/amazon%20holiday%20delivery%20boxes%20by%20Cineberg%20via%20iStock.jpg)

Amazon (AMZN) shares are pushing meaningfully higher this morning after the multinational said its Amazon Web Services (AWS) cloud division grew a better-than-expected 20% year-over-year in its third quarter.

This marked the strongest quarterly growth for Amazon Web Services in about three years, helping ease concerns that the cloud computing platform is losing ground to Microsoft Azure and Google Cloud.

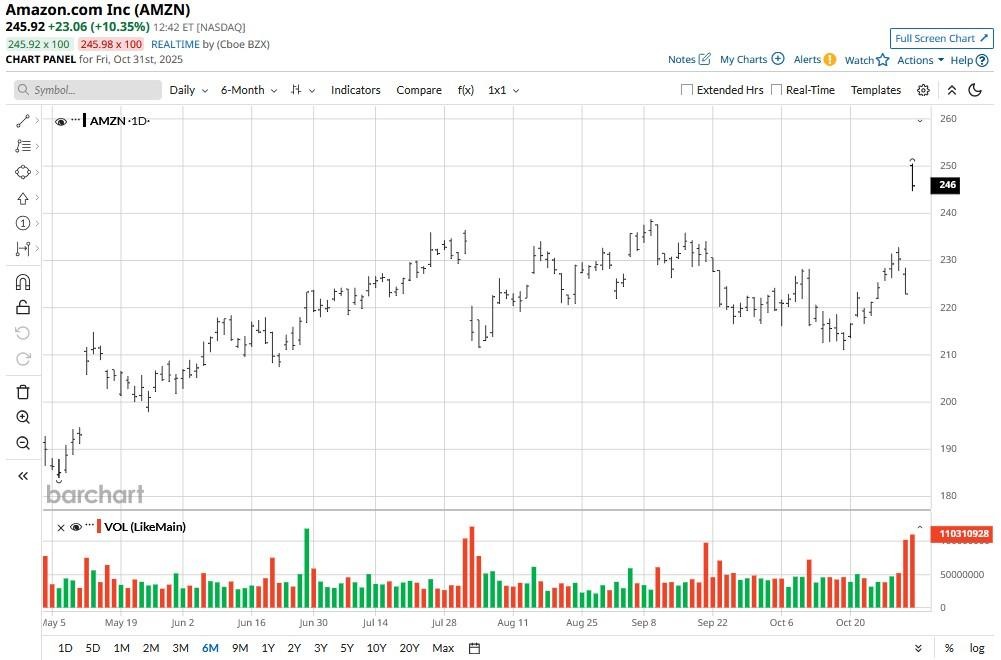

Following Q3 numbers that topped analysts’ expectations on both the top and the bottom line, AMZN stock is up more than 50% versus its year-to-date low set in April.

BofA Raises Its Price Target on Amazon Stock

Investors are rewarding Amazon stock today as the company saw continued momentum across all its business segments. This also prompted Bank of America to lift its price target on the big tech name.

“AMZN is well-positioned to capitalize on global growth of eCommerce and other secular trends such as cloud computing, online advertising, and connected devices,” the investment firm said in its research note.

BofA now sees upside in AMZN shares to $303, indicating potential gains of nearly 25% from here.

At 33x forward earnings, Amazon is trading at a compelling valuation relative to some of the other AI beneficiaries, including Nvidia (NVDA) at about 49x currently, its analysts concluded.

Where Options Data Suggests AMZN Shares Are Headed

Options traders also seem to believe that AMZN shares will remain in an upward trajectory through the remainder of 2025.

According to Barchart, contracts expiring in January currently indicate potential for further upside to roughly $270. Even in the near term, options are pointing to a push higher in Amazon stock to $254 by Nov. 7.

Barchart also has an overall “Buy” opinion on the Seattle-headquartered firm, especially since it has meaningfully breached the 38.2% Fibonacci retracement from its 13-week high, indicating bulls are back in control.

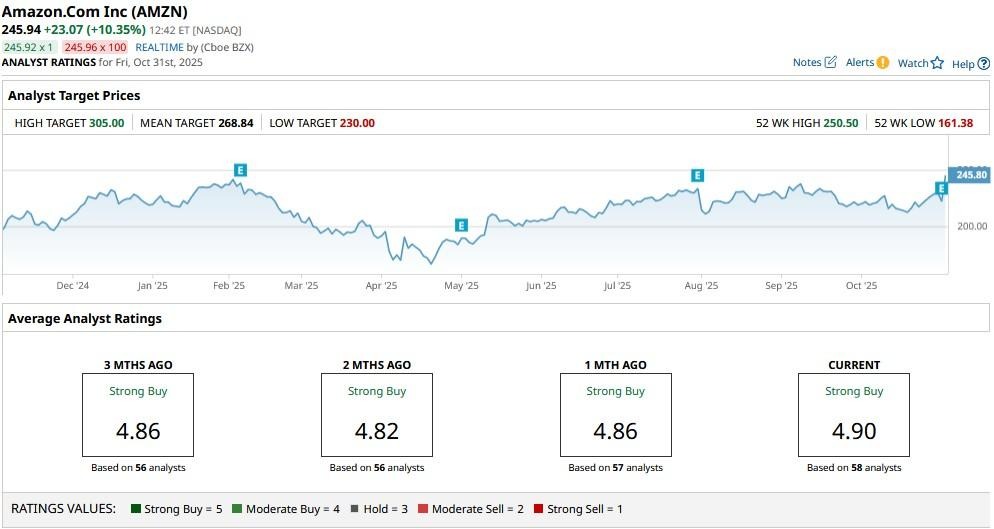

Wall Street Rates Amazon at ‘Strong Buy’

Wall Street analysts recommend owning Amazon stock heading into 2026.

The consensus rating on AMZN shares following the post-earnings surge sits at “Strong Buy” with the mean target of $269 indicating potential upside of another 10% from here.