While advanced innovations such as artificial intelligence have buoyed the broader technology ecosystem, the sector has recently encountered significant pressure. As such, quite a few tech powerhouses have suffered volatility. However, e-commerce and cloud-computing giant Amazon.com Inc (NASDAQ:AMZN) has managed to ride out the storm. Still, perpetual bullish cycles are difficult to come by these days, raising questions about AMZN stock.

On a year-to-date perspective, Amazon's market performance isn't exactly remarkable, gaining a bit under 9%. In contrast, the benchmark S&P 500 index has gained nearly 11%. However, since the close of April 21 — when AMZN stock finished the session at $167.32 — the security gained over 42%. In early August, AMZN also managed to pop above its 50-day moving average following a brief downturn.

In the past few months, Amazon has benefited from strong fundamentals. For example, the tech powerhouse has been increasingly competing in the burgeoning satellite internet market, a sector which could be worth $40 billion by 2030. Through Project Kuiper, Amazon's satellite internet initiative, the company intends to compete with SpaceX's Starlink and other low-earth orbit (LEO) broadband providers.

However, not everything has been smooth sailing for the business. In late July through early August, AMZN stock tumbled despite the underlying company delivering on paper what would be perceived as an outstanding earnings and revenue beat. Still, AMZN provided a sharp discount as investors were initially spooked by a slowdown in the company's cloud business, Amazon Web Services (AWS).

To be fair, Amazon CEO Andy Jassy's explanation that the issue was not related to demand but capacity appeared to reinvigorate technical momentum in AMZN stock. Still, volume levels seem to have faded slightly relative to prior years, raising concerns about forward viability.

Also, an interesting wrinkle has recently materialized. Despite Amazon extending its annual Prime Day sales event to four days this year — thereby delivering record sales — internal data suggests that U.S. Prime membership sign-ups fell short, both in terms relative to last year's totals and the company's own targets.

The Direxion ETFs: In other words, Amazon may not be the invincible tech juggernaut that some investors may have assumed it was. Subsequently, directionally agnostic traders may have ample justification for their particular viewpoints. This dynamic serves Direxion just fine, which offers contrasting exchange-traded funds.

For optimistic investors, the Direxion Daily AMZN Bull 2X Shares (NASDAQ:AMZU) seeks the daily investment results of 200% of the performance of AMZN stock. For pessimistic speculators, the Direxion Daily AMZN Bear 1X Shares (NASDAQ:AMZD) seeks 100% of the inverse performance of the namesake security.

While these products offer many practical applications, a core driver of Direxion ETFs is flexibility. In typical cases, traders interested in leveraged or short positions must engage the options market. However, financial derivatives impose complexities that may not be suitable for all investors. In contrast, Direxion ETFs can be bought and sold much like any other publicly traded security, thus easing the learning curve.

Though convenient, market participants of specialized funds must consider their unique risk profile. First, leveraged and inverse ETFs typically incur greater volatility than funds tracking benchmark indices, such as the Nasdaq Composite index. Second, Direxion ETFs are designed for exposure lasting no longer than one day. Holding these ETFs longer than recommended may expose traders to value decay due to the daily compounding effect.

