/Amazon_com%20Inc_%20%20package%20by%20-%20AdrianHancu%20via%20iStock.jpg)

Valued at a market cap of $2.3 trillion, Amazon.com, Inc. (AMZN) is a leading global technology company that operates in multiple industries, including e-commerce, cloud computing, advertising, digital streaming, and AI. The Seattle, Washington-based company is scheduled to announce its fiscal Q3 earnings for 2025 in the near future.

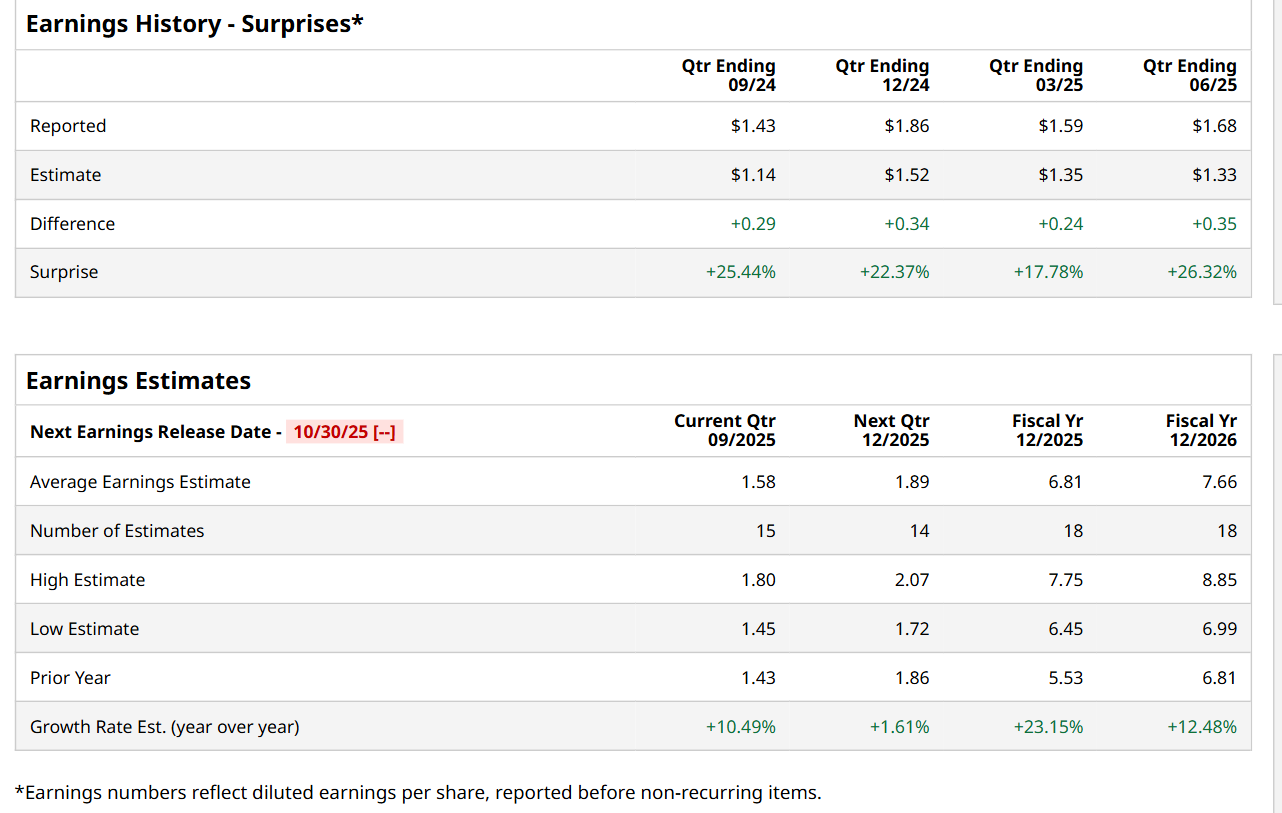

Ahead of this event, analysts expect this e-commerce giant to report a profit of $1.58 per share, up 10.5% from $1.43 per share in the year-ago quarter. The company has a promising trajectory of consistently beating Wall Street’s bottom-line estimates in each of the last four quarters. In Q2, AMZN’s EPS of $1.68 exceeded the forecasted figure by a notable margin of 26.3%.

For the current fiscal year, ending in December, analysts expect AMZN to report a profit of $6.81 per share, up 23.2% from $5.53 per share in fiscal 2024. Furthermore, its EPS is expected to grow 12.5% year-over-year to $7.66 in fiscal 2026.

