Following its second-quarter earnings report, Amazon.com Inc.‘s (NASDAQ:AMZN) stock experienced a significant sell-off. However, a closer look at the details from the earnings call reveals that the primary reason for the slowdown in Amazon’s cloud business, Amazon Web Services (AWS), is not a lack of demand, but a severe capacity issue, with CEO Andy Jassy specifically identifying power as the “single biggest constraint.”

Check out the AMZN stock price over here.

What Happened: Even though the market appeared to react negatively to the 17% year-over-year revenue growth reported by AWS, Eric Allen, co-founder at Stealth, suggested in an X post that the market’s reaction was “totally wrong.”

Additionally, according to a chart from Fiscal.ai, AWS trailed behind Microsoft’s Azure at 30% and Google Cloud at 20% for the same quarter.

Despite this, the company’s backlog figure, as reported by Vice President of Investor Relations, Dave Files, was a staggering $195 billion at the end of the quarter, up 25% year over year. This figure strongly supports CEO Jassy’s comments about the capacity issue on the earnings call.

“We have more demand than we have capacity at this point,” Jassy stated. “And I think that and you see, you know, some of the constraints, and they kind of exist in multiple places. The single biggest constraint is power.” Jassy also mentioned other challenges with chips and components for building servers and noted that he doesn’t believe the capacity issue will be fully resolved “in a couple of quarters.”

This sentiment was echoed by the tech expert Allen, who criticized the market’s interpretation.

“As usual, market gets $AMZN and AWS totally wrong,” he posted. “There's Literally a power capacity issue and a backlog of demand AWS as explained by CEO. Yet market sees 17% YoY and decided not fast enough so they sell off. Dummies. Long AMZN.”

Allen’s analysis highlights the central conflict: the market is punishing Amazon for a growth rate that is constrained by supply, not demand, which is arguably a more favorable long-term problem for a company to have.

Why It Matters: Amazon reported second-quarter net sales of $167.7 billion, up 13% year-over-year. The net sales total beat a Street consensus estimate of $161.9 billion. Meanwhile, its quarterly earnings per share of $1.68 beat a Street estimate of $1.30.

The company expects third-quarter net sales to come in a range between $174.0 billion and $179.5 billion, versus a Street estimate of $172.8 billion. It expects operating income to be in a range of $15.5 billion to $20.5 billion, compared to $17.4 billion in the third quarter of 2024.

Price Action: AMZN stock fell 7.55% in premarket on Friday after declining by 6.63% in after-hours on Thursday. The stock was up 6.31% year-to-date and 27.19% over a year.

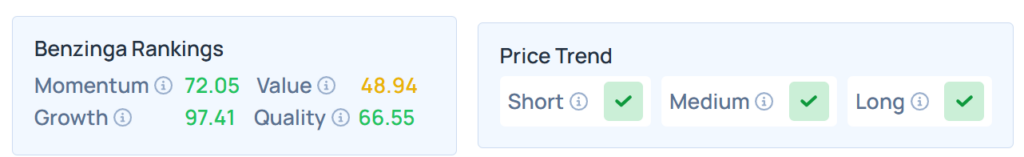

Benzinga's Edge Stock Rankings indicate that AMZN maintains a strong price trend across the short, medium, and long term. However, the stock scores moderately on value rankings. Additional performance details are available here.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, were lower in premarket on Thursday. The SPY was down 0.38% at $632.08, while the QQQ declined 0.53% to $565.01, according to Benzinga Pro data.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Image Via Imagn Images