/Advanced%20Micro%20Devices%20Inc_%20office%20sign-by%20Poetra_RH%20via%20Shutterstock.jpg)

OpenAI has secured warrants to acquire up to a 10% stake in Advanced Micro Devices (AMD) as part of an artificial intelligence infrastructure deal it signed with the chipmaker on Monday.

OpenAI has teamed up with the semiconductor firm to diversify its chip supply beyond Nvidia (NVDA). In its press release, the AI company said it will deploy some 6 GW of AMD graphics processing units (GPUs).

Following today’s surge, AMD stock is up roughly 170% versus its year-to-date low in early April.

Significance of OpenAI Deal for AMD Stock

AMD shares rallied this morning mostly because the OpenAI deal is a major validation of its MI-300X accelerators for artificial intelligence workloads.

According to the multinational, the partnership will generate tens of billions of dollars in revenue over several years. It reinforces the narrative that AMD is emerging as the leading alternative to NVDA chips.

In a segment of CNBC’s “Squawk on the Street” today, former hedge fund manager Jim Cramer also touted the firm’s breakthrough in chip design and performance efficiency after the OpenAI announcement.

All in all, the agreement signals growing industry confidence in the chipmaker’s ability to scale AI infrastructure, attract top-tier partners, and challenge entrenched incumbents across hyperscale and enterprise deployments.

Do AMD Shares Have An Edge Over Nvidia?

While AMD stock has already had a cosmic run in recent months, it remains relatively inexpensive to own compared to its larger peer, Nvidia.

Advanced Micro Devices is currently going for a price-sales (P/S) multiple of a little under 11x, versus Nvidia at north of 35x currently.

Beyond valuation, AMD shares offer exposure to multiple secular growth drivers including AI, gaming, data centers, and embedded systems, without the concentration risk of NVDA’s hyperscaler-heavy top line.

In short, the company’s expanding partnerships, robust product roadmap, and improving margins position it as a diversified, high-upside play in next-gen compute infrastructure.

AMD Remains a ‘Buy’-Rated Stock

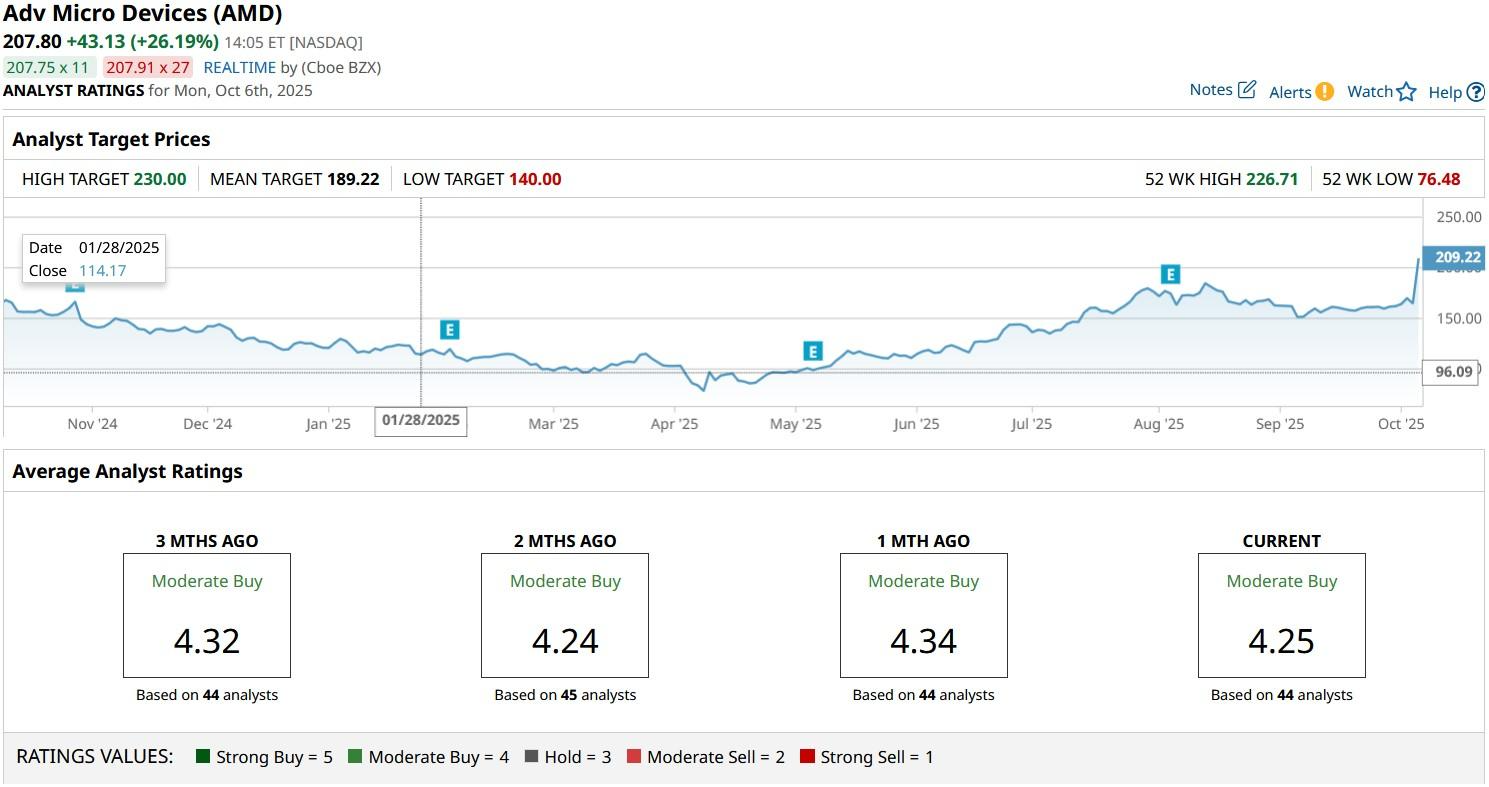

Investors should also note that Wall Street currently rates AMD stock at “Moderate Buy” as well.

According to Barchart, price targets on AMD shares go as high as $230, indicating potential upside of another 10% from here.