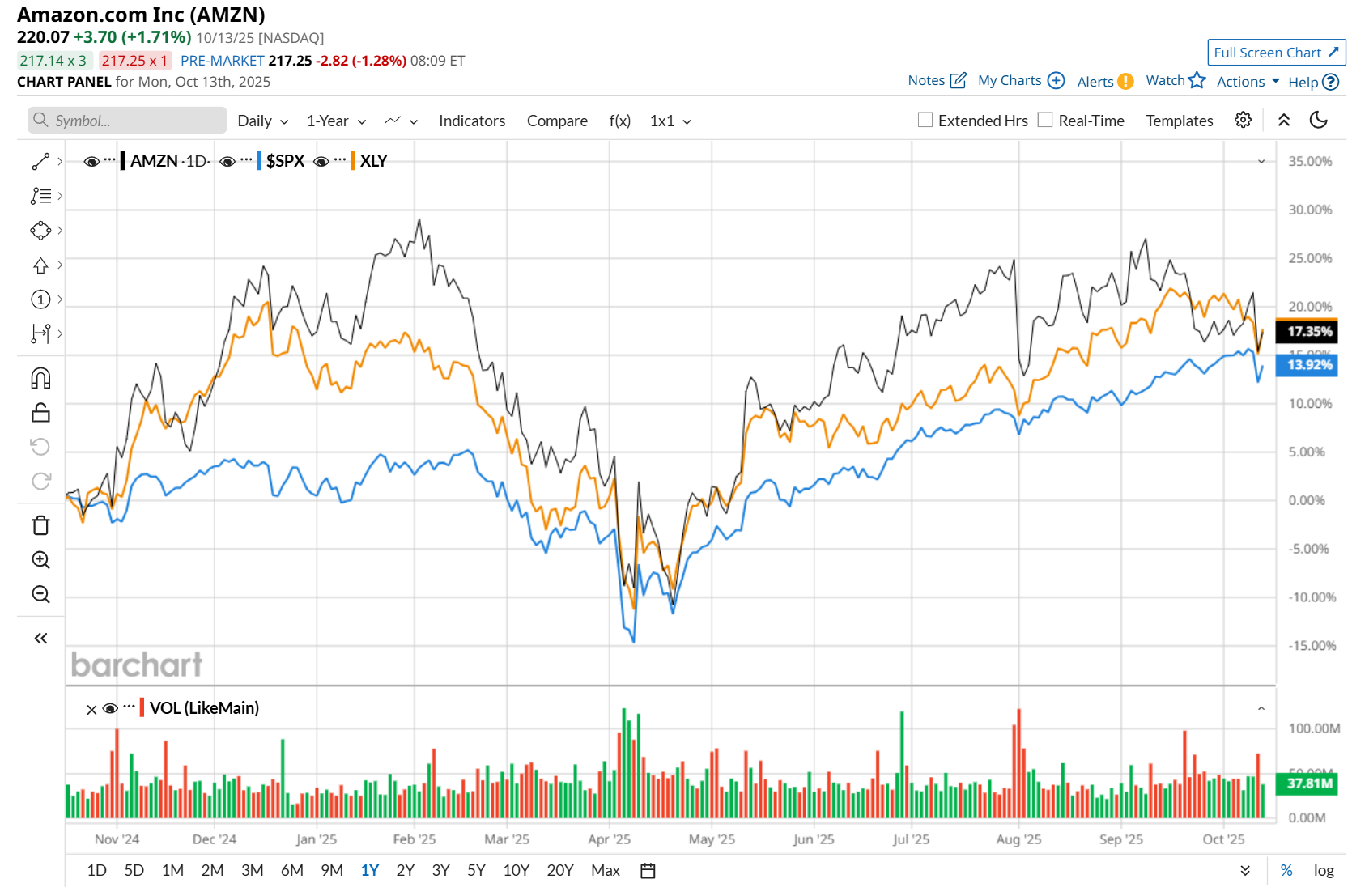

AMZN has outpaced the S&P 500 Index's ($SPX) 14.4% return over the past 52 weeks, with its shares up 15.6% over the same time frame. However, it has trailed behind the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 17% uptick over the same time period.

AMZN posted better-than-expected Q2 earnings results on Jul. 31. Due to robust revenue growth across all reportable segments, the company’s total net sales improved 13.3% year-over-year to $167.7 billion, surpassing consensus estimates by 3.3%. Moreover, its EPS of $1.68 grew 33.3% from the year-ago quarter and came in 26.3% ahead of analyst estimates. Yet, its shares plunged 8.3% in the following trading session.

Wall Street analysts are highly optimistic about AMZN’s stock, with a "Strong Buy" rating overall. Among 57 analysts covering the stock, 50 recommend "Strong Buy," six indicate "Moderate Buy," and one suggests a "Hold” rating. The mean price target for AMZN is $267.30, implying a 21.5% potential upside from the current levels.