Earlier this week, Alibaba (BABA) stock gained momentum after Chinese state media reported that the e-commerce giant had secured a major AI customer, believed to be China Unicom, the country's second-largest telecommunications company.

According to China's CCTV broadcaster, China Unicom will deploy Alibaba's AI accelerators from its semiconductor unit, T-Head, as part of a massive new data center project in Qinghai Province. While Alibaba doesn't sell chips directly, customers access the computing power through its cloud services platform.

The partnership offers validation of Alibaba's domestic AI capabilities at a crucial time. China is aggressively promoting homegrown semiconductor solutions as U.S. export restrictions limit access to Nvidia's (NVDA) cutting-edge AI chips. Recently, reports emerged that China's internet regulator told companies to stop purchasing certain Nvidia processors.

Alibaba is well-positioned as one of China's leading AI players, boasting proprietary models and a dominant cloud infrastructure. The China Unicom win demonstrates real enterprise demand for domestic AI solutions.

However, Alibaba faces intense regulatory scrutiny, as geopolitical tensions are likely to impact its global expansion. The company's cloud division, although growing, still lags its international rivals in terms of scale and profitability.

While this AI customer win provides positive momentum, investors should weigh Alibaba's domestic AI strength against ongoing macro challenges before making investment decisions.

Is Alibaba Stock a Good Buy Right Now?

Valued at a market capitalization of $363 billion, Alibaba is one of the most prominent companies globally. Despite its massive size, Alibaba grew revenue by 10% year-over-year (YoY) to $34.7 billion in Q2 2025. The Chinese e-commerce giant also expanded its cloud business by 26% due to surging demand for AI.

Cloud Intelligence Group's revenue growth was driven by AI-related products, maintaining triple-digit expansion for the eighth consecutive quarter, which now accounts for over 20% of external customer revenue. CEO Eddie Wu highlighted the company's strategic partnership with SAP (SAP), which positions Alibaba Cloud as a global computing partner.

Alibaba’s aggressive push into quick commerce has shown impressive early traction, despite incurring notable investment costs. Since launching Taobao Instant Commerce in April, the number of monthly active consumers reached 300 million in August, driving a 25% growth in Taobao app users. Peak daily orders reached 120 million, with the business already leading the food delivery market in terms of order volume.

However, this rapid expansion came at a cost. Alibaba China E-commerce Group's adjusted EBITDA declined 21% as it invested heavily in quick commerce infrastructure and user acquisition. The business burned through approximately $5.4 billion in free cash flow, primarily due to accelerated AI investments, while cloud infrastructure investments totaled $5.5 billion in capital expenditures.

Looking ahead, Alibaba has committed $53.2 billion in technology investments over the next three years, as well as $7 billion for consumption initiatives. Management expects quick commerce losses to halve in the near term while targeting $140 billion in incremental GMV within three years from its instant commerce platform.

