/Amazon%20-%20Image%20by%20Tada%20Images%20via%20Shutterstock.jpg)

We are quickly nearing the end of the third quarter, and while the S&P 500 Index ($SPX) has pared some gains, it is still near its record highs and is up 13.3% year to date. All Magnificent 7 stocks were positive for the year as of last week, as Apple (AAPL) and Tesla (TSLA), which were in the red previously, rebounded from their lows.

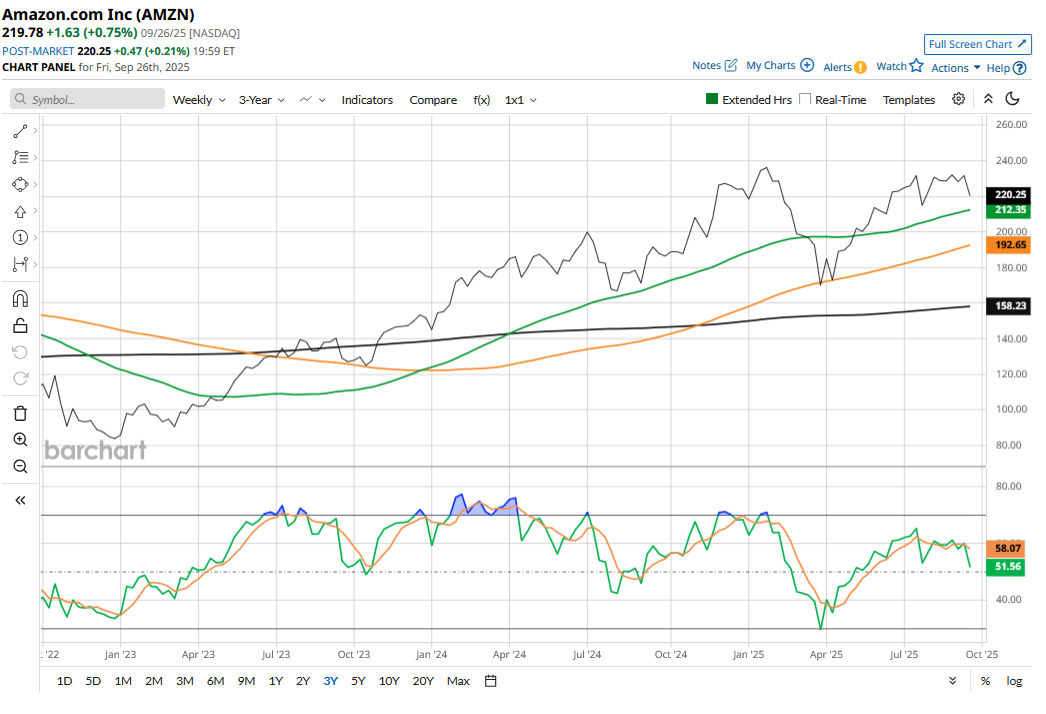

Alphabet (GOOG) (GOOGL), too, has been a hot trade and joined the $3 trillion market cap club. One name that has underperformed amid the market rally is Amazon (AMZN). The stock is barely in the green this year and has been trading flat for the last three months, even as Magnificent 7 peers have raced ahead. In this article, we’ll analyze why AMZN has underperformed this year and examine whether the stock can play catch-up in the final quarter of the year.

Why Has Amazon Stock Underperformed?

Amazon’s rally from its 2022 lows was driven by optimism over a revival in growth in the company’s enterprise-focused Amazon Web Services (AWS) business, as well as relentless cost cuts that helped drive up margins. The story played out well, and AWS has returned to double-digit growth while the margins of Amazon’s North America and International operations were 7% and 3.4% respectively, in the trailing 12 months.

However, it’s no longer a “saleable” story as AWS’s growth has lagged Microsoft (MSFT) Azure and Google Cloud – the top two cloud players in that order, after Amazon. AWS’s operating margin also fell to 32.9% in Q2 2025 as compared to a record high of 39.5% in Q1. The company attributed lower margins to higher stock-based compensation, higher depreciation expense, and adverse forex movements.

