/Advanced%20Micro%20Devices%20Inc_%20logo%20and%20chart%20data-by%20Poetra_%20RH%20via%20Shutterstock.jpg)

Advanced Micro Devices (AMD) recently announced a huge deal with OpenAI, which could mean that the ChatGPT-maker gets a 10% stake in the chipmaker. Through this partnership, OpenAI would also deploy six gigawatts of AMD’s Instinct GPUs over several years. The deployments are set to start late next year.

The bullish investor sentiments surrounding this partnership have led AMD stock to surge. Analysts at HSBC raised AMD’s price target from $185 to a Street-high $310, while keeping a “Buy” rating on the shares. HSBC projects huge revenue potential from the OpenAI deal of around $80 billion, which is more than 10 times the expected revenue from AMD’s artificial intelligence (AI) GPUs for 2025.

Of course, this multi-billion-dollar revenue opportunity would be a huge deal for AMD, especially if it wants to challenge Nvidia's (NVDA) market-leading position. Is AMD stock a buy at this juncture?

About AMD Stock

Headquartered in Santa Clara, California, AMD remains a major player in the semiconductor industry, specializing in high-performance computing and graphics solutions. The company has been expanding its footprint in critical technology sectors, including AI, data centers, and gaming. The company has a market capitalization of $410 billion.

The company launched the Instinct MI350 Series GPUs this year, which underscores a leap in AI performance and energy efficiency. The company is also developing next-generation AI racks called “Helios,” which extend AMD’s operability to deliver open, scalable infrastructure that meets the growing demand for AI. These efforts position AMD at the forefront of AI hardware innovation.

The company also expanded its partnership with Oracle (ORCL). Under the deal, Oracle will deploy 50,000 AMD GPUs starting in the third quarter of 2026, with more deployments to follow.

Based on strong tailwinds from its prospects in the AI space, AMD stock has been surging. Over the past 52 weeks, the stock has gained 65%, while it is up 109% year-to-date (YTD). Over the past month alone, it has increased by 57%. On Oct. 24, AMD stock reached a 52-week high of $253.39.

AMD stock still trades at a stretch. Its price sits at 74.8 times forward earnings, which is significantly higher than the industry average.

AMD’s Q2 Results Were Better Than Expected

On Aug. 5, AMD reported its second-quarter results for fiscal 2025. Revenue increased 32% year-over-year (YOY) to $7.69 billion, which surpassed Wall Street analysts’ expected $7.41 billion figure. Data center revenues increased by 14% from the prior-year period to $3.2 billion due to strong demand for AMD EPYC processors.

AMD faced headwinds from the U.S. government's export control on its Instinct MI308 data center GPU products, which led to the company incurring inventory and related charges of about $800 million. Its non-GAAP gross margin for the quarter dropped 10 percentage points to 43%. Without the charges related to export control, its non-GAAP gross margin would have been 54%.

AMD’s non-GAAP EPS also declined by 30% YOY to $0.48, but this surpassed the consensus estimate of $0.47.

For the third quarter, the company expects revenue to be $8.7 billion, give or take $300 million, which indicates 28% YOY growth. Non-GAAP gross margin is expected to be 54%.

Wall Street analysts are considerably optimistic about AMD’s future earnings. They expect the company’s EPS to increase by 28% YOY to $0.97 for the third quarter. For the current fiscal year, EPS is projected to surge 20% annually to $3.14, followed by a 68% growth to $5.28 in the next fiscal year.

What Do Analysts Think About AMD Stock?

Wall Street analysts have turned exceptionally bullish on AMD stock based on its prospects. Recently, analysts at BofA Securities raised the price target from $250 to $300, while maintaining a “Buy” rating. BofA Securities analysts raised the price target after the company showcased its MI450 Series Helios racks at the OCP Conference.

Analysts at Wedbush also maintained an “Outperform” rating, while raising the price target of $190 to $270, citing AMD's new AI partnerships that can be highly additive to its revenue stream. Wolfe Research analysts upgraded AMD from “Peer Perform” to “Outperform,” with a price target of $300.

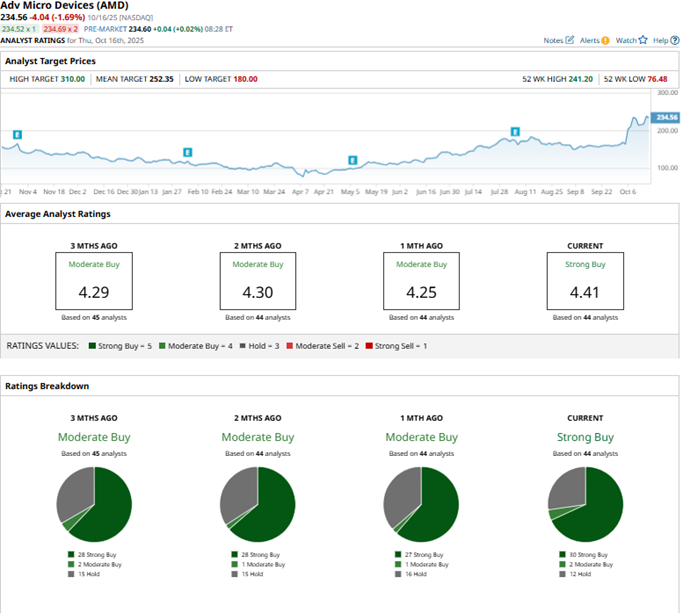

AMD has been a popular on Wall Street, with analysts awarding it a consensus “Strong Buy” rating overall. Of the 44 analysts rating the stock, a majority of 30 analysts rate it a “Strong Buy,” two analysts suggest a “Moderate Buy,” and 12 analysts play it safe with a “Hold” rating. The consensus price target of $253.70 represents minimal upside from current levels. However, the Street-high HSBC-given price target of $310 indicates potential upside of 23%.

Key Takeaways

AMD’s strategic partnerships that harness its AI capabilities are expected to be accretive to the company’s top and bottom lines. The development of next-generation AI racks should also be beneficial for the business. Therefore, the company might be able to justify the new Street-high price target and could be a solid buy now.