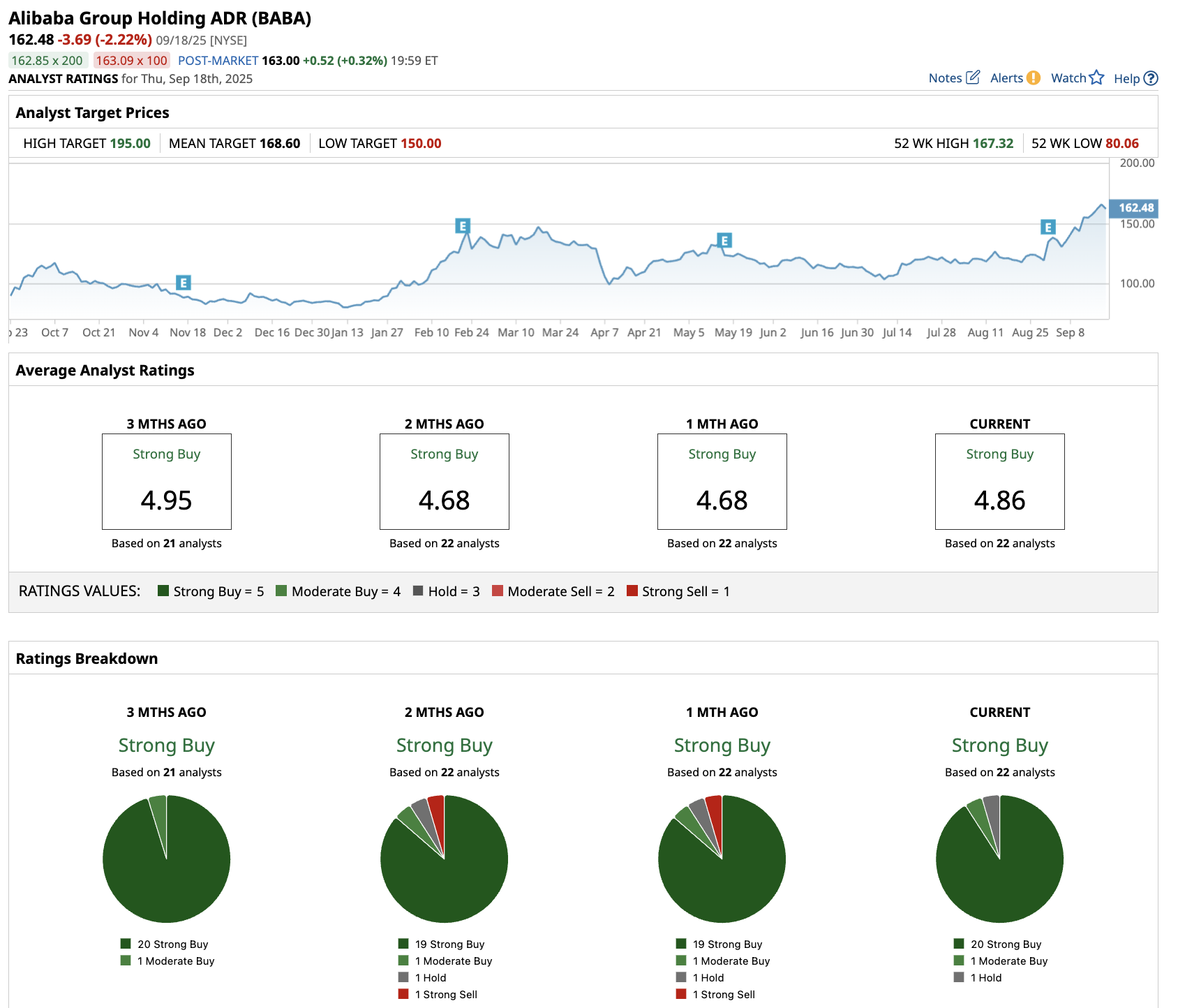

What is the BABA Stock Price Target?

Analysts tracking Alibaba stock forecast revenue to rise from $138.24 billion in fiscal 2025 (ended in March) to $199.2 billion in fiscal 2030. In this period, its free cash flow is forecast to expand from $10.2 billion to $28.6 billion.

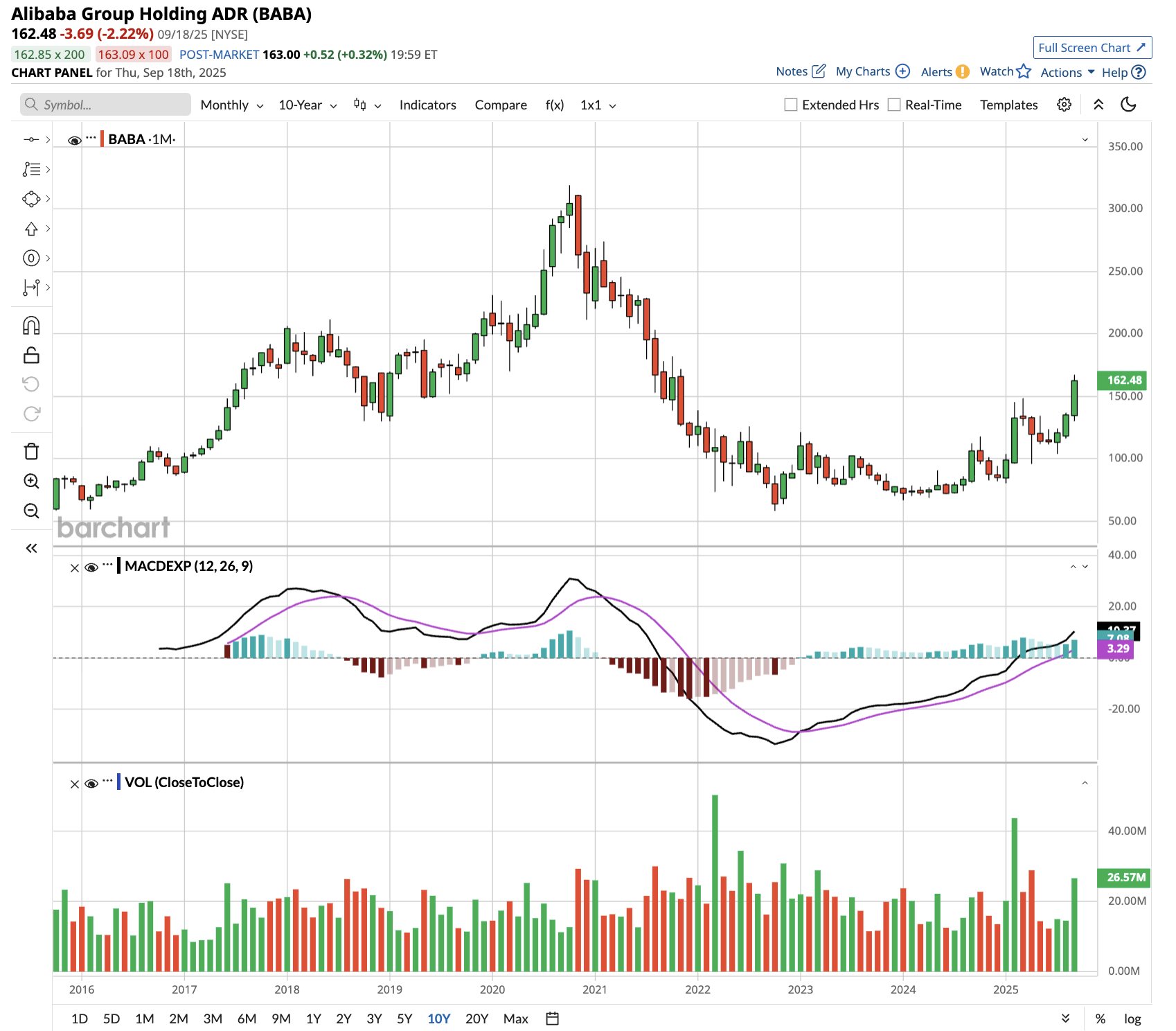

Currently, BABA stock is priced at a forward free cash flow (FCF) multiple of 31.4x, which is above its five-year average of 14.8x. If it trades at 20x FCF, the tech stock could gain close to 60% within the next four years.

Out of the 25 analysts covering BABA stock, 20 recommend “Strong Buy,” one recommends “Moderate Buy,” and one recommends “Hold.” The average BABA stock price target is $169, which is above the current price of $162.50.