Alphabet (GOOGL) (GOOG) has been among the cohort of megacap tech stocks that have helped drive the Nasdaq.

The index sports a year-to-date gain of almost 30%, while the S&P 500 is up more than 13%. Both are seeing a pullback at the moment; trying to avoid a fifth daily decline in the past six days.

Don't Miss: Tesla Win Streak Might Snap; Here's 2 Buy-the-Dip Spots

For Alphabet’s part, it’s been viewed as a laggard in the AI race, which has helped propel Nvidia (NVDA), Microsoft (MSFT) and other stocks higher so far in 2023.

A few weeks ago we looked at the prospect of Alphabet stock engaging in a catchup trade to its FAANG peers.

Netflix (NFLX) enjoyed this catalyst earlier this year, and even though Alphabet has performed well in 2023 — up 37% — it’s still the worst-performing FAANG component.

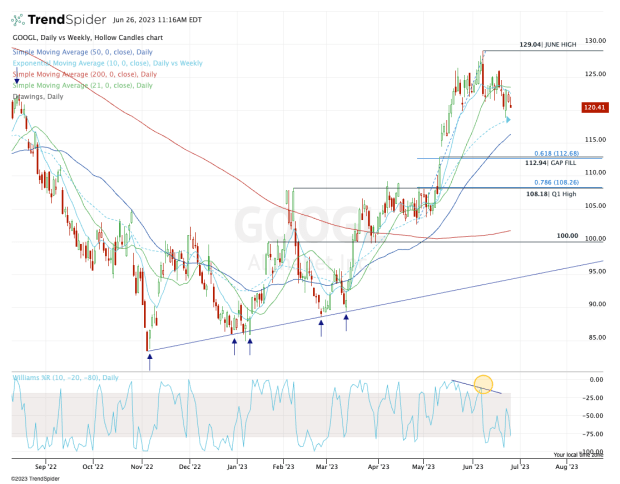

That said, the stock has still traded quite well, and a look at the chart shows a clear trend to the upside.

When to Buy the Dip in Alphabet Stock

Chart courtesy of TrendSpider.com

When Alphabet shares made the push to the June high at $129.04, keen observers noted that it did so with a negative divergence in the RSI measure. While that doesn’t predict a pullback, it had experienced traders on the lookout for such a reaction.

Last week, Alphabet stock almost tagged the rising 10-week moving average, but bounced just before actually testing it. With that price action, it will be interesting to see whether the stock will test the 10-week and/or the 50-day moving average.

Given the trend, one would expect these measures to hold as support. But I am looking for a bit deeper of a correction.

Don't Miss: an AMD Stock Make New Highs? First, Here's Where Support Must Hold

If that’s the case, a pullback to the $113 area looks attractive. That’s where the gap-fill measure and the 61.8% retracement of the recent rally comes into play.

If we get a yet deeper fade in Alphabet stock, that could thrust the $108 area into play.

At that level, we have the first-quarter high, the recent breakout area and the 78.6% retracement.

A retest of a prior breakout zone is often on watch by traders, as it’s a level where buyer interest was intense. If it lines up with other key measures — like a notable retracement or prior high — then all the better.

For now, let’s see how Alphabet handles the 10-week and 50-day moving averages. If we get further weakness below these measures, then these buy-the-dip areas will be in focus.

Get exclusive access to portfolio managers and their proven investing strategies with Real Money Pro. Get started now.