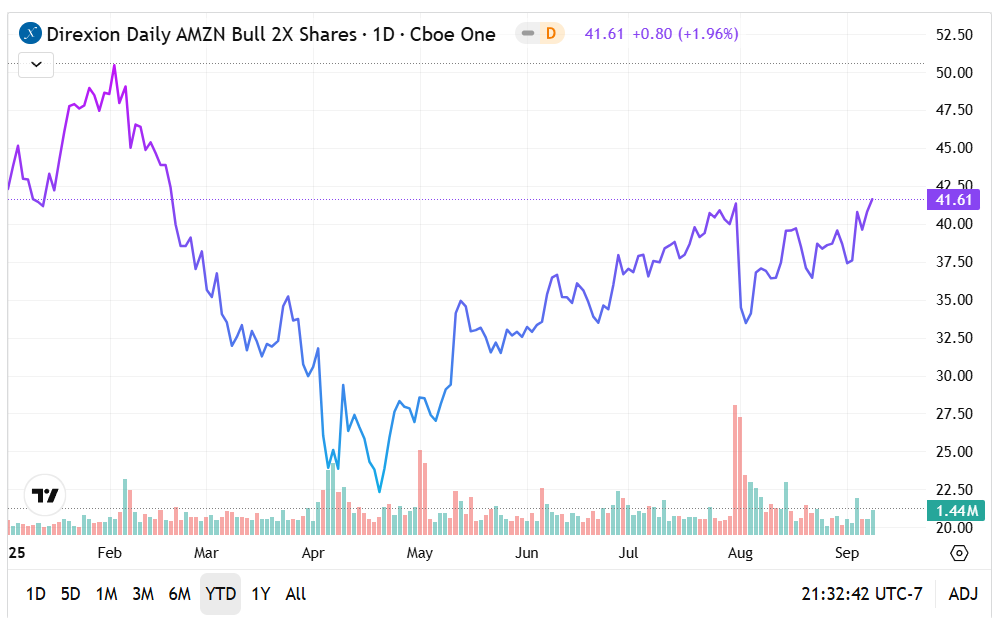

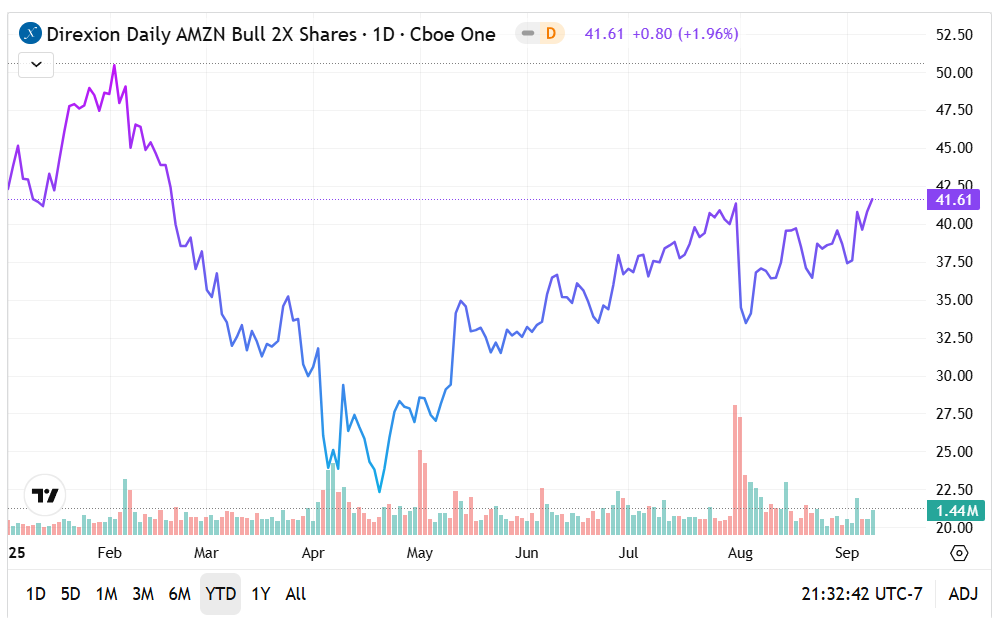

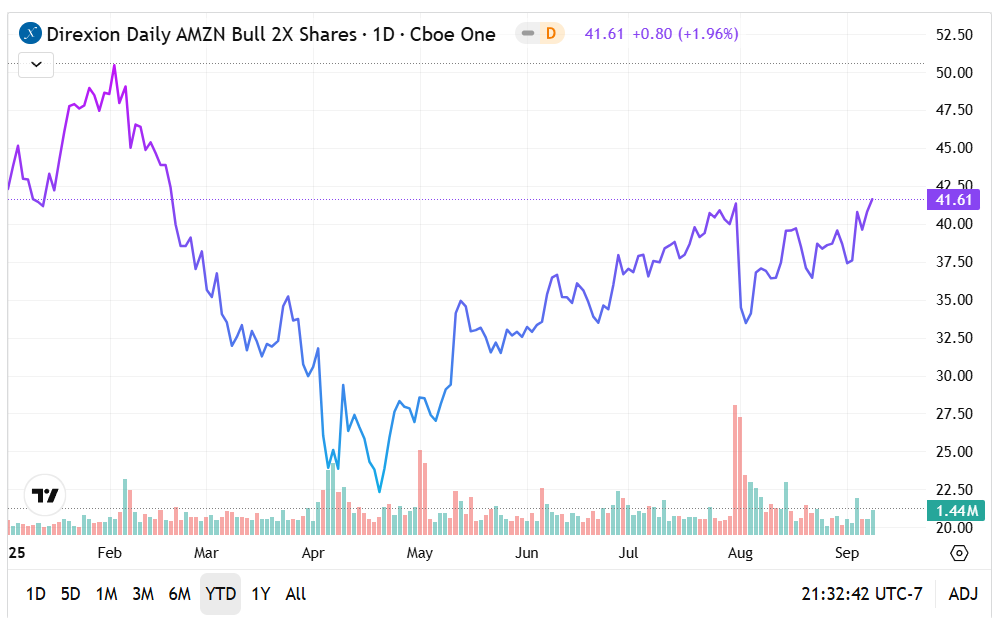

The AMZU ETF: While AMZN stock is up on a year-to-date basis, the same can't be said about the AMZU ETF, thus reflecting the value decay risks of extended exposure.

- Currently, the technical profile of the AMZU ETF appears robust, with the price action firmly above its 50 and 200 DMAs.

- However, there may be horizontal resistance at $42. Subsequently, the AMZU ETF must convincingly break above this threshold to spark confidence among the bulls.

The AMZD ETF: As would be expected, the upside performance of AMZN stock has sent the AMZD ETF into negative territory for the year, down 13%.

- At the moment, the technical profile of the AMZD ETF would be considered rather poor, with the price action below the 50 and 200 DMAs.

- One technical metric to watch closely is volume. While the metric has been all over the map, there appears to be rising acquisition lately, possibly hinting at a sentiment pivot.

Featured image by Preis_King from Pixabay.