As anyone who has ever owned a car knows, driving is expensive in more ways than one — as the world reacted to Russia's invasion of Ukraine with sanctions and economic boycotts, gas prices around the world were one of the first to take a hit.

But along with the initial purchase of a car — another not-so-easy task given supply chain disruptions and a global semiconductor shortage — and rising cost of gas, maintenance and insurance are two other inescapable costs that can cause a serious dent on one's wallet.

"Households' transportation budgets are already under significant financial strain amid the highest inflation in 40 years, and almost every facet of driving is getting more expensive," Bankrate analyst Sarah Foster said in a statement.

"Used and new vehicles prices are up 41.2% and 12.4% from a year ago, respectively. Tire prices are up 15.4%, vehicle parts and equipment rose 11.3%, and Americans in March paid the highest prices on record at the gas pump.

How Much Does The Average Driver Spend on Car Insurance?

According to the Bankrate's annual True Cost of Auto Insurance report released on Monday, drivers nationwide spend an average of $1,771 a year on insurance.

U.S. Census data puts the average household income at $68,852 so this adds up to 2.57% of what the average American family earns a year.

Of course, this number varies greatly state by state and New York, Louisiana and Florida take the lead as one of the most expensive places in the country to stay insured — full coverage in New York adds up to $2,996 a year.

When looking at individual metropolitan areas, Miami is the place one should avoid driving if trying to save money — at $3,508, a year of coverage will take up 5.58% of the average household income. Maine, meanwhile, has very cheap insurance coverage at just $876 a year.

Boston, Seattle and Washington, D.C. are the cheapest major cities to get coverage while Miami, Tampa and Detroit are the most expensive.

Having Kids (Who Drive) Is Even More Expensive

Naturally, these types of general calculations don't say much given that so much about how much one pays for auto insurance depends on things like car use and driving history — adding a teen driver to a car will send your coverage up by an average of $2,081 a year.

Bankrate

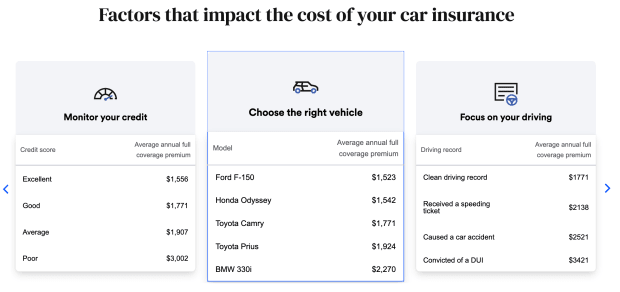

Covering a Ford (F) F-150 costs an average of $1,523 while a BMW 330i (BMW) will take a whopping $2,270. Even a single speeding ticket will increase average coverage to $2,138 while those with a clean record will pay $1,771.

Who Will be Able to Afford to Continue Driving?

Coupled with the rising cost of gas and regular inflation, these numbers are certainly alarming — a recent survey of 2,000 Americans found that the average one worried about money six times a day.

But at the same time, not driving is simply not an option for many Americans who live outside major cities with strong transportation systems.

According to recent numbers from the American Public Transportation Association, 45% of all Americans do not have access to reliable public transportation near their home.

"The full impact of inflation on drivers is yet to be seen, but inflation in motion tends to stay in motion: Insurance companies are reacting to higher repair and equipment costs by increasing their premiums, underscoring the importance of shopping around if you live in one of these costlier metro areas," Foster said.