/Amazon%20-%20Image%20by%20Tada%20Images%20via%20Shutterstock.jpg)

The earnings season for Mag 7 began last week, with Tesla (TSLA) posting a mixed set of numbers. Scarce updates on the near-term outlook dampened sentiment, and the stock closed in the red. This week, we’ll get September quarter earnings from Apple (AAPL), Amazon (AMZN), Alphabet (GOOG) (GOOGL), and Microsoft (MSFT).

With year-to-date gains of just about 3.4%, Amazon is the worst-performing “Magnificent 7” stock in 2025. Amazon shares have been stuck in a tight range since mid-May and haven’t really participated in the recent rally over the period since that has catapulted broader markets to record highs. In this article, we’ll look at Amazon’s Q3 2025 earnings estimates and examine whether the report can turn the tide for the e-commerce giant.

Amazon Q3 Earnings Preview

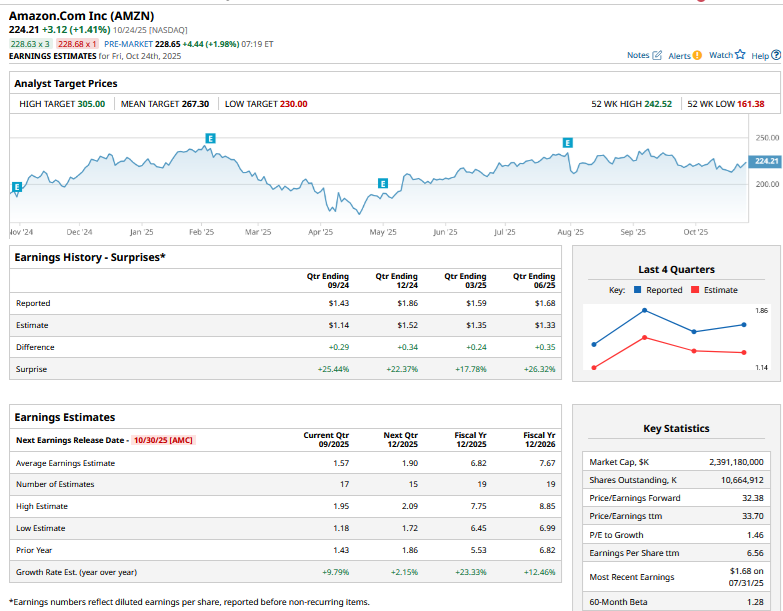

Analysts expect Amazon to report revenues of $177.7 billion in Q3, representing a 11.9% year-over-year increase. During the Q2 earnings, the company guided for Q3 revenues between $174 billion and $179.5 billion, implying year-over-year growth between 10%-13%. Consensus estimates call for Amazon’s Q3 earnings per share (EPS) to rise 9.8% to $1.57. Amazon does not provide EPS guidance, but management guided for Q3 operating income between $15.5 billion and $20.5 billion.

Here’s what else I will be watching in Amazon’s Q3 earnings call.

- Holiday Spending Outlook: I will be watching out for Amazon’s commentary on the sales outlook for the holiday season amid reports of stress among lower-income households.

- Grocery Strategy: I will watch out for any comments on the company’s grocery strategy. Amazon has been expanding its same-day grocery service in the U.S. as well as internationally and has also come up with its private-label grocery brand. At the same time, it announced the closure of all Fresh stores in the U.K. last month. Grocery can be a key driver for Amazon’s growth, and I will keep an eye on the new initiatives the company is taking to grow that business.

- AWS and AI Initiatives: Amazon’s enterprise-focused Amazon Web Services (AWS) has been losing market share, and during the Q3 earnings call, I will watch out for the outlook for that business, which remains the company’s cash cow. The company might also talk about the recent AWS outage, which took down several websites and applications across the world. On a similar note, I believe Amazon could unveil more artificial intelligence (AI) initiatives. The company has lost out on the recent AI rally even as it is among the key AI plays.

- Prime Price Hike: Amazon recently borrowed a leaf from Netflix’s (NFLX) playbook and announced a crackdown on password sharing in Prime. During the Q3 earnings call, I will watch out for any discussion on the Prime price hike. The company hasn’t announced a price hike since 2022, and we could see a hike sometime next year, which could add billions of dollars to Amazon's top line. Amazon might also face questions about its live event strategy, as streaming rivals like Netflix and Disney (DIS) are doubling down on that segment.

Amazon Stock Forecast

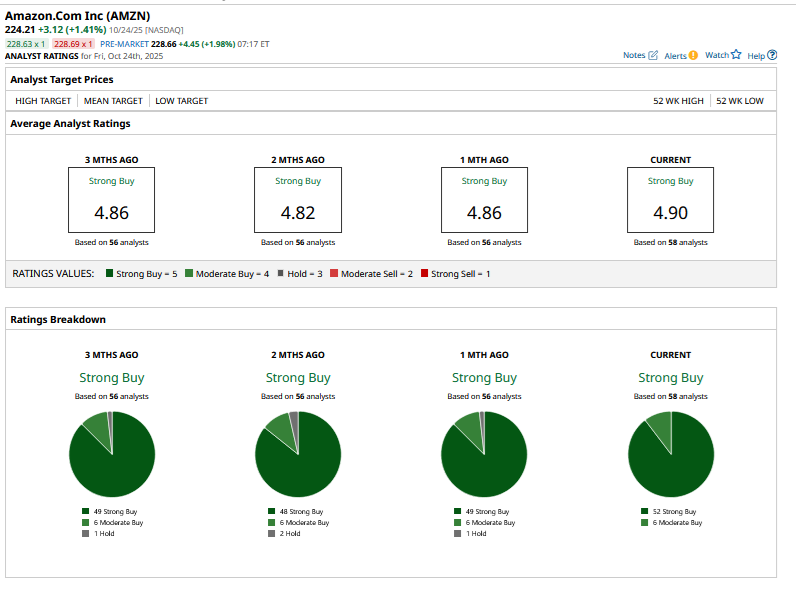

Amazon has been Wall Street’s darling for the last few years, and many brokerages have listed it as a top pick. Despite the YTD underperformance, sell-side analysts are not giving up on AMZN and have instead doubled down on their bullishness heading into the Q3 report.

Several brokerages, including Goldman Sachs, KeyBanc, Stifel, and Wedbush, have raised Amazon’s target price this month. Amazon – which only has “Buy” or higher ratings from the 58 analysts polled by Barchart – has a mean target price of $267.30, which is 19.2% higher than current levels. The stock’s Street-high target price of $305 is over 36% higher.

I was tactically bearish on Amazon for a few months but turned bullish late last month as the risk-reward started to look favorable. I remain bullish on AMZN heading into the Q3 print and believe that the YTD underperformance and reasonable valuations (a forward price-to-earnings ratio of 32.4x) set the floor for a post-earnings bump unless the company comes up with an ugly set of numbers. I view the odds of that happening as very low given recent positive indicators.