Advanced Micro Devices (AMD Get Advanced Micro Devices, Inc. Report stoc on Wednesday tipped its hand that this name still has potential strength.

In fact, growth stocks in general performed pretty well on Wednesday despite the increased volatility from the FOMC announcement.

AMD powered higher on the day, giving bulls a two-times weekly-up rotation.

Further, FAANG finished higher, with the exception of Apple (AAPL Get Apple Inc. (AAPL) Report, while Tesla (TSLA Get Tesla Inc Report, VanEck Semiconductor ETF (SMH Get VanEck Vectors Semiconductor ETF Report and ARK Innovation ETF (ARKK Get ARK Innovation ETF Report all climbed on the day.

AMD’s rotation was important because it gave bulls confidence to stick with it despite the volatility.

The company is a top pick for many analysts, as is Nvidia (NVDA Get NVIDIA Corporation Report.

But Nvidia followed AMD’s lead from Wednesday, giving bulls a powerful rotation of its own on Thursday.

Now the question remains, just how far can AMD stock go from here?

AMD, Apple and Nvidia are holdings in the Action Alerts PLUS member club. Want to be alerted before AAP buys or sells AMD, AAPL or NVDA? Learn more now.

Trading AMD Stock

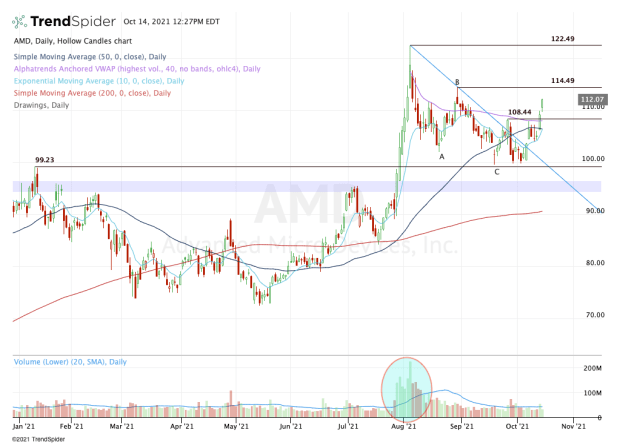

Chart courtesy of TrendSpider.com

On Oct. 5, I discussed buying the dip in Nvidia. For both Nvidia and AMD, the stocks ultimately bottomed this month on Oct. 4 and have been enjoying rallies ever since.

For AMD, the stock gave bulls a clean ABC correction back down to the $100 level and the breakout spot from the prior high.

While a mild rally from this level resulted in another pullback — the one that led to the Oct. 4 low — the shares ultimately held support and moved higher.

Until Wednesday though, AMD stock was struggling with the 50-day moving average and the daily VWAP that’s measured from the all-time high.

Speaking of that all-time high, notice all the volume that took place amid that push higher in early August. That suggests institutional buying and gives a nod to the bulls when it comes to buying this name on the dip.

In short, that type of institutional buying should lead to support on the dips, which is exactly what we saw.

Yesterday the stock went two-times weekly-up over $108.44, clearing the 50-day and daily VWAP measure in the process.

Now let’s see if AMD can get to the B leg high near $114.50. If it does, I’d love to see $108 to $110 act as support, along with the 10-day moving average.

Above $115 opens the door to the $120 to $122 area.

Below the 50-day moving average puts $100 back in play.