Based in Pasadena, California, Alexandria Real Estate Equities, Inc. (ARE) is a top-tier REIT that focuses on properties tailored for the life sciences, agtech, and tech industries. It develops and manages advanced laboratory and office spaces in major innovation hubs, including San Diego, Boston, the Bay Area, and North Carolina’s Research Triangle. The REIT currently has a market capitalization of $13.91 billion.

Serving biotech firms, research institutions, and pharmaceutical companies, Alexandria provides environments that support breakthrough discoveries. The company emphasizes sustainable development and long-term growth, playing a key role in advancing scientific and technological innovation through its strategic, high-performing real estate assets nationwide.

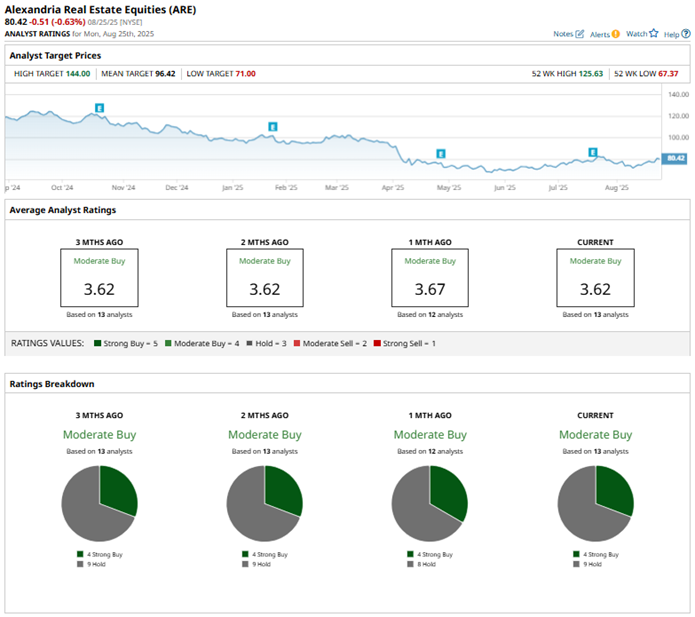

The REIT’s stock has not been performing well for quite some time now. Over the past 52 weeks, Alexandria Real Estate’s shares have declined by 33.7%, while they are down by 17.6% year-to-date (YTD). The stock has broadly underperformed the S&P 500 Index ($SPX), which has gained 14.3% and 9.5% over the same periods, respectively.

Turning our focus to the sector-specific The Real Estate Select Sector SPDR Fund (XLRE), we see that the ETF has declined by 2.9% over the past 52 weeks and gained 3.6% YTD, thereby outperforming Alexandria Real Estate’s stock.

In July, Alexandria Real Estate signed a 16-year lease agreement with a longtime multi-national pharmaceutical tenant for a build-to-suit research hub spanning over 466,598 rentable square feet (RSF) in San Diego. This is the largest life sciences lease in the company's history.

On July 21, the REIT reported its Q2 results for fiscal 2025. Its total revenues dropped marginally year-over-year (YOY) to $762 million. However, this was higher than the $750.6 million top line that Wall Street analysts had expected. Its FFO also declined by 1.3% to $2.33 per share, but this was higher than the $2.29 per share that Wall Street analysts had expected. The stock increased by 3.1% intraday on July 22 on the back of the better-than-expected results.

For the fiscal year 2025, ending in December 2025, Wall Street analysts expect the REIT’s bottom line to decline by 2.5% YOY to $9.23 per share on a diluted basis and by 7.4% to $8.55 per share in fiscal 2026. The company has a mixed history of surpassing consensus estimates, topping or meeting them in three of the trailing four quarters and missing them on one other occasion.

Among the 13 Wall Street analysts covering Alexandria Real Estate’s stock, the consensus is a “Moderate Buy.” That’s based on four “Strong Buy” ratings and nine “Hold” ratings. This configuration has remained relatively stable over the past three months.

Wall Street analysts are currently recommending caution on Alexandria Real Estate’s stock. In July, analysts at RBC Capital maintained the stock’s rating at “Sector Perform,” while lowering the price target from $100 to $98. RBC Capital analyst Michael Carroll noted the company’s position within its sector.

Alexandria Real Estate’s mean price target of $96.42 indicates a 19.9% upside over current market prices. The Street-high price target of $144 implies a potential upside of 79.1%.

On the date of publication, Anushka Mukherjee did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.