Mountain View, California-based Alphabet Inc. (GOOG) operates as a holding company, providing various internet products such as Google Chrome, Google Cloud, Google Maps, etc., and healthcare services, and more. With a market cap of approximately $3.3 trillion, Alphabet operates through Google Services, Google Cloud, and Other Bets segments.

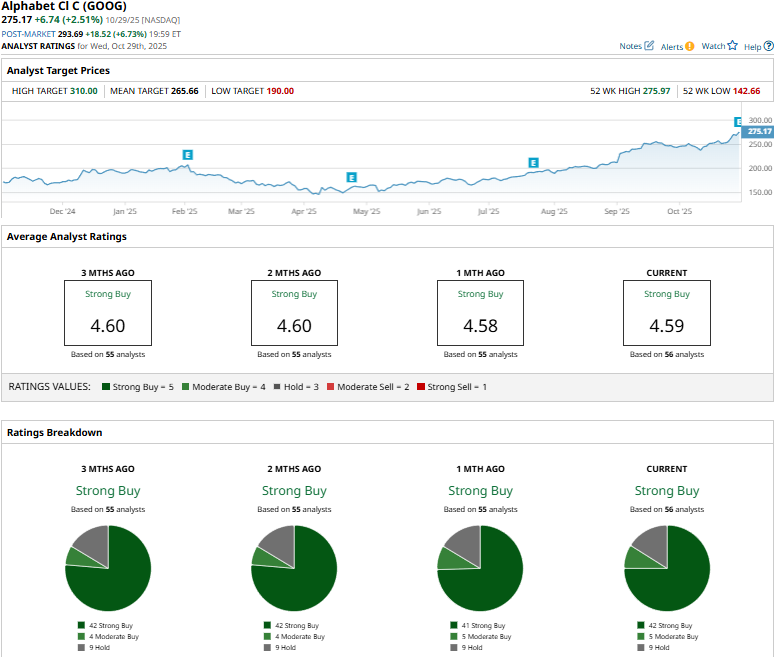

Alphabet has notably outperformed the broader market over the past year. GOOG stock has soared 60.8% over the past 52 weeks and 44.5% in 2025, compared to the S&P 500 Index’s ($SPX) 18.1% gains over the past year and 17.2% returns on a YTD basis.

Narrowing the focus, GOOG has also outperformed the Communication Services Select Sector SPDR ETF Fund’s (XLC) 26% surge over the past year and 20.1% gains on a YTD basis.

In Q3 2025, Google Search, YouTube ads, Google subscriptions, platforms, and devices all observed a solid double-digit growth in revenues, while Google Cloud observed an even more impressive 33.5% surge in revenues to $15.2 billion. Moreover, the company’s revenues crossed the $100 billion mark for the first time in a quarter. Its topline grew 15.9% year-over-year to $102.3 billion, exceeding the Street’s expectations of $99.9 billion by 2.4%. Moreover, its EPS soared 35.4% year-over-year to $2.87, surpassing the consensus estimates by a notable margin. In the anticipation of solid growth, Google’s stock prices gained 2.5% in yesterday’s trading session before its Q3 results were released after markets closed.

For the full fiscal 2025, ending in December, analysts expect GOOG to deliver a 23.4% year-over-year growth in earnings to $9.92 per share. Moreover, the company has a solid earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

Moreover, analysts remain optimistic about the company’s prospects. GOOG has a consensus “Strong Buy” rating overall. Of the 56 analysts covering the stock, opinions include 42 “Strong Buys,” five “Moderate Buys,” and nine “Holds.”

This configuration is slightly more bullish than a month ago, when 41 analysts gave “Strong Buy” recommendations.

On Oct. 20, Oppenheimer analyst Jason Helfstein maintained an “Outperform” rating on Alphabet and raised the price target from $270 to $300.

As of writing, Google is trading above its mean price target of $265.66, and its street-high target of $310 suggests an upside potential of 12.7% from current price levels.