READ THE FULL ALQGC RESEARCH REPORT

Recent Partnerships

Licensing & Production Agreement with Julphar

On December 6, 2021, Quantum Genomics S.A. (

As part of the deal, Quantum will receive up to $20 million in upfront, development and sales milestone payments as well as royalties on future sales. In exchange, Julphar will receive exclusive license to market firibastat in the Middle East, Africa, Turkey, and the Commonwealth of Independent States, which comprises member states Armenia, Azerbaijan, Belarus, Kazakhstan, Kyrgyzstan, Moldova, Russia, Tajikistan, and Uzbekistan. Julphar will also be the exclusive producer of firibastat in these regions, leveraging its manufacturing facilities in the emirate of Ras Al Khaimah for mass production, which could even support production for territories outside the currently defined area. Julphar has also pledged, through a $2 million private placement, to become a shareholder in Quantum.

We estimate that there is a population of approximately 700 million in the Middle East, Africa, Turkey, and the Commonwealth of Independent States. Consumption of health care products and services here is on average below that of Europe and the United States and we assume a lower penetration rate for this region. Despite the lower penetration level, the number of patients is expected to be high given the large population.

Licensing Agreement with Teva Israel

On November 25, 2021, Quantum announced that it had signed an exclusive license agreement with Teva Israel Ltd., a subsidiary of Teva Pharmaceutical Industries Ltd, to market firibastat in Israel, adding to this year's commercialization progress. Quantum will receive up to $11 million in payments and 25% to 30% in royalties on future sales. In exchange, Teva will receive exclusive rights to market firibastat in Israel.

Under the terms of the agreement, Teva Israel will have exclusive marketing, selling and distribution rights to develop and commercialize firibastat in Israel for resistant and difficult-to-treat hypertension. The licensed regions have a population of approximately 9.2 million with a similar prevalence of hypertension as in other developed areas of the world. Teva's global reach may provide an opportunity to expand firibastat into additional new geographies.

Existing Partnerships

Partnerships for Development and Commercialization

Over the last two years, Quantum has been busy forging relationships with pharmaceutical companies and distributors around the world to commercialize firibastat. In the following sections we summarize the arrangements made prior to those with Teva Israel and Julphar.

Exclusive Licensing and Collaboration Agreement with Biolab Sanus

Establishment of commercialization partners for firibastat began with Biolab Sanus in late 2019. Under the terms of the agreement with Biolab, Quantum will receive upfronts and milestones of up to $21.2 million and royalties in exchange for exclusive commercialization rights in Latin America. Biolab agreed to fund part of the Phase III study in difficult-to-treat/resistant hypertension in Latin America, a part of the overall pivotal evaluation of firibastat.

Biolab Sanus

Biolab Sanus Pharmaceuticals is one of the five largest pharmaceutical companies in Brazil and the leader in cardiology and arterial hypertension. The company operates four production facilities (plants) in Jandira, Taboão da Serra, Bragança Paulista, and Rio de Janeiro. Together, these production facilities produce over 100 million units per year. In addition, it has research and development facilities in Itapecerica da Serra and Mississauga, Ontario. It has one distribution center in Extrema and headquarters in São Paulo. Across the company, there are 3,200 employees, and the sales team alone consists of 1,400 representatives. The company features a portfolio with over 100 products, substantial investment in research and development and commitment to over 50 international partnerships.

Exclusive Licensing and Collaboration Agreement with Orient EuroPharma

On September 22, 2020, Quantum announced that it had entered into an exclusive licensing and collaboration agreement with Orient EuroPharma (OEP) for the commercialization of firibastat in South East Asia, Australia and New Zealand. In the agreement, Quantum will receive upfront and milestone payments up to US$19 million plus double-digit royalties on sales, with milestones based both on development and sales. The total upfront amount has not been disclosed.

Under the terms of the agreement, OEP will have exclusive rights to commercialize firibastat in difficult-to-treat or resistant hypertension in Taiwan, Malaysia, the Philippines, Singapore, Vietnam, Thailand, Indonesia, Myanmar, Cambodia, Australia and New Zealand. The estimated addressable population in these regions is 10 million people. OEP will also fund part of the Phase III study for firibastat in difficult-to-treat/resistant hypertension in Taiwan.

OEP

Founded in 1982, OEP started as a prescription drug distributor and has grown to become a multinational pharmaceutical company. The company was listed on the Taiwan Exchange in 2003. The company is now vertically integrated and engages in R&D, manufacturing, sales and clinical trials in the development and commercialization of pharmaceuticals. In 2019, OEP had over 1,000 employees and operated two subsidiaries, OrientPharma and OP NanoPharma. The company has three major business units that focus on prescription medicine, nutricare and anti-aging, respectively.

Exclusive Licensing Agreement with Xediton Pharmaceuticals

In October 2020, Quantum signed an exclusive agreement with Xediton Pharmaceuticals granting the latter rights to develop and commercialize firibastat. Xediton will maintain exclusive rights to market firibastat in Canada for difficult-to-treat or resistant hypertension. Quantum has already recruited patients in the country as part of the effort to seek approval for the product with Health Canada in conjunction with the Phase III FRESH study. Xediton will pay Quantum upfront and milestones of up to $11.35 million and double-digit royalties on sales of firibastat. From 1.0 to 1.5 million Canadians are estimated to suffer from difficult hypertension.

Xediton Pharmaceuticals

Xediton is an Ontario, Canada-based private pharmaceutical company selling prescription medicines, non-prescription medicines and medical devices. It offers a portfolio of sixteen products in the anti-fungal, anti-infective, pain, oncology and cardiovascular markets.

Exclusive Licensing Agreement with DongWha Pharm

On December 2, 2020, Quantum entered into a licensing and collaboration agreement with DongWha Pharm. The agreement grants commercialization rights to firibastat for the treatment of difficult-to-treat or resistant hypertension in South Korea. The agreement includes upfront and milestone payments of up to $18.5 million and double digit royalties on sales. DongWha will also participate in the global clinical trial and open clinical centers in Korea in support of the New Hope trial. There are an estimated one million individuals in South Korea in the addressable hypertension market.

DongWha Pharm

DongWha Pharm was founded in 1897 with an early focus on medicine and cosmetics. The Seoul, Korea based pharmaceutical company offers a selection of over the counter medications, food and drink, health and beauty, cosmetic and other prescription drug products. DongWha also has a research and development division with candidates in the cardiovascular, anti-inflammatory, ulcerative colitis and other areas. The company's nationwide sales and marketing network make it a valuable partner for commercializing firibastat in South Korea assuming approval.

Exclusive Licensing Agreement with Faran

Announced on December 15, 2020, Quantum entered into an exclusive licensing and collaboration agreement with Faran, a pharmaceutical company based in Greece. Faran obtained exclusive commercialization rights for firibastat in difficult-to-treat/resistant hypertension in Greece. In exchange, Quantum will receive milestone and upfront payments of up to $12.1 million and double-digit royalties on sales. Faran is a Greek pharmaceutical company founded in 1950 with turnover of €37.2 million in 2019. Faran has 78 employees, and has collaborated with top pharmaceutical names such Meiji, Sandoz, and Novartis Hellas.

Pipeline

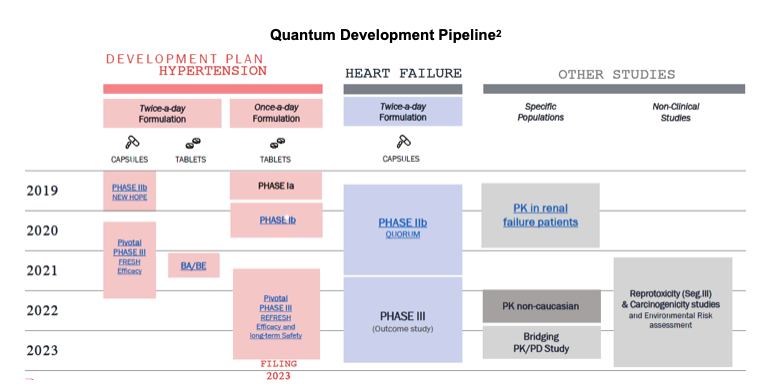

Quantum's pipeline consists of one drug, firibastat, with various formulations pursuing multiple indications. It is being investigated in difficult-to-treat and resistant hypertension, heart failure, renal failure also in once per day formulations. The candidate is currently in one Phase III trial for hypertension, Phase I trials for QD formulation hypertension and renal failure, and has completed a Phase II trial for heart failure.

