Chinese e-commerce giant, Alibaba Group Holding Ltd. (NYSE:BABA), is set to release its second-quarter results on Tuesday. Ahead of the earnings, a prominent analyst is urging caution, pointing to persistent macro headwinds and deteriorating fundamentals.

Nvidia Chip Ban, Strained Cash Flows

Ahead of the company’s second-quarter results, independent investor Parkev Tatevosian, CFA, highlighted significant headwinds facing it that could weigh on the stock.

This includes no longer having access to Nvidia Corp.’s (NASDAQ:NVDA) prized chips “because of export restrictions,” forcing the Chinese giant to instead rely on “chips from local service providers,” even as it spends “aggressively to expand its data center capacity optimized for artificial intelligence,” in line with American hyperscalers.

See Also: Why Are Shares Of Alibaba Higher Today?

Tatevosian noted that Alibaba is “utilizing larger clusters and larger buildings and larger scale in order to deliver similar results” using the local chips that are far from cutting edge. This leaves it at a disadvantage relative to its U.S.-based peers.

He also highlighted that the company’s profitability metrics have been under pressure for the past several years. “Alibaba's operating cash flow to sales ratio has been declining since 2016, when it peaked at 56%,” he said, noting that it has since declined to 15% in the most recent trailing twelve-month period.

He attributed this to rising competition in the Chinese e-commerce industry, which he said has made it harder to generate similar returns as it had in the past.

Sees Downside Risks For BABA

Despite the stock’s 89.21% year-to-date rally, Tatevosian maintains a neutral stance on it, adding that he sees its fair value “to be worth $141 per share,” which is 12.27% below its current market price at $160.73 per share.

He concluded by reiterating his “hold” rating for the stock, noting that the valuation was “not especially attractive,” with the added risk of heading into its earnings release.

Consensus Estimates Remain Bullish

Heading into its earnings results, the company hit a significant milestone with its Qwen AI app, which is off to a blistering start with 10 million downloads in just its first week.

Prominent Wall Street analyst, however, continue to maintain their bullish stance on the stock, expecting the company to generate $34.43 billion, up from $33.70 billion last year. Earnings, however, are expected to drop to $0.81 per share, from $2.15 in the prior year.

The company has beaten analyst consensus estimates for revenue and earnings for 7 of its last 10 quarterly earnings releases.

Goldman Sachs analysts maintained their buy rating for the stock, while raising their Price Target to $205, from $179, representing an upside of 27.54% from current levels.

Similarly, Benchmark analyst Fawne Jiang recently reiterated their buy rating on the stock, while raising their target to $195, which is an upside of 21.32%. The average consensus Price Target stands at $172.19, an upside of 7.12% from its current level.

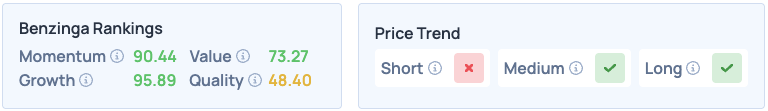

Alibaba’s shares were up 5.10% on Monday, closing at $160.73, and are up 0.94% overnight. The stock scores high on Momentum, Value and Growth in Benzinga’s Edge Stock Rankings, with a favorable price trend in the Medium and Long terms. Click here for deeper insights into the stock, its peers and competitors.

Read More:

Photo courtesy: Shutterstock