Amazon.com, Inc. (NASDAQ:AMZN) will release earnings results for the second quarter, after the closing bell on Thursday, July 31.

Analysts expect the Seattle, Washington-based company to report quarterly earnings at $1.33 per share, up from $1.26 per share in the year-ago period. Amazon projects to report quarterly revenue at $162.11 billion, compared to $147.98 billion a year earlier, according to data from Benzinga Pro.

Amazon.com is disputing a report that it has raised prices on thousands of items in response to tariffs imposed by President Donald Trump.

Amazon shares fell 0.4% to close at $230.19 on Wednesday.

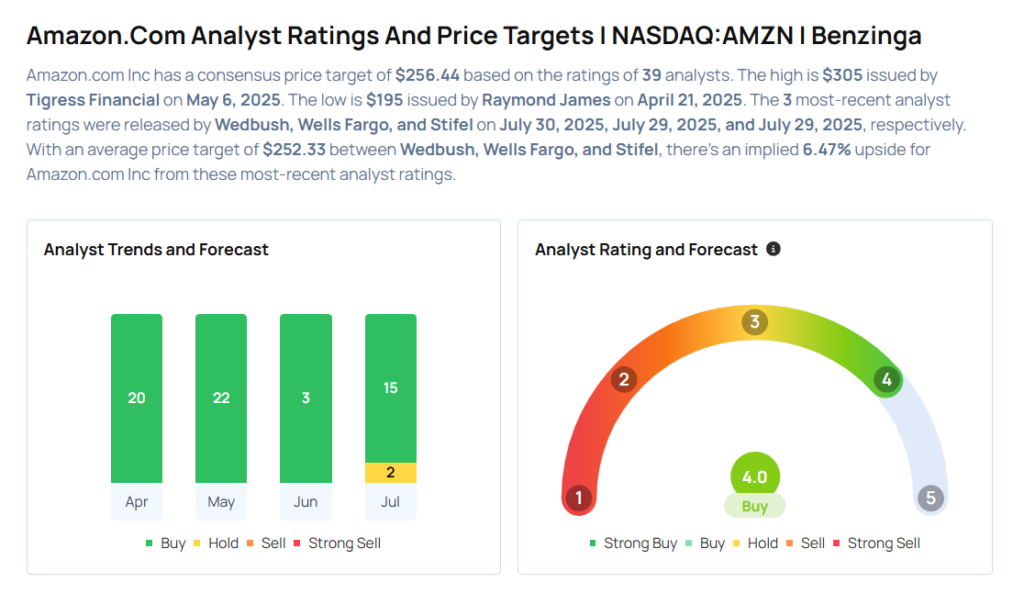

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Wedbush analyst Scott Devitt maintained an Outperform rating and increased the price target from $235 to $250 on July 30, 2025. This analyst has an accuracy rate of 83%.

- Wells Fargo analyst Ken Gawrelski maintained an Equal-Weight rating and raised the price target from $238 to $245 on July 29, 2025. This analyst has an accuracy rate of 74%.

- Stifel analyst Mark Kelley maintained a Buy rating and increased the price target from $245 to $262 on July 29, 2025. This analyst has an accuracy rate of 86%.

- UBS analyst Stephen Ju maintained a Buy rating and raised the price target from $249 to $271 on July 28, 2025. This analyst has an accuracy rate of 75%.

- B of A Securities analyst Justin Post maintained a Buy rating and increased the price target from $248 to $265 on July 23, 2025. This analyst has an accuracy rate of 85%.

Considering buying AMZN stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock