Update 6/6/2025 9:00 am ET: Jon Peddie has kindly provided us with comments regarding AMD's GPU business underperformance in Q1 2025. He believes that the sources of AMD's decline in GPU shipments lie in the company's failure to accurately predict demand for its GPU products six to nine months in advance, as well as the necessity to balance its TSMC allocations between Zen CPUs and Radeon GPUs. Read the exact comments below.

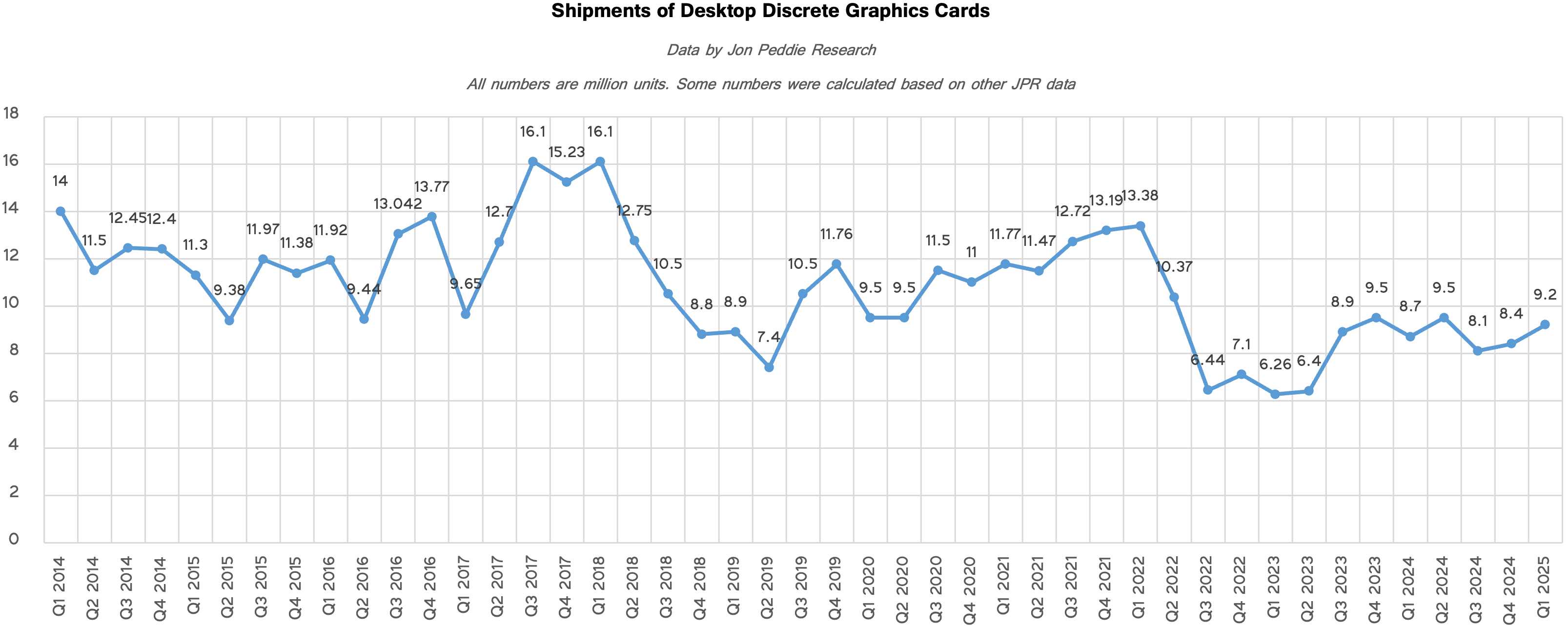

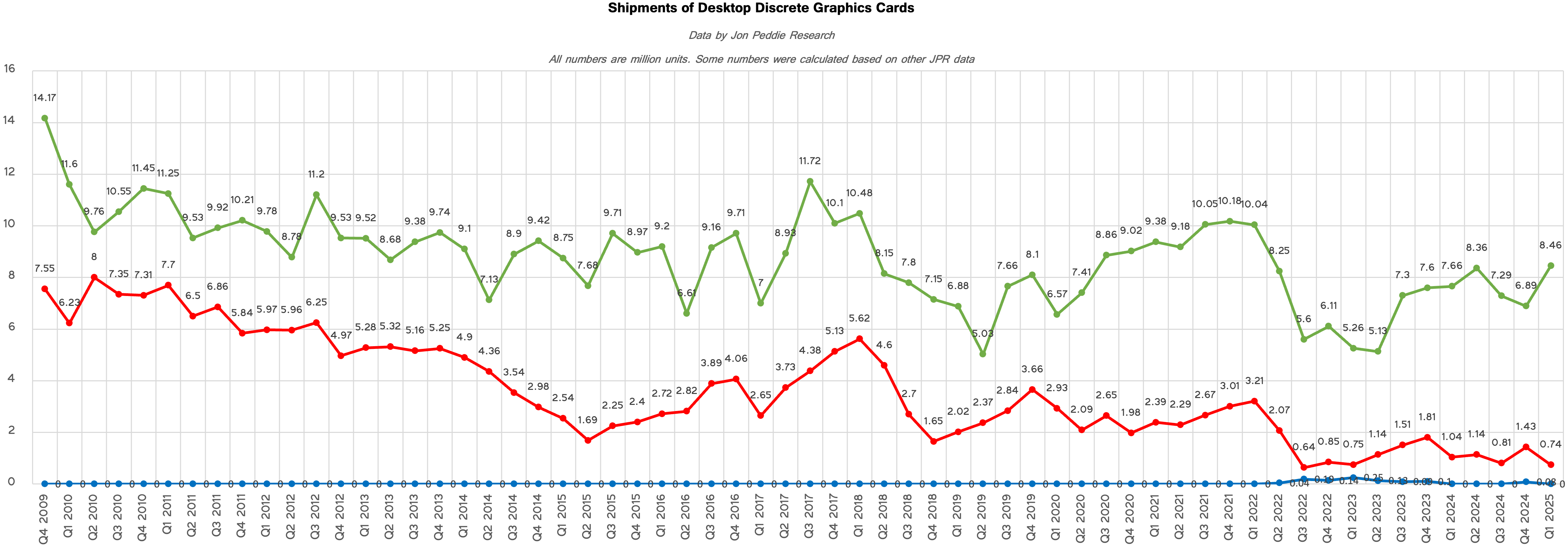

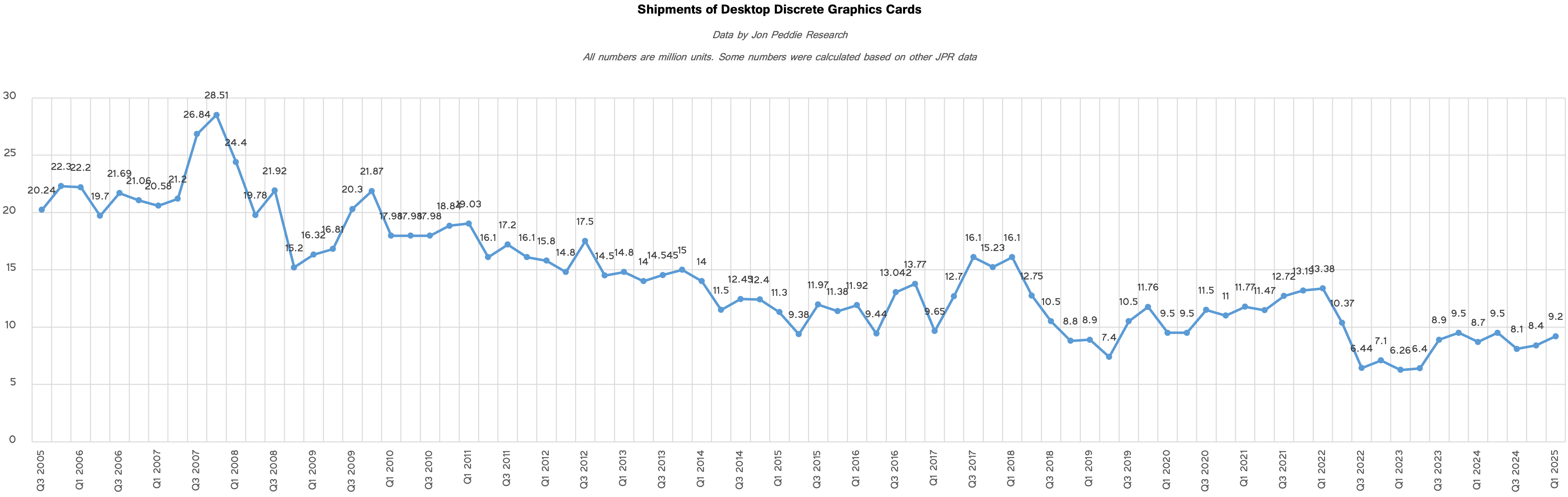

AMD's desktop GPU market share, based on sales into the market, has dropped to a historic low in the latest report from Jon Peddie Research, despite the company's launch of new products during the quarter. Discrete GPU shipments for desktop PCs increased significantly both quarter-over-quarter and year-over-year in Q1 2025 and totaled 9.2 million units. However, as both AMD and Nvidia rolled out their new-generation graphics cards in the first quarter, Nvidia managed to sell millions of its new GeForce RTX 50-series GPUs and capture its highest market share, while AMD struggled to sell even 750,000 add-in-boards, which is why its share dropped to a historical low.

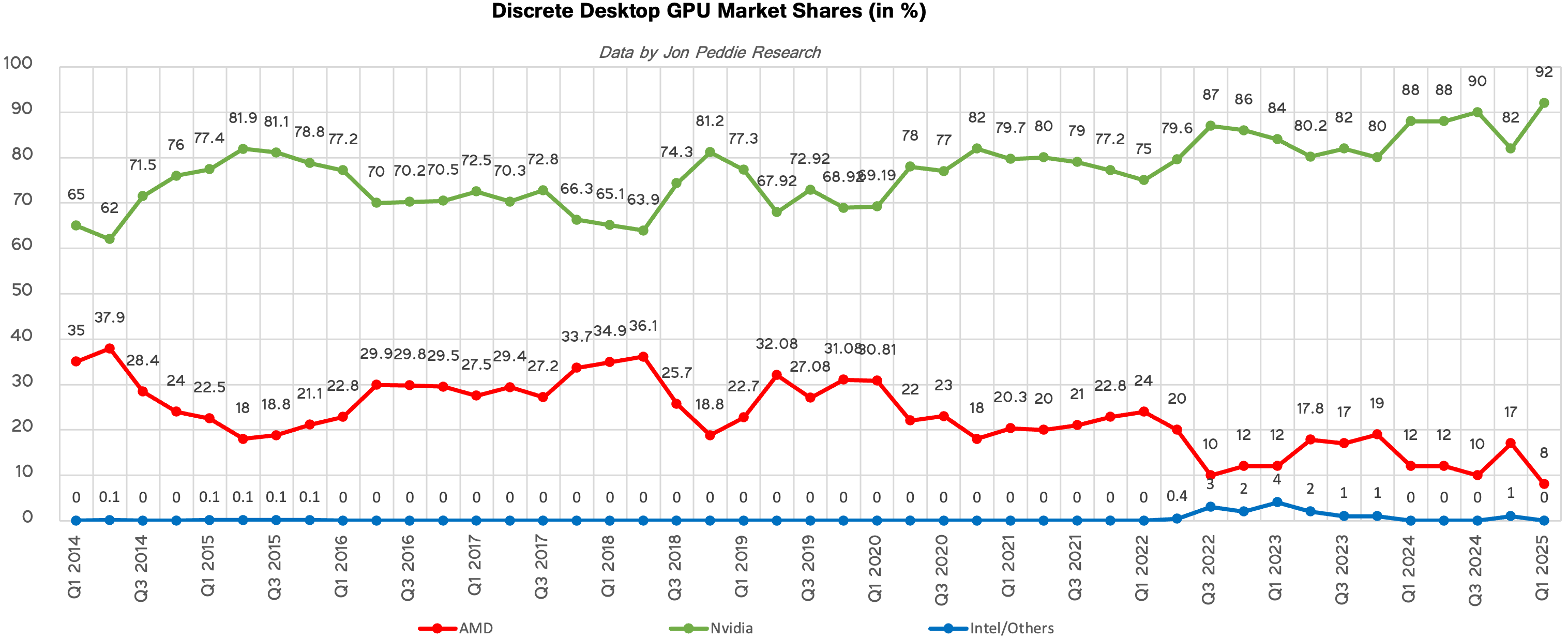

Nvidia now commands around 92% of the desktop discrete GPU market, while AMD's share declined to approximately 8%, the company's lowest share ever.

The industry shipped 9.2 million standalone graphics processing units for desktop PCs during the first quarter, up 8.5% compared to the prior quarter and by 5.3% on an annual basis. In terms of market share dynamics, Nvidia was the only major vendor to expand its position, gaining 8.5%. AMD’s share declined by 7.3%, while Intel's share saw a smaller contraction of 1.2%.

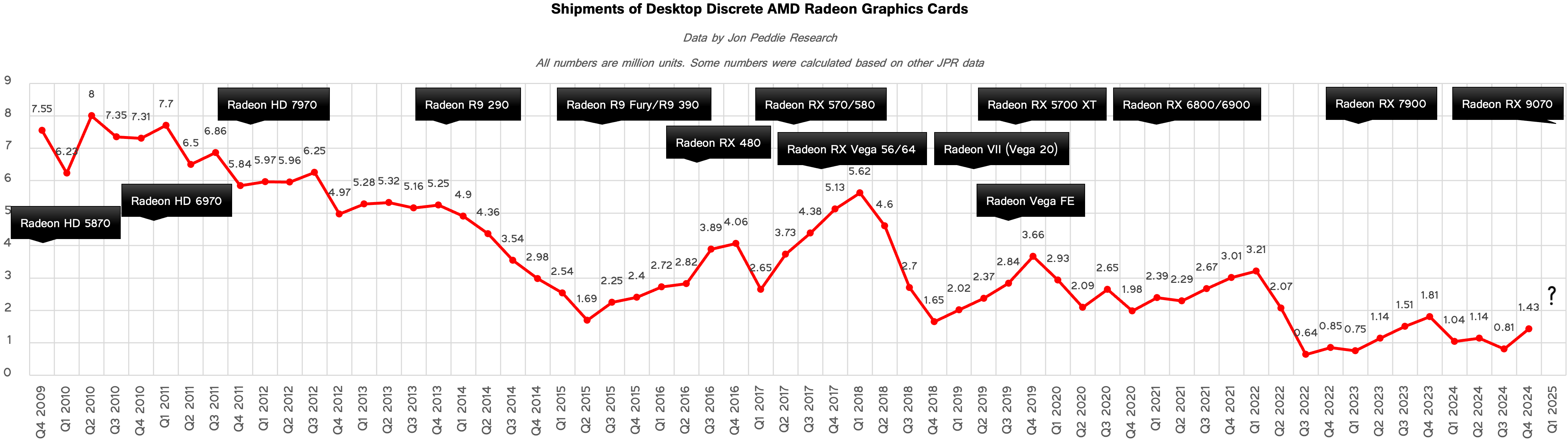

AMD's GPU shipments totaled approximately 740,000 to 750,000 units, the company's worst results in three years. To make matters worse, for the first time in decades (if not ever), the quarterly sales of AMD GPUs declined despite the launch of new halo products. Jon Peddie, the head of Jon Peddie Research, believes the poor performance was a result of an AMD demand misprediction in Q1.

Nvidia sold around 8.46 million standalone graphics processors for desktops, the company's best result in three years, especially keeping in mind that the company sold quite expensive products ($379 - $1999) during the first quarter and these products happen to be some of the best graphics cards around.

