/Amazon%20box%20delivery%20by%20Tumisu%20via%20Pixabay.jpg)

Cloud computing has long been one of the most lucrative pillars of big tech, and few companies have capitalized on it quite like Amazon (AMZN). Its Amazon Web Services (AWS) division grew out of an internal need to manage the company's massive e-commerce business, and now powers much of the mega-cap's high-margin growth, emerging as a dominant force in enterprise infrastructure over the past decade.

But that growth engine is now undergoing a reset. Amazon recently confirmed job cuts within AWS following an internal review of priorities and organizational efficiency. The company says the move isn’t driven by artificial intelligence (AI) disruption, but by a need to streamline operations and double down on key strategic areas. While AMZN continues to hire in core roles, the layoffs have sparked fresh questions about the pace and direction of AWS’s evolution.

For investors, the real question now is whether this marks a warning sign or a buying opportunity - especially with Amazon set to report earnings in just over a week, on July 31. Let’s break down what these strategic changes mean for AMZN stock and how you should play it going forward.

About Amazon Stock

Founded in 1994, Amazon (AMZN) revolutionized retail by pioneering e‑commerce, and then cloud computing. Today, Amazon employs over 1.6 million people worldwide and operates leading online marketplaces, AWS cloud services, digital streaming platforms, and AI research initiatives. The hyperscaler has transformed how we shop, work, and live while driving sustainable long‑term growth.

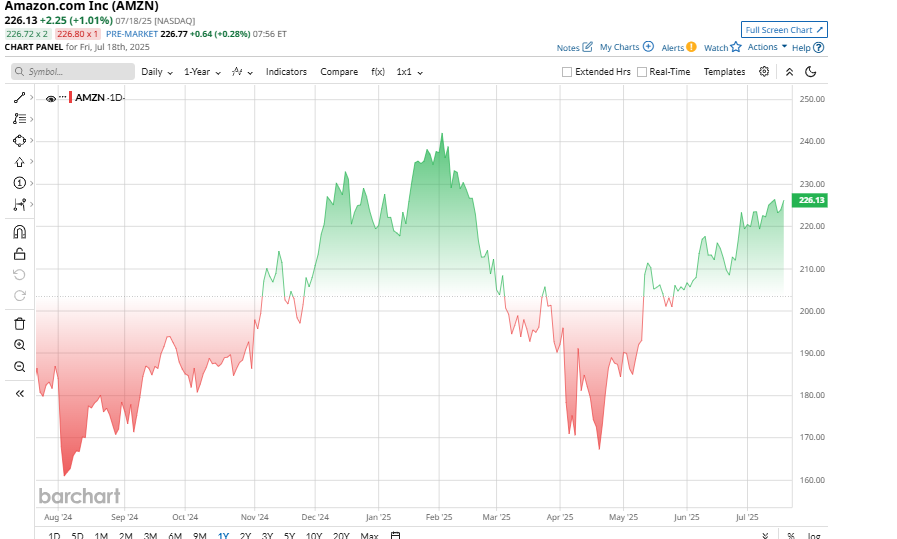

Amazon’s stock is up about 3.8% year-to-date, underperforming the broader market on tariff-related headwinds and ongoing trade tensions. However, the shares have rallied 27.5% from their late-April lows, fueled by a record Prime Day, strong AWS cloud AI demand, and robust advertising results.

AMZN trades at a premium valuation, as indicated by its price/sales ratio of 3.50 and forward price/earnings ratio of 36.85. However, given its status as a Magnificent 7 stock that has outperformed the broader S&P 500 Index ($SPX) by a wide margin over the last decade, AMZN arguably deserves some kind of premium to its sector peers.

Plus, at current levels, Amazon stock trades about 20% below its own 5-year average EV/EBITDA, and about 6% below its all-time high share price.

Is Amazon Shrinking AWS?

The news that “Amazon is cutting AWS jobs” can be alarming, but the details matter. Reports indicate Amazon is eliminating “at least hundreds” of positions in AWS, including in its training and certification teams. The company’s statement frames this as a targeted reorganization: “After a thorough review of our organization, our priorities, and what we need to focus on going forward, we’ve made the difficult business decision to eliminate some roles across particular teams in AWS,” Amazon said.

At the same time, Amazon noted that it still has “thousands of open roles” across AWS and is actively hiring in core teams. This suggests the company is redeploying resources, not trimming down AWS - which has effectively become its core profit engine, and the crown jewel of the company.

Drilling down, in Q1 2025, AWS revenue was $29.3 billion, up about 17% year-over-year. This unit generated $11.5 billion in operating profit - 23% higher than a year ago, and by far the largest chunk of Amazon’s overall profit. Analysts estimate AWS’s annualized revenue run-rate is roughly $117 billion, and the segment still commands about 29% of the global cloud-infrastructure market.

Is AMZN Stock a Buy on AWS Upside?

Even as AWS grows at a healthy clip, its long-term runway could be enormous. Amazon CEO Andy Jassy has repeatedly noted that the vast majority of corporate IT spending is still “on-premises,” meaning it hasn’t moved to the cloud yet. Specifically, in his 2023 shareholder letter, he observed that “more than 85% of the global IT spend is still on premises” and predicts that over the next 10–20 years this will flip, with most workloads migrating to cloud platforms.

Jassy also indicated that prior to the latest AI boom, AWS expected a “multi-hundred-billion-dollar” revenue run rate. He now says he believes it could be even larger. These comments underscore Amazon’s view that AWS still has room to grow explosively, especially as companies adopt AI, big data, and other advanced services that run on AWS infrastructure.

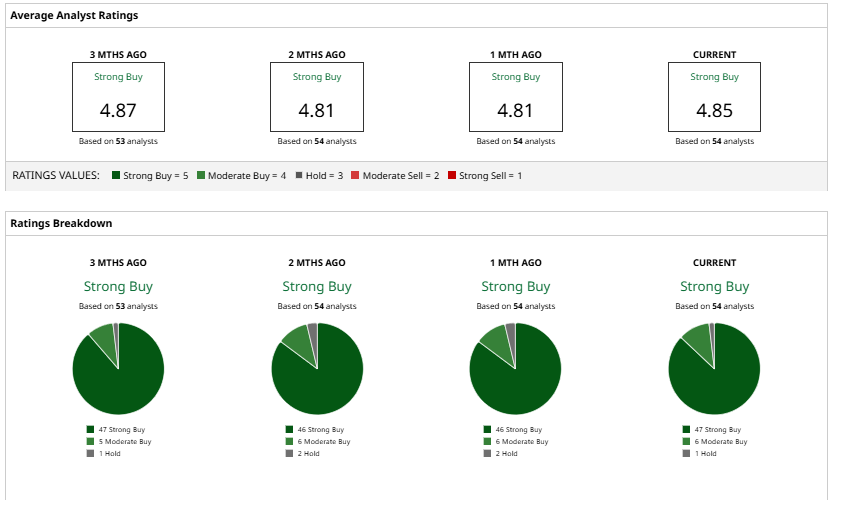

Overall, the consensus of 54 analysts tracking AMZN is a “Strong Buy,” and the average price target of $249.85 implies about 10% upside potential.