Advanced Micro Devices Inc (NASDAQ:AMD) shares are trading higher late Thursday, extending gains from Wednesday’s session fueled by multiple developments. Here’s what investors need to know.

What To Know: Investor enthusiasm is largely being driven by a Wednesday report that competitor Intel Corp (NASDAQ:INTC) is in early discussions to add AMD as a customer for its foundry business.

A potential manufacturing partnership would be a landmark shift in the semiconductor landscape, providing AMD a major alternative to its primary chip producer, Taiwan Semiconductor Manufacturing Company Ltd (NYSE:TSM). Such a deal could diversify AMD’s supply chain while also representing a significant vote of confidence in Intel’s manufacturing capabilities.

Further bolstering the positive sentiment, AMD and IBM (NYSE:IBM) announced a strategic collaboration on Wednesday. The partnership will see the duo provide a large cluster of AMD’s Instinct MI300X AI accelerators on IBM Cloud for the AI startup Zyphra.

Read Also: Intel Stock Rallies 50% Over The Last Month—Government’s Stake Nearly Doubles To $16 Billion

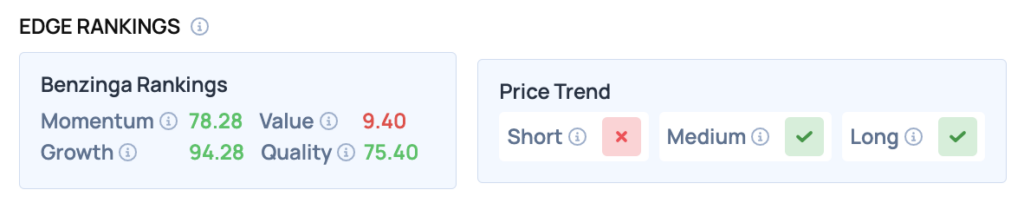

Benzinga Edge Rankings: According to Benzinga Edge stock rankings, AMD boasts an exceptional Growth score of 94.28, underscoring its strong market position.

AMD Price Action: Advanced Micro Devices shares closed Thursday up 3.49% at $169.73, according to Benzinga Pro. The stock is trading near its 52-week high of $186.65.

The stock is meanwhile trading above its 50-day moving average of $165.73, suggesting a bullish trend. Key resistance is observed near the recent high of $171.05, while support can be identified around the 50-day moving average.

Read Next: Nvidia’s Value Reaches $4.6 Trillion, Bitcoin Eyes $120,000: What’s Moving Markets Thursday?

How To Buy AMD Stock

By now, you're likely curious about how to participate in the market for Advanced Micro Devices — be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option or sell a call option at a strike price above where shares are currently trading — either way, it allows you to profit from the share price decline.

Image: Shutterstock