Ihor Dusaniwsky at S3 Partners tracks short interest in stocks in real time, and he posts a number of his charts on Twitter. Dusaniwsky has developed a Short Squeeze score and ranks AMC ‘s and GameStop’s metric a 10 out of 10 for a short squeeze.

The number comes from an algorithm he created and is not subjective. Some of the factors in it are short sale liquidity, trading liquidity, financing liquidity and mark-to-market profit and losses. He wrote in an email, “A security is considered “crowded” on the short side if some or all of the following occur:”

- There is a large amount of dollars at risk on the short side (high short interest)

- There is a large proportion of a security’s tradable float shorted (high S3 SI % Float)

- There is scarcity of stock loan supply (high stock borrow fees)

- There is limited daily trading volume (high days to cover)

However, even when these criteria are met it does not necessarily mean the stock is a short squeeze candidate. Dusaniwsky added, “While a stock can be “crowded” it might not necessarily be a short squeeze candidate. An additional variable, which is necessary for a short squeeze to occur, are substantial net-of-financing mark-to-market losses.”

He continued, “A short position, no matter how crowded, that continues to be profitable cannot be squeezed. No trader will be forced to exit a position that continues to be profitable. Mark-to-market losses are the primary impetus for a Short Squeeze to occur, and AMC’s recent rally has pushed it into potential Short Squeeze territory.”

AMC large recent short-side mark-to-market losses have kept it at the top of the league tables for his Short Squeeze Risk Metric. Other stocks with a 10 out of 10 score are Bed, Bath & Beyond

AMC hasn’t seen a short squeeze

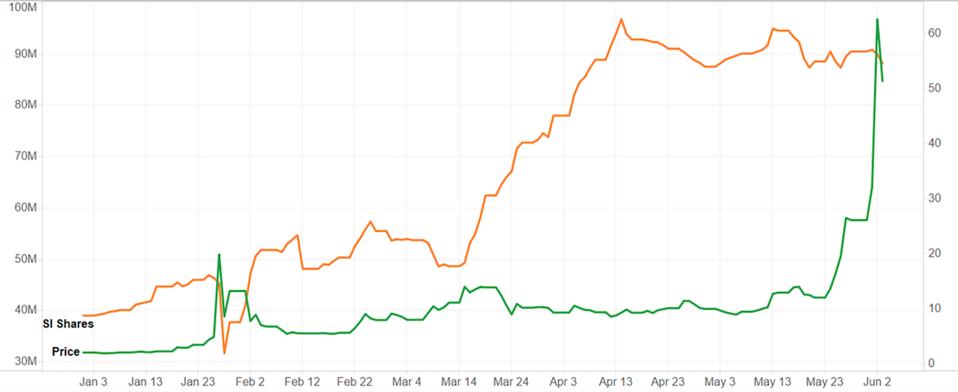

As the chart below shows the number of shares being shorted fell significantly in late January (the gold line) when the stock had its initial pop due to wallstreetbets Reddit crowd jumping in. As AMC’s stock price came back down the number of shares shorted steadily increased until mid-April, where it has essentially remained around 90 million.

Dusaniwsky wrote, “We have seen AMC short covering this week, but by no means are we seeing a wholesale short squeeze in this stock at the moment. Short sellers have covered about 796,000 shares, worth $41 million, over the last 30 days, with buy-to-covers growing over the last week with 1.40 million covered, worth $72 million.”

At Friday’s close of $47.91:

- AMC short interest is $4.53 billion of $21.6 billion market cap

- 88.20 million shares shorted

- 17.65% Short Interest percent of float

- Shorts are now down $3.91 billion in year-to-date mark-to-market losses

- This includes up $302 million on Friday’s decline of 6.7%

- Shorts are down $1.99 billion or 52%, last week

Why the stock could round trip: Valuation

Before Covid-19 hit the economy in 2020 AMC had lost money and had negative free cash flows two of the three previous years. Trying to use earnings or cash flow as a valuation tool would show exorbitant results and not be of much use. Probably the best metric is market cap to revenue.

- Dec. 31, 2017: $1.58 billion with $5.08 billion in revenue = 0.31x market cap to revenue

- Dec. 31, 2018: $1.48 billion with $5.46 billion in revenue = 0.27x market cap to revenue

- Dec. 31, 2019: $747 million with $5.47 billion in revenue = 0.14x market cap to revenue

- Dec. 31, 2020: $248 million with $1.24 billion in revenue = 0.20x market cap to revenue

To remove the impact of Covid-19 lets use 2018’s and 2019’s revenue, which are essentially the same, of $5.47 billion and Friday’s market cap of $21.6 billion (compared to $11.8 billion last Friday).

June 4, 2021: $21.6 billion with $5.47 billion in revenue = 3.9x market cap to revenue

At the current valuation AMC’s shares are 12.7 times more expensive than 2017’s valuation level. At some point in time reality should catch up what can easily be called an overvalued stock.

Moderate short covering of GameStop

Dusaniwsky calculates that there continues to be moderate short covering in GameStop with short sellers covering 262,000 shares, worth $68 million, over the last 30 days but most of that short covering occurring over the last week with 145,000 bought-to-cover, worth $38 million.

Recap using Friday’s stock price of $248.36:

- GME short interest is $2.99 billion of $17.6 billion market cap

- 11.58 million shares shorted

- 20.32% Short Interest percent of float

- Shorts are still down $6.77 billion in year-to-date mark-to-market losses

- This includes up $114 million on Friday’s decline of 3.8%

- Shorts are down $294 million or 10%, last week

Dusaniwsky’s chart on GameStop is available via his tweet.

GameStop’s valuation also doesn’t make sense

Before Covid-19 derailed the U.S. and worldwide economies GameStop was slowly losing revenue from fiscal 2016 to 2018 then had a sharp drop-off in fiscal 2019 (ended in January 2020). GameStop may be able to shake up its business enough to recover at least some of downturn but it won’t happen overnight.

- Fiscal 2016 revenue: $8.6 billion

- Fiscal 2017 revenue: $8.5 billion

- Fiscal 2018 revenue: $8.3 billion

- Fiscal 2019 revenue: $6.5 billion

- Fiscal 2020 revenue: $5.1 billion

- Fiscal 2021 revenue: $5.43 billion estimate

- Fiscal 2022 revenue: $5.37 billion estimate

Note that while GameStop’s fiscal year ended on January 30, 2021, and would normally be labeled fiscal 2021, GameStop calls it fiscal 2020.

When calculating the company’s valuation metrics these results use fiscal 2018’s $8.3 billion in revenue so as to be as generous as possible.

At Friday’s close of $248.36

- GameStop has a market cap of $17.6 billion

- Which is 13.8 times greater than December 31, 2020’s market cap of $1.3 billion

- And 2.1x market cap to fiscal 2018’s revenue

- Vs. 0.15x at December 31, 2020