/Allstate%20Corp%20logo%20sign%20-by%20360b%20via%20Shutterstock.jpg)

Valued at a market cap of $56 billion, The Allstate Corporation (ALL) is one of the largest publicly traded personal lines insurers in the United States, best known for its auto, home, and life insurance products. Founded in 1931 and headquartered in Northbrook, Illinois, Allstate serves millions of customers across the U.S. through its network of exclusive agents, independent agents, and direct channels.

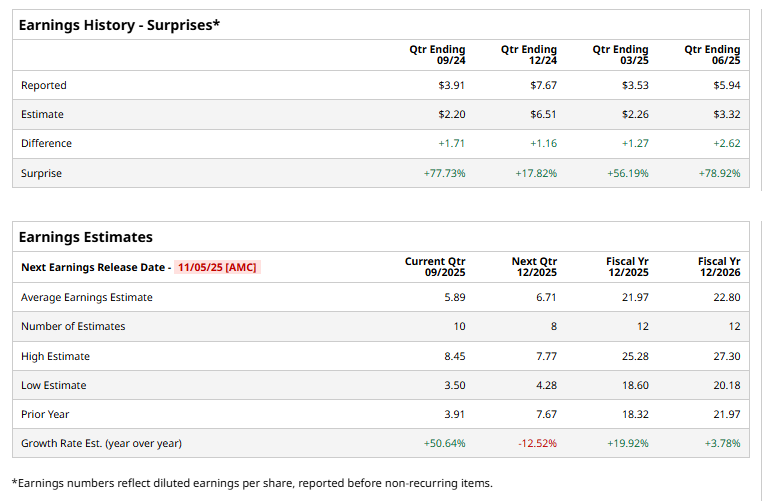

ALL is expected to announce its fiscal Q3 2025 earnings results after the market closes on Wednesday, Nov. 5. Ahead of this event, analysts expect the Northbrook, Illinois-based company to report an adjusted EPS of $5.89, up 50.6% from $3.91 in the year-ago quarter. The company has surpassed Wall Street's earnings estimates in the last four quarters.

For fiscal 2025, analysts expect the insurer to report an adjusted EPS of $21.97, up 19.9% from $18.32 in fiscal 2024.

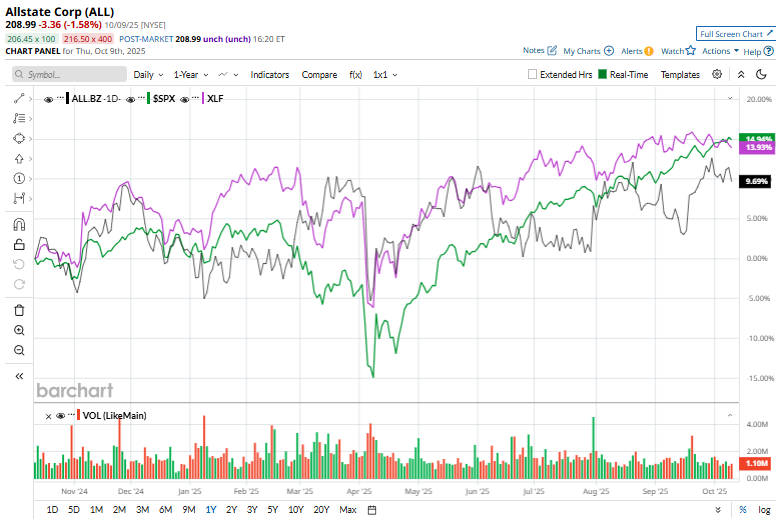

Shares of Allstate have returned 13% over the past 52 weeks, trailing both the S&P 500 Index's ($SPX) 16.3% rise and the Financial Select Sector SPDR Fund's (XLF) 16.5% return over the same period.

Allstate shares climbed 5.7% on July 30 after the company delivered stellar second-quarter 2025 results. Its adjusted EPS of $5.94 handily beat analyst estimates. The impressive performance reflected a robust rebound in the property-liability segment, where underwriting income surged to $1.28 billion, up from a loss in the prior year, and the underlying combined ratio improved to 79.5%. Moreover, a $754 million boost in net investment income further strengthened investor confidence in Allstate’s recovery momentum.

Analysts' consensus view on Allstate’s stock is cautiously optimistic, with a "Moderate Buy" rating overall. Among 24 analysts covering the stock, 15 recommend "Strong Buy," one "Moderate Buy," six suggest "Hold," and two give a "Strong Sell."

The average analyst price target of $230.65 implies a 10.3% upside from current market prices.