Milestones

➢ Launch REFRESH study – January 2021

➢ Orient EuroPharma Equity Stake – February 2021

➢ First patient enrolled in REFRESH study – July 2021

➢ QUORUM Phase II topline results, presented at ESC – August 2021

➢ FRESH trial topline – 2Q:22

➢ With supportive data, launch Ph3 outcome study in HF – 2022

➢ Interim results for REFRESH study – Mid-year 2023

➢ FDA submission of firibastat – 3Q:23

➢ Firibastat approval and commercialization – 2024

Valuation

Since our last update, Quantum has reported two new partnerships that expand the covered population by over 700 million individuals. Some of the countries that have been added, such as Israel, Turkey and many of the oil-rich Middle Eastern countries have established health care systems in place where we could expect higher penetration rates. However, in the Commonwealth of Independent States and Africa, health care systems are not as mature. For all new regions, we assume 33% of the population is hypertensive and 12% of this group has uncontrolled hypertension.

These assumptions generate an addressable population of 364,000 in Israel and the market we expect Teva to target. Sales as a proportion of addressable hypertensive population are forecast to begin at 25 basis points in 2024 and rise to 125 basis points by 2027. Following patent expiration, we forecast a decline to 50 basis points. Pricing in Israel is expected to be similar to that in Europe and is forecast at $3,000 per annual course of treatment. We apply the midpoint of the 25-30% royalty revenues disclosed in the press release to estimate royalty revenues and then apply a 50% probability of success to the result for the revenue input in our discounted cash flow (DCF) model.

In the MEAT region, we expect an addressable population of approximately 27.7 million. Due to the lower level of health care system development in the region on average, we assume initial penetration of 20 basis points in the first year of commercialization rising to 120 basis points of penetration by year four. Following patent expiration, we see a decline in penetration to 60 basis points and further compression over time. Pricing in MEAT is expected to be similar to that in the APAC region or about $900 per annual course of treatment. Royalty rates were not disclosed for the arrangement with Julphar and we assume a 30% royalty that represents all economic value received from the partner. A 50% probability of ultimate commercialization is assumed and the result is fed into our revenue and DCF model to produce our target price.

The net impact of the partnerships with Teva Israel and Julphar is an increase of our target price from €16 per share to €18.00 per share.

Summary

Quantum adds to its list of partners with Teva Israel and Julphar. In exchange for exclusive rights to market firibastat in Israel, Quantum will receive up to $11 million in payments and 25% to 30% in royalties on future sales. The exclusive licensing and production agreement with Julphar may provide up to $20 million in upfront, development and sales milestone payments to Quantum, as well as royalties on future sales. Julphar can mass-produce firibastat, serving the Middle East; Africa; Turkey; and CIS, using its state-of-the-art manufacturing facilities. Julphar has also pledged to invest $2 million in Quantum through a private placement.

Quantum continues to build a global market for firibastat with development and commercialization partnerships around the world. Additional opportunity remains for deals in countries such as Japan, India, North America, China and unpenetrated areas in Europe. New sources of capital and cash reserves of almost €29 million suggest a runway beyond 2022. We expect additional milestone funds in future quarters which will further support development programs and perhaps eliminate the need for further capital raises.

SUBSCRIBE TO ZACKS SMALL CAP RESEARCH to receive our articles and reports emailed directly to you each morning. Please visit our website for additional information on Zacks SCR.

DISCLOSURE: Zacks SCR has received compensation from the issuer directly, from an investment manager, or from an investor relations consulting firm, engaged by the issuer, for providing research coverage for a period of no less than one year. Research articles, as seen here, are part of the service Zacks SCR provides and Zacks SCR receives quarterly payments totaling a maximum fee of up to $40,000 annually for these services provided to or regarding the issuer. Full Disclaimer HERE.

________________________

1. Compiled by Zacks Analysts

2. Source: Quantum Genomics June 2021 Corporate Presentation