Investors are always encouraged to diversify their holdings as a hedge against possible downturns.

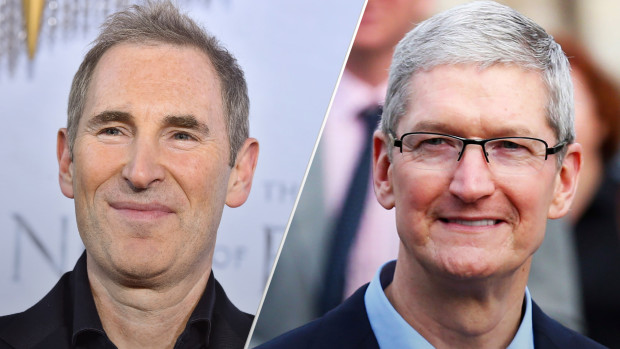

Sometimes that diversity comes with tough choices, like whether the own Apple (AAPL) -) stock or Amazon (AMZN) -).

DON'T MISS: Top Apple Analyst Dan Ives Thinks Earnings Will Be a 'Flex the Muscles Moment' For Company

Both are tech giants with market caps above $1 trillion and a bunch of cash to spend. But after this week's earnings releases from both companies, investors can reassess their stance on them with the latest information.

Since stock picking is more art than science, veterans looking at the same data can come to vastly different conclusions about which is the better company that will offer the best returns.

"If I had to choose I would choose Amazon because at the end of the day Amazon has more levers to pull. Apple is basically a hardware company. 60% of its revenue is from hardware. $3 trillion stock, it's hard to see tremendous gains from here," Matt Higgins of RSE Ventures told CNBC.

More Technology:

- The Company Behind ChatGPT Is Now Facing a Massive Lawsuit

- Prominent EV Company Says Latest Deal Will Be the First of Many

- Apple Makes a Big New Move With Elon Musk's Twitter

"The reality is the next iPhone release will tell the big story. The consumer is under pressure, are they going to be going into their pocket to buy another phone? It's easily something they could defer."

But while Apple is down more than 3% in early market trading Friday after reporting an unprecedented third consecutive quarter of falling revenue, shares of Amazon are up more than 10% following its own earnings beat.

Gene Munster of Deepwater Asset Management is way more enthusiastic about the space in general, but unlike Higgins, he would own Apple over Amazon "in a heartbeat."

"Amazon had a better quarter than Apple, that's pretty clear to me. But if you look at Apple vs Amazon and which of those two companies to own over the next 5 years I'd take Apple over Amazon in a heartbeat," Muster told CNBC.

"Lumpy is not good for investor confidence and steady is. The key takeaway from Apple's quarter is the results. The active install base grew. That means that the the flywheel is working and the business continues to be steady."

You can check out Munster's full comments in the video below.