Alibaba Group Holding Ltd (NYSE:BABA) saw its Hong Kong-listed shares surge by 18.5% on Monday amid strong quarterly performance of the company’s cloud computing unit and the unveiling of a new AI chip.

Cloud Growth Pushes Alibaba Shares To March peak

The stock’s surge on Monday marked its highest level since March. The company’s cloud computing unit was the driving force behind the impressive quarterly results, with investors showing confidence in Alibaba’s expansion into new areas, particularly “instant commerce,” a fiercely competitive sector in China.

Check out the current price of BABA stock here.

Despite a 2% year-on-year increase in revenue for the June quarter, which fell short of analyst expectations, the company’s net income surged by 78% annually, surpassing forecasts. The cloud computing unit’s revenue also grew by 26% annually, a faster rate than the previous quarter, indicating a continuous acceleration in Alibaba’s cloud growth.

This rally in Hong Kong follows the momentum of Alibaba’s recent earnings report, which saw its New York-listed shares close nearly 13% higher on Friday.

Alibaba’s AI Chip Fuels Optimism Despite Nvidia Doubts

The surge in Alibaba’s shares also comes after the company unveiled a new AI chip designed to reduce China’s reliance on Nvidia Corp (NASDAQ:NVDA), a significant U.S. semiconductor company. This move was seen as a direct challenge to U.S. restrictions and highlighted China’s determination to counter these restrictions with homegrown technology.

Despite the initial impact of Alibaba’s new AI chip on Nvidia’s stock, some industry experts like prominent investor Ross Gerber dismissed the move as “laughable,” suggesting that it was merely a strategic posturing to maintain sales.

Alibaba’s recent surge in shares indicates that investors are optimistic about the company’s future, particularly its cloud computing unit and its foray into new technologies like AI chips.

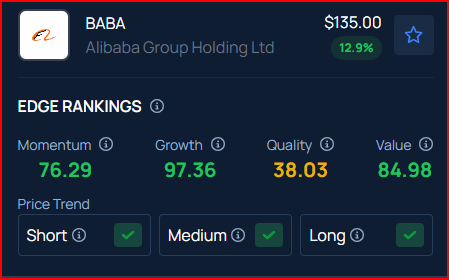

According to Benzinga Edge Stock Rankings, Alibaba has a growth score of 97.36% and a momentum rating of 76.29%. Click here to see how it compares to other leading tech companies.

READ MORE:

Image via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.