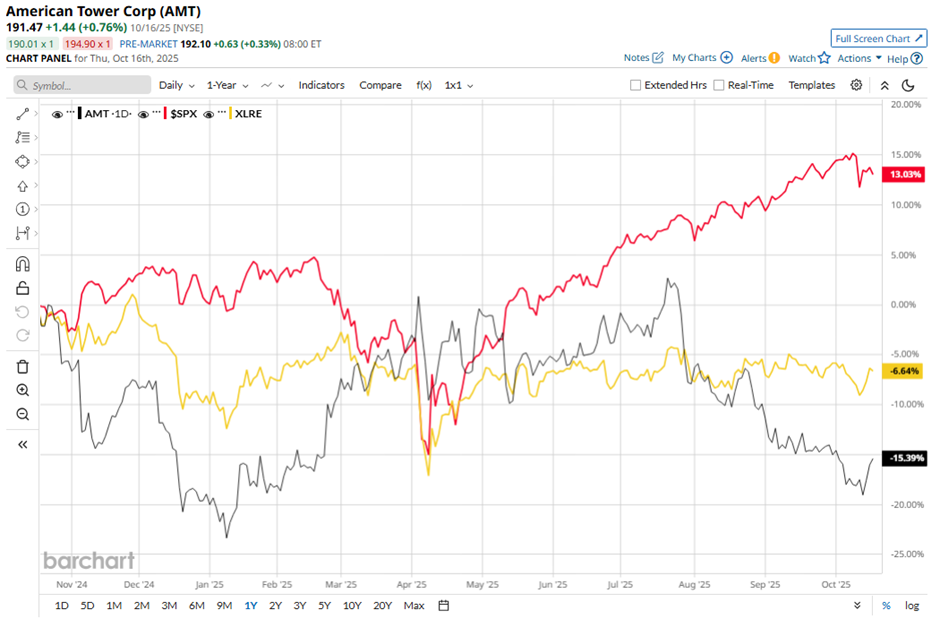

Shares of American Tower have declined 15.8% over the past 52 weeks, underperforming the broader S&P 500 Index's ($SPX) 13.5% gain and the Real Estate Select Sector SPDR Fund's (XLRE) 6.6% decrease over the same time frame.

Shares of American Tower fell 4.2% on Jul. 29 after the company slightly lowered its 2025 organic tenant billings growth outlook for the U.S. and Canada to about 4.3% and cut its leasing forecast by roughly $5 million. Management also reduced its 2025 net income forecast to $2.34 billion - $2.44 billion, citing weaker foreign currency impacts. Additionally, Q2 2025 net income dropped 58.1% year-over-year to $381 million, pressuring investor sentiment despite stronger-than-expected quarterly revenue of $2.63 billion.

Analysts' consensus view on AMT stock is strongly optimistic, with an overall "Strong Buy" rating. Among 23 analysts covering the stock, 16 suggest a "Strong Buy," one gives a "Moderate Buy," and six recommend a "Hold." The average analyst price target for American Tower is $240.30, indicating a potential upside of 25.5% from the current levels.