/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

Commanding a market cap of $3.3 trillion, Alphabet Inc. (GOOGL) is the parent company of Google and one of the world’s largest tech giants. The California-based tech behemoth operates a diversified portfolio of businesses across digital advertising, search, cloud computing, artificial intelligence, consumer hardware, and digital media platforms.

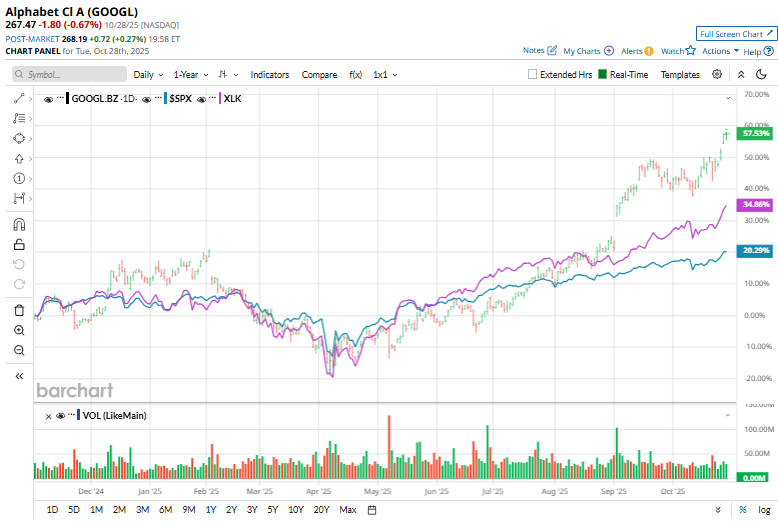

Shares of this internet media giant have outperformed the broader market over the past year. GOOGL has gained an impressive 60.4% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 14.5%. The story continues in 2025, where Alphabet’s shares have climbed 41.3% year-to-date, more than doubling the index’s 17.2% rise.

Narrowing the focus, GOOGL has also outpaced the Technology Select Sector SPDR Fund's (XLK) 31.2% return over the past year and 29.9% gain in 2025.

Alphabet has outpaced the broader market over the past year, thanks to easing regulatory worries and steady momentum across the business. Google Cloud continues to impress, and AI is being baked deeper into Search, YouTube, and enterprise products, giving the company a clear edge. With unmatched strength in search, digital advertising, and core internet infrastructure, Alphabet is not just benefiting from the AI era, it is helping define it. Additionally, GOOGL surpassed a $3 trillion market valuation for the first time on Sept. 15, rising 2.8% for the day.

For the current fiscal year, ending in December, analysts expect GOOGL’s EPS to grow 23.4% to $9.92 on a diluted basis. The company’s earnings surprise history is impressive. It beat the consensus estimate in each of the last four quarters.

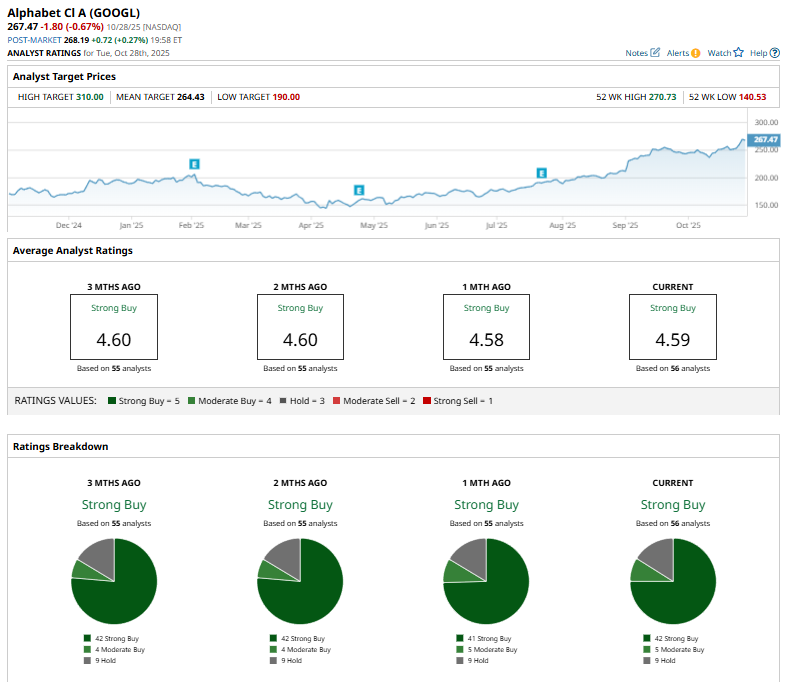

Among the 56 analysts covering GOOGL stock, the consensus is a “Strong Buy.” That’s based on 42 “Strong Buy” ratings, five “Moderate Buys,” and nine “Holds.”

The current configuration is more bullish than it was a month ago, when 41 analysts issued a “Strong Buy” rating for the stock.

On October 24, Stifel analyst Mark Kelley reaffirmed his “Buy” rating on Alphabet and raised the price target from $222 to $292.

The stock currently trades above mean price target of $264.43 and the Street-high price target of $310 suggests a notable upside potential of 15.9%.