/Advanced%20Micro%20Devices%20Inc_%20office%20sign-by%20Poetra_RH%20via%20Shutterstock.jpg)

Shares of Advanced Micro Devices (AMD) have cooled off a bit after a strong run earlier this year. The market has grown cautious, weighing concerns about valuation alongside the impact of U.S. export restrictions to China. The latest earnings added to the pain, as AMD reported a year-over-year decline in artificial intelligence (AI) revenue in the data center business during the second quarter.

Much of the weakness in AI revenue was due to the U.S. export ban, which cut into sales of the company’s MI308 accelerators in China. On top of that, the launch of AMD’s next-generation MI350 series created a temporary pause in demand, as customers chose to wait for the more advanced chips.

Despite the softer quarter, AMD’s long-term prospects remain intact. The company is entering the second half of the year with catalysts that could reaccelerate its growth. The ramp of its Instinct MI350 series accelerators is expected to drive its data center AI revenue. At the same time, its EPYC server processors and Ryzen chips continue to gain share, giving the company multiple growth levers beyond data center AI.

EPYC and Ryzen Processor Sales to Support AMD’s Growth

AMD’s latest quarterly report reflects the strength of its diversified revenue model, with strong sales of EPYC and Ryzen processors driving growth despite headwinds in AI-related revenues. In the second quarter, AMD’s revenue surged 32% year-over-year to $7.7 billion, surpassing expectations. The data center segment increased 14% to $3.2 billion, driven by robust demand for the EPYC portfolio across cloud and enterprise workloads, as well as new use cases tied to AI.

The surge in adoption reflects the growing role of CPUs alongside GPUs in powering emerging AI applications that require agentic capabilities. Each token generated by a GPU triggers multiple CPU tasks, creating fresh demand for AMD’s processors. This trend fueled record-setting sales of both current- and prior-generation EPYC chips, marking the company’s 33rd straight quarter of market share gains.

AMD is seeing higher adoption of EPYC across cloud and telecom service providers. Meanwhile, enterprise on-premise adoption is also growing. To capture smaller-scale deployments, AMD introduced its EPYC 4005 series, offering enterprise-grade performance in cost-optimized solutions for SMBs and hosted IT providers. Ryzen processors also posted record sales, strengthening the company’s position across PCs and embedded markets.

Looking forward, AMD could deliver strong growth ahead in its server CPU business. Demand for both cloud and on-premise computing continues to expand as companies scale their digital operations. At the same time, AMD is steadily gaining market share, which strengthens its competitive position. Furthermore, the surge in AI is driving significant investment in general-purpose infrastructure and is likely to increase demand for server CPUs.

AMD’s AI Engine Is Revving Up Again

AMD’s data center AI business looks set for a strong rebound after a softer Q2. Moreover, management sees its AI data center revenue climbing into the tens of billions over time. Notably, AMD’s MI300 and MI325 accelerators gained traction last quarter, winning new deals. This progress paves the way for the upcoming MI350 series, designed to deliver high-performance AI computing at lower cost. The ramp of its Instinct MI350 series accelerators will boost its AI revenue. Meanwhile, development of the next-gen MI400 chips is advancing quickly, with strong early customer interest.

Beyond hardware, AMD has been bolstering its AI ecosystem. Recent acquisitions are expanding its software and services capabilities. Another promising growth driver is sovereign AI. Governments worldwide are partnering with AMD to power secure, national AI systems, with over 40 active projects in progress.

Is AMD Stock a Buy Now?

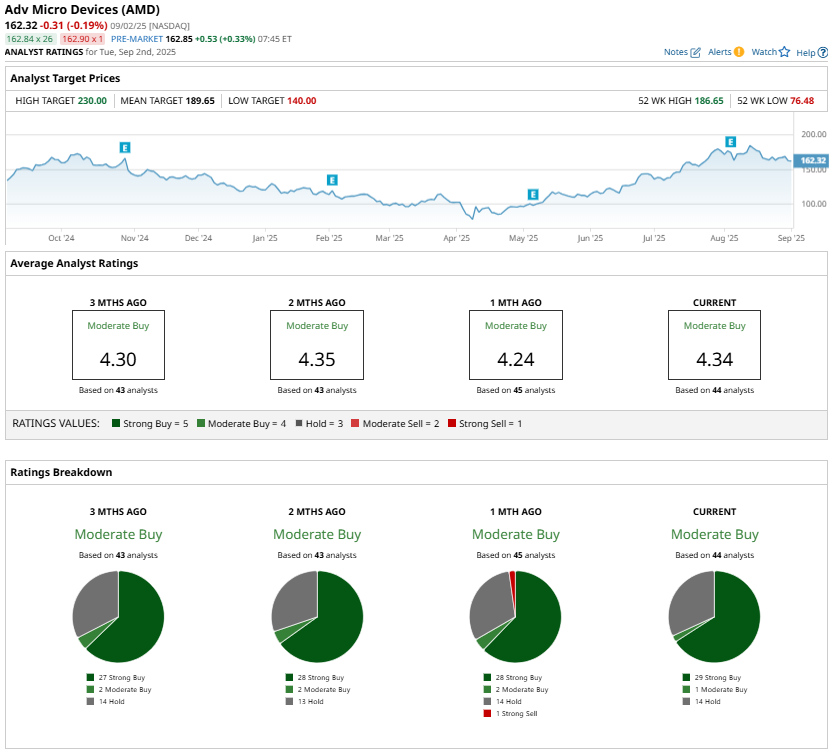

Analysts are cautiously optimistic about AMD stock and have a “Moderate Buy” consensus rating. However, note that challenges from export restrictions and product transitions are temporary, and AMD has strong growth catalysts that will drive future growth.

With EPYC and Ryzen processors driving steady gains and the ramp of MI350 accelerators poised to reaccelerate AI revenue, AMD is well-positioned to capture expanding demand across data centers, PCs, and emerging AI applications. Thus, for investors with a long-term outlook, this dip may be the time to buy AMD stock.