/Alibaba%20by%20testing%20via%20Shutterstock.jpg)

Chinese internet and e-commerce giant Alibaba (BABA) has stepped into the smart glasses arena with the introduction of its Quark AI glasses, slated for release in China by the end of 2025. Powered by Alibaba’s advanced Qwen large language model and its Quark AI assistant, these glasses feature a built-in camera and offer hands-free calling, music streaming, real-time language translation, and automatic meeting transcription.

The move underscores Alibaba’s commitment to strengthening its presence in China’s rapidly evolving AI industry, putting it in direct competition with international giants like Meta Platforms (META) and Xiaomi (XIACY) in the fast-growing market for AI-enhanced wearable technology.

With this catalyst heating up, how should investors play BABA stock here?

About Alibaba Stock

Alibaba Group is a Chinese technology conglomerate and a global leader in e-commerce, cloud computing, digital media, and financial technology, with major platforms including Alibaba.com, Taobao, Tmall, Alipay, and Alibaba Cloud.

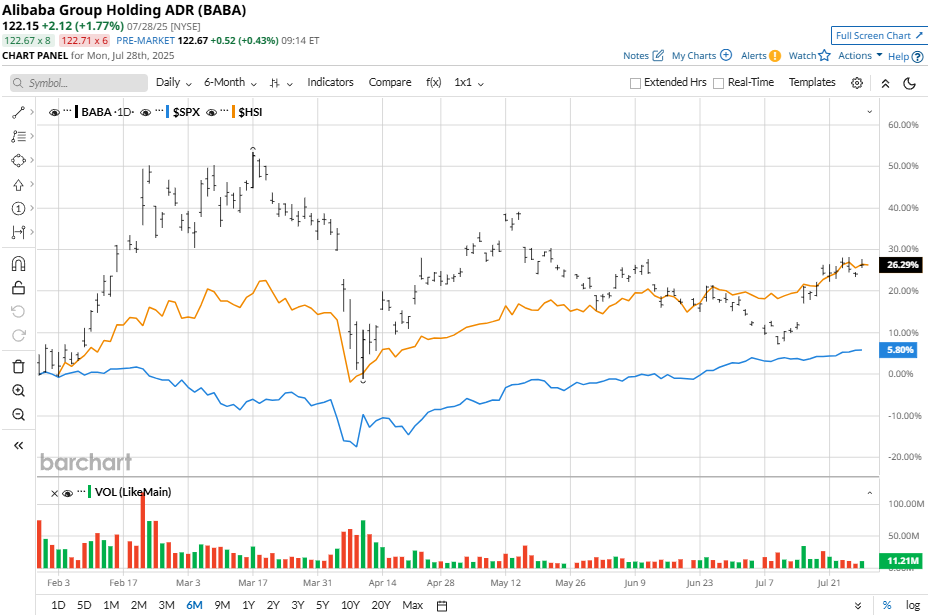

Alibaba’s stock has gained about 43% year-to-date in 2025, significantly outperforming both the Hang Seng Index ($HSI) and the S&P 500 Index ($SPX).

Alibaba’s Financial Performance

Alibaba reported its most recent financial results on May 15.

The company posted revenue of $32.58 billion, up 7% year-over-year, but slightly short of analyst expectations. Earnings per share came in $0.71 on a diluted basis, missing consensus forecasts. BABA stock fell following the earnings release given the revenue and EPS miss.

Alibaba posted a 36% year-over-year increase in adjusted EBITA to $4.5 billion, indicating ongoing operational efficiency improvements. Operating income surged 93% to $3.92 billion, and non-GAAP net income saw a 22% rise to $4.11 billion.

Management emphasized sustained investment in AI and cloud, reaffirming their “AI-driven” focus to navigate a competitive, fast-evolving market.

Should You Buy, Sell, or Hold Alibaba?

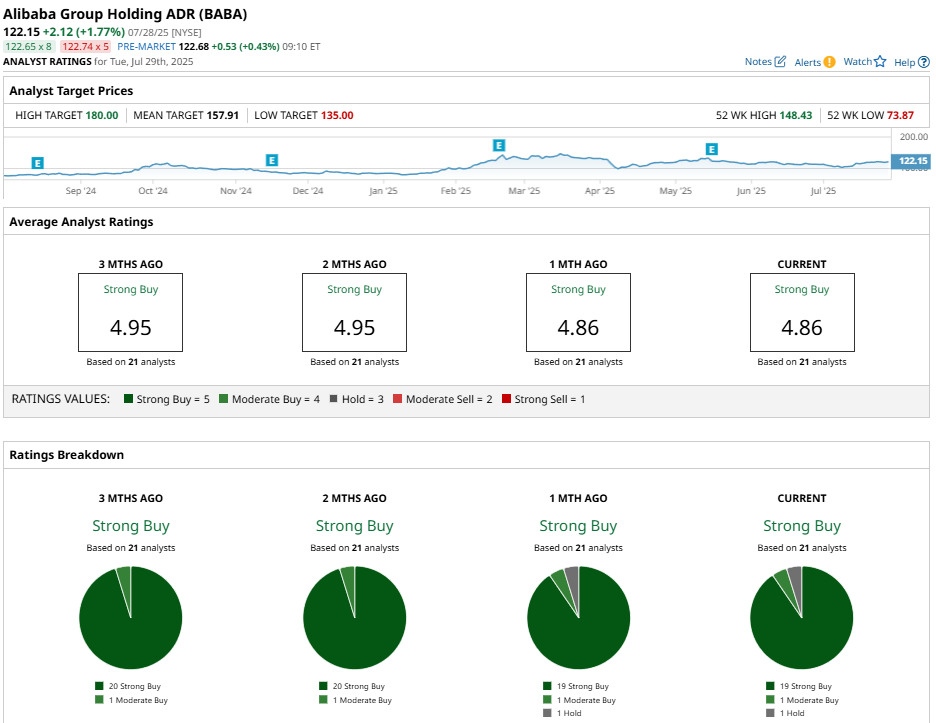

Alibaba stock is currently highly favored by Wall Street analysts, who assign it a “Strong Buy” consensus rating. The mean price target stands at $157.91, which implies potential upside of 31%.

Out of the total recommendations, 19 analysts rate Alibaba as a “Strong Buy,” while one rates it “Moderate Buy” and one rates it “Hold.”