"AMD and Nvidia have to walk a tight rope wire when it comes to placing orders at fabs like TMSC — and you never get it right all the time," said Jon Peddie, president of Jon Peddie Research, in a conversation with Tom's Hardware. "Forecasting demand six to nine months in advance, when the economic and political environment is so unstable adds an additional layer of complexity. Then you have yield issues on top of it all, and of course you have to get the specs right. Nonetheless, AMD has been doing this for decades and knows all those tradeoffs, plus in their case they have the added burden of balancing resources of demand for Zen CPUs against GPUs."

The numbers from Jon Peddie Research appear to contradict comments made by Lisa Su, Chief Executive of AMD, who stated during the quarter that the launch of the company's Radeon RX 9070-series products was AMD's most successful product launch in terms of first-week sales. Yet, this is not exactly the case. Jon Peddie Research monitors how many GPU chips each company sells-in to its partners per quarter, not the number of cards sold through retailers. By contrast, Lisa Su mentioned sold through results of the Radeon RX 9070-series, referring to the final stage where the retailer sells the product to the end user.

Images of AMD's early Navi 48 graphics processors — the GPUs that power the Radeon RX 9070-series boards — indicate that their assembly took place in late October 2024, which means that production of the actual silicon started approximately 90 days prior, in late July 2024. This suggests that AMD had been building up inventory for several months ahead of the official launch on March 6, 2025.

While the total number of GPUs and add-in boards accumulated before the release remains unclear, Jon Peddie Research reported back in March that AMD delivered around 1.43 million discrete desktop GPUs to partners in the fourth quarter of 2024. The lion's share of these processors were likely AMD's Navi 48, so it is reasonable to conclude that AMD entered the first quarter of 2025 with a substantial stockpile of Navi 48 chips. Although precise figures are not available, it is likely that AMD's partners shipped well over a million Radeon RX 9070-series graphics cards during the quarter. However, this was a result of accumulating GPUs over a period of about six months.

By contrast, the company AMD supplied its partners with only around 740,000 to 750,000 GPUs (probably mostly Navi 48 and Navi 44, although we are speculating) in the first quarter, which explains why the company could not meet demand for its Radeon RX 9070 and 9060-series products in the second quarter. The reasons why AMD did not ramp up shipments/production of its Radeon RX 9000-series RDNA 4-based GPUs in late Q4 2024 – early Q1 2025 are unclear. However, JPR's numbers indicate that the company had reduced sales (and possibly production) of GPUs from Q4 to Q1, which is an unprecedented event. This likely means that shortages of AMD's latest Radeon products — the Radeon RX 9060 and 9070 series — will persist at least through the second quarter.

"We were surprised to see AMD’s shipments drop so drastically in Q1," said Peddie. "At the same time Nvidia was ramping Blackwell filling any vacuum AMD may have left. Both companies' products have been criticized at the low end, which is traditionally a volume market. But in the past few quarters, the high end has taken off and that is where Nvidia had an open playing field, and so far, still does. So, it is a combination of economic and political instability, and consumer demand shifting to the high end that has caught AMD in a crossfire so to speak."

While shipments of graphics cards were up in the first quarter, sales of desktop processors dropped. JPR reports that the desktop CPU market contracted sharply as volumes dropped by 14.5% year-over-year and 20.6% sequentially.

"The PC market is caught in the crosswinds, some might say crossfire, of Trump's trade wars, with on-again and off-again, special cutout, and changing import/export rules," said Dr. Jon Peddie, president of Jon Peddie Research. "As part of the turmoil, some PC suppliers have pulled back or held orders, while a few have increased orders, hoping to lock in prices. Pre-ordering to lock in prices is a temporary fix, which will cause a depression in future quarters’ sales, as discussed here. We think overall PC sales and, subsequently, client PC GPU sales will be down for the year.”

Follow Tom's Hardware on Google News to get our up-to-date news, analysis, and reviews in your feeds. Make sure to click the Follow button.