The operating margins of Amazon’s North America segment were 7.5% in Q2, and while there could be some incremental increase, the margin expansion story looks largely played out.

Amazon’s top-line growth has also been tepid and has invariably disappointed, including the Q3 guide, which came in below Street estimates. Notably, Amazon’s U.S. e-commerce business is facing competitive pressure, particularly from Walmart (WMT), which has capitalized on its wide store network to counter the Seattle-based company’s competitive strength in logistics.

Recently, Amazon’s $2.5 billion settlement with the Federal Trade Commission, which accused the company of deceiving customers into signing up for Prime, did not help matters and only dampened sentiment.

AMZN Finally Got an Upgrade

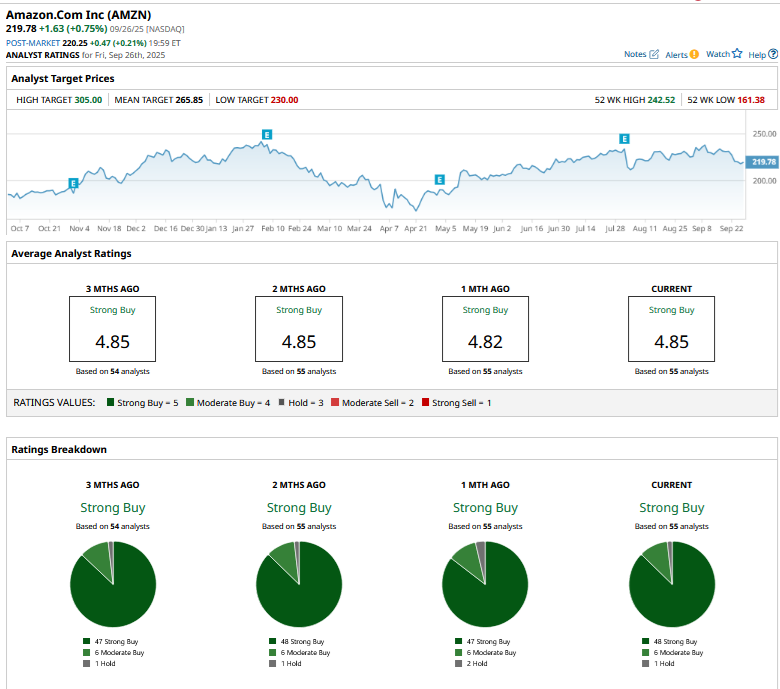

Meanwhile, amid all the pessimism around its business, Amazon earned an upgrade from Wells Fargo last week as analyst Ken Gawrelski upgraded the stock to an “Overweight” while raising the target price from $245 to $280. While Wall Street shares Gawrelski’s bullishness toward Amazon, and it has a consensus rating of “Strong Buy” from the 55 analysts actively covering the stock, his target price is around $15 ahead of what the average sell-side analyst has put on Amazon.

Is It Time to Buy Amazon Stock?

While Amazon is among my top holdings, I have been circumspect about the stock over the last few months, given lingering concerns over the U.S. economy and market share losses in AWS. However, I believe the worst of underperformance is behind us, considering the stock trades at reasonable valuations with a forward price-earnings (P/E) multiple of 32.3x.

That said, Amazon needs a new story to sell for sentiment to improve. Looking at Magnificent 7 peers, optimism over robotaxi expansion and CEO Elon Musk’s share sale helped buoy sentiment toward Tesla. As for Apple, which until the other day was in the red for the year like Tesla, a strong reception to the iPhone 17 helped propel the stock higher. In Alphabet’s case, it was the favorable court ruling in the Department of Justice antitrust case.

For Amazon, the trigger could be the upcoming Q3 earnings, where we’ll get to hear updates on the performance of AWS and the company’s commentary on how it sees holiday shopping shaping up in Q4. The company might also provide more color on its AI strategy and monetization plans to justify its burgeoning capex toward building AI infrastructure.