Shares of Google parent Alphabet Inc (NASDAQ:GOOGL) (NASDAQ:GOOG) hit a new all-time high Monday, buoyed by a string of positive developments in its artificial intelligence and cloud computing divisions coupled with a favorable macroeconomic environment. Here’s what investors need to know.

What To Know: The rally follows several key announcements on Alphabet’s aggressive push into high-growth sectors. Last week, the company unveiled “Gemini for Government,” a competitively priced suite of AI and cloud services aimed at federal agencies, signaling a strong move to capture public sector contracts.

This was compounded by the news of a six-year agreement with Meta Platforms Inc (NASDAQ:META), valued at over $10 billion, for Google Cloud to support Meta’s extensive AI infrastructure needs.

These strategic wins are built on a foundation of impressive financial strength. In its recent second-quarter earnings report, Alphabet surpassed analyst expectations, posting revenues of $96.43 billion and showcasing remarkable 32% year-over-year growth in its Google Cloud segment, which generated $13.6 billion.

Fueling the broader market optimism, Friday comments from Federal Reserve Chair Jerome Powell suggesting a willingness to tolerate short-term inflation have ignited a market-wide “Everything Rally,” creating a fertile ground for growth stocks.

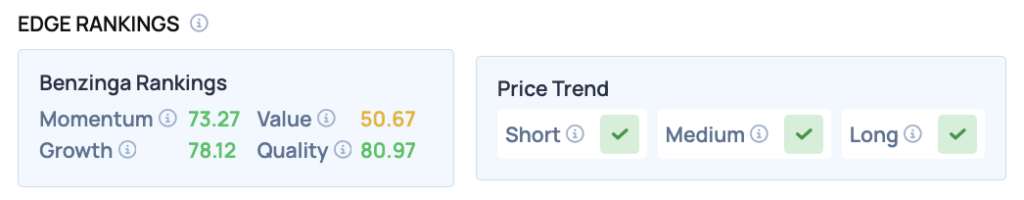

Price Action: According to data from Benzinga Pro, GOOGL shares are trading higher by 1.33% to $208.83 Monday afternoon. The stock has a 52-week high of $210.52 and a 52-week low of $140.53.

Read Also: The ‘Everything Rally’ Is Back—Thanks To Powell’s Risky Bet On Jobs

How To Buy GOOGL Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in Alphabet’s case, it is in the Communication Services sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Image: Shutterstock