/Alphabet%20(Google)%20Image%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

Alphabet Inc (GOOGL) stock is still below my free cash flow (FCF)-based price target and those from other analysts. Shorting out-of-the-money puts and calls is a viable strategy here, ahead of its upcoming earnings release.

GOOGL is at $256.16 in midday trading on Monday, Oct. 20. My prior target price was $276.75 as seen in a Sept. 16 Barchart article, “Alphabet Stock Off Its Peak - Is It Undervalued? It Could Be If FCF Stays Strong.”

I showed that based on its average price/earnings (P/E) multiple valuation ($268.24), its FCF yield value ($309) and analysts' targets ($253), the average was +12% higher at $276.75.

Even at today's price, this target price is still +8% higher, although the FCF-based target price is still over +20% higher.

I will update this target price once the company releases its Q3 earnings next week on Oct. 29.

But until then, it still makes sense to short out-of-the-money (OTM) puts and calls.

Shorting OTM Puts

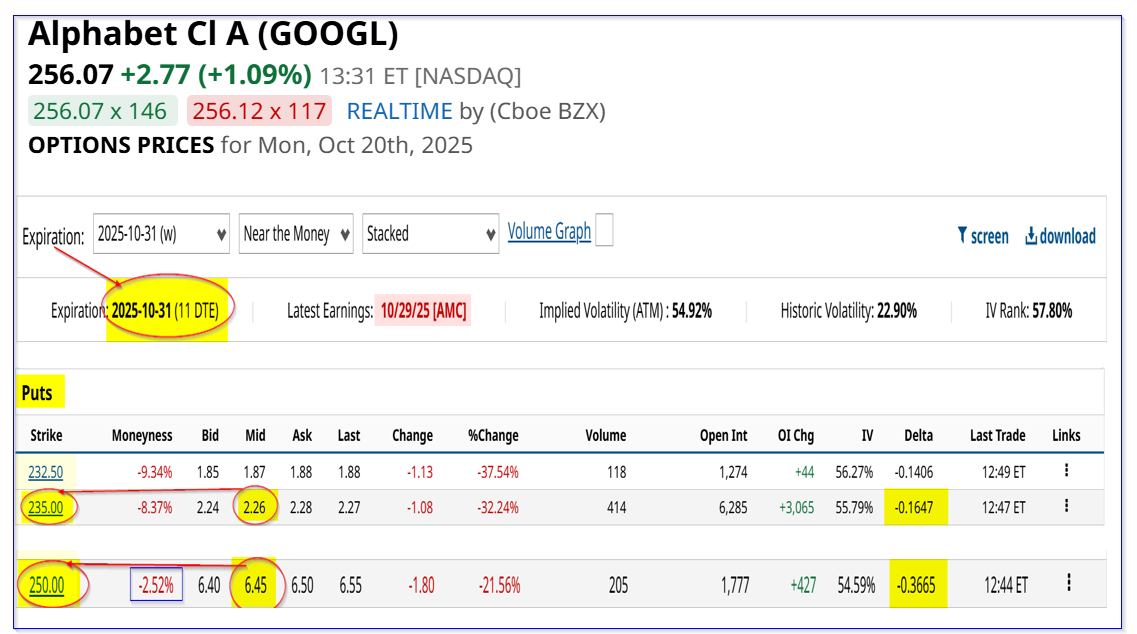

I discussed selling short the $235.00 put option expiring Oct. 31 in my last article on Sept. 26. At the time, this strike price was over 5% out-of-the-money (i.e., below the $246.95 trading price), but the premium income received was still $5.88.

That meant the short-put yield was 2.50% (i.e., $5.88/$235.00).

Now GOOGL is up almost $10.00 three weeks later and the put premium is down 61% to $2.28 today. So, that has been a successful trade and it's likely to expire worthless by Oct. 31.

It may be too early to roll this over to a new period as the short-put yield is still almost 1% (i.e., $2.28/$235.00 = 0.0097 or 0.97%).

Investors with enough capital can also short out-of-the-money puts in a new period, although the new earnings release could affect those premiums.

It might make more sense to enter a new short-term cash-secured put, if the investor has enough capital.

For example, the $250.00 put option for the same Oct. 31 expiry period has a midpoint premium of $6.45. That provides an immediate 2 week yield of 2.58% (i.e., $6.45/250.00).

This means the investor is betting that GOOGL stock won't fall below a breakeven point of $250-$6.45, or $243.55 before Oct. 31. That is 4.92% lower than today's price.

That doesn't seem likely as the earnings won't be released until Oct. 29. The investor could likely close this out before the earnings release at a lower price, due to the normal wasting away of extrinsic value in an out-of-the-money short put play.

Shorting OTM Covered Calls

Investor might also look to the same period to short covered calls. The yield premiums for selling out-of-the-money (OTM calls here, assuming the investor owns 100 shares or at least an in-the-money (ITM) call option (i.e., for a poor-man's covered call).

For example, the $275.00 call option for Oct. 31 expiry, which is near my $276 target price, or over 7% higher, has a midpoint premium of $3.45.

The yield is very attractive:

$3.40/ $256.00 = 1.3% covered call yield for 2 weeks

Moreover, even if GOOGL stock moves up to $275, the investor makes a total return of +8.75%:

$275+ $3.40 = $278.40

$278.40 / $256.00 = 1.0875 -1 = +8.75% upside for 2 weeks

That is an attractive return. And again, the stock is not likely to move significantly higher (i.e., the delta ratio is only 0.25) than this point given that the earnings occur on Oct. 29. The investor could easily close out the position before then.

The bottom line is that it makes sense to short OTM puts and calls here in GOOGL stock.