Madison, Wisconsin-based Alliant Energy Corporation (LNT) is a regulated public utility company. Valued at $16.5 billion by market cap, it currently serves approximately 1 million electric and 430,000 natural gas customers across Iowa and Wisconsin via its subsidiaries Interstate Power & Light and Wisconsin Power & Light. The company operates a diverse energy generation portfolio, including coal, natural gas, wind, solar, hydroelectric, and energy storage, and is progressing toward net-zero greenhouse gas emissions by 2050.

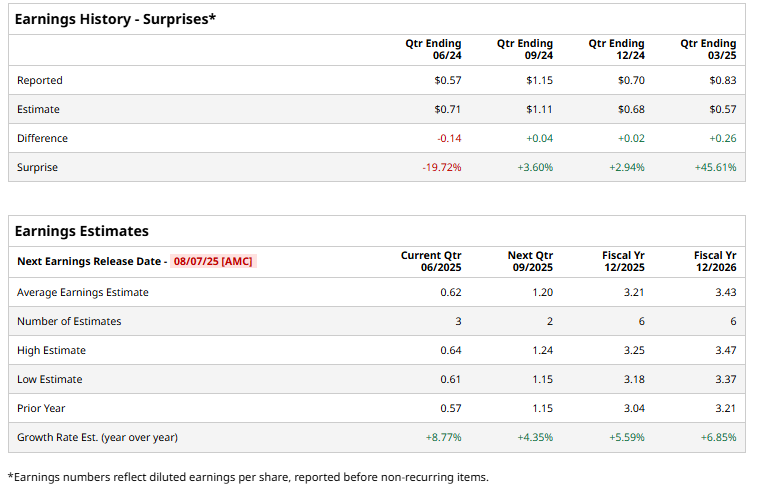

The utility major is expected to announce second-quarter results on Thursday, Aug. 7. Ahead of the event, analysts expect Alliant Energy to report a non-GAAP profit of $0.62 per share, up 8.9% from $0.57 per share reported in the year-ago quarter. The company has surpassed Wall Street’s earnings expectations in three of the past four quarters while missing on another occasion.

For fiscal 2025, Alliant is expected to report an adjusted EPS of $3.21, up 5.6% from $3.04 in fiscal 2024.

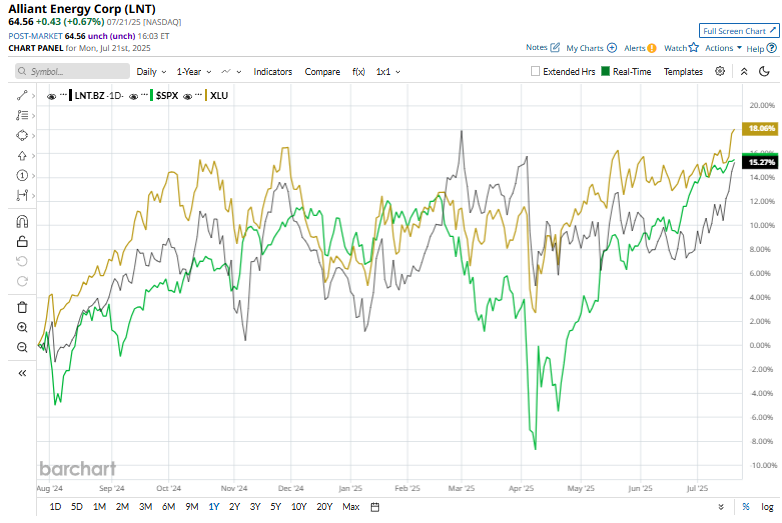

LNT stock has gained 17.7% over the past 52 weeks, outpacing the S&P 500 Index’s ($SPX) 14.5% surge but lagging behind the Utilities Select Sector SPDR Fund’s (XLU) 19.8% returns during the same time frame.

On July 18, Aliant shares popped 1.4% after declaring a quarterly cash dividend of $0.5075 per share, which is payable on August 15, to shareholders of record as of July 31. This marks the 319th consecutive quarterly dividend payment by the company, a streak that dates back to 1946, highlighting Alliant’s strong commitment to delivering consistent and reliable returns to its investors.

The consensus opinion on LNT stock is moderately bullish, with an overall “Moderate Buy” rating. Out of the 12 analysts covering the stock, six recommend “Strong Buy,” five suggest a “Hold,” and one advises a “Strong Sell” rating. Its mean price target of $65.55 represents a 1.5% premium to current price levels.