E-commerce giant Alibaba Group Holding Ltd (NYSE:BABA) and on-demand service platform operator Meituan (OTC:MPNGY) jointly handed out 92% of China's antitrust fines, the SCMP reports.

China raked in 23.6 billion yuan ($3.53 billion) in antitrust fines in 2021, up 52 times versus 2020. Alibaba's record 18.2 billion yuan penalty and Meituan's 3.4 billion yuan fine over their monopolistic practices formed the bulk of the penalties for 2021 following China's antitrust investigations to contain the "irrational expansion of capital" in the tech sector.

China closed 175 cases in 2021, up 61.5% from 2020. Alibaba and Meituan had allegedly forced merchants to forge agreements with their respective platforms.

China also penalized the other influential companies, like social media and video gaming company Tencent Holding Ltd (OTC:TCEHY), TikTok owner ByteDance, and ride-hailing firm DiDi Global Inc (NYSE:DIDI), for failing to report their merger and acquisition deals for antitrust reviews.

The State Anti-Monopoly Bureau acknowledged significant success in disciplining monopolistic behaviors and focused on restoring market confidence, hinting at ease in the regulatory crackdown.

The Chinese government ramped up efforts to stimulate the economic slowdown from its Covid-19 policy. China's top leadership met Big Tech executives expressing their support for the sector.

The State Anti-Monopoly Bureau looked to uphold regulations in some areas. The SAMR also released new guidance for online promotion events during the June 18 midyear shopping festival, taking place on popular e-commerce sites like JD.com, Inc (NASDAQ:JD) and Alibaba's Taobao.

Price Action: BABA shares traded lower by 2.23% at $116.95 in the premarket on the last check Thursday.

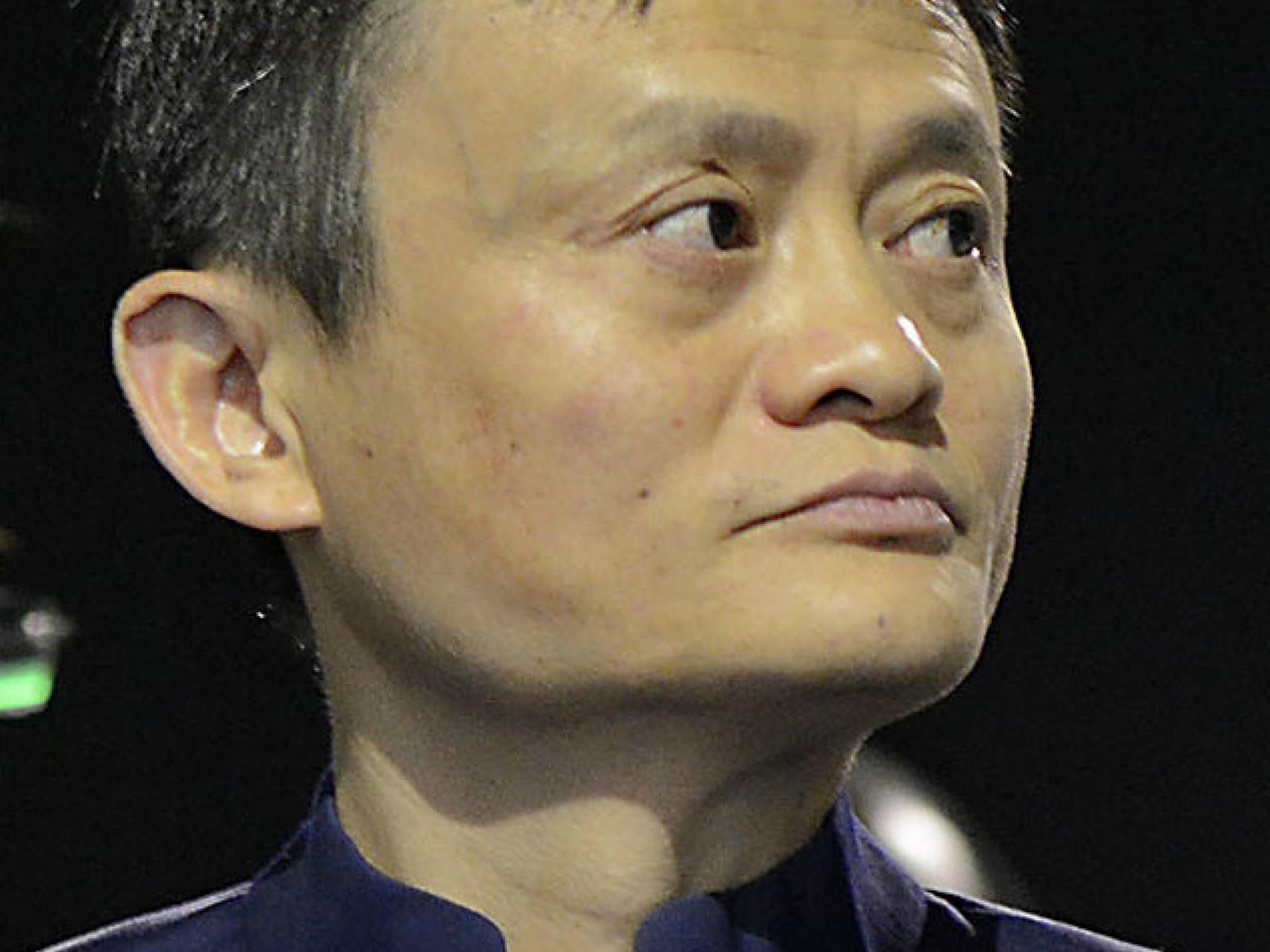

Photo via Wikimedia Commons