Financial management plays a huge role in our lives, whether it is managing a family budget, running a small business or a large corporation. Effective money management is the most important criterion for success and growth. With the advancement of technology, there are apps created specifically for this purpose. They help track income and expenses, analyze trends and patterns, and provide advice on how to improve finances.

Smart budget: concept and principles

A smart budget is a system for planning and controlling expenses and income, which uses modern technologies and methods to optimize the financial resources of an organization. It allows users to take into account many factors, such as current business needs, projected changes in the market situation, seasonal factors and other external influences on business processes. A smart budget also provides the ability to analyze expense and revenue data, identify opportunities to save money, and make informed and sound decisions about managing the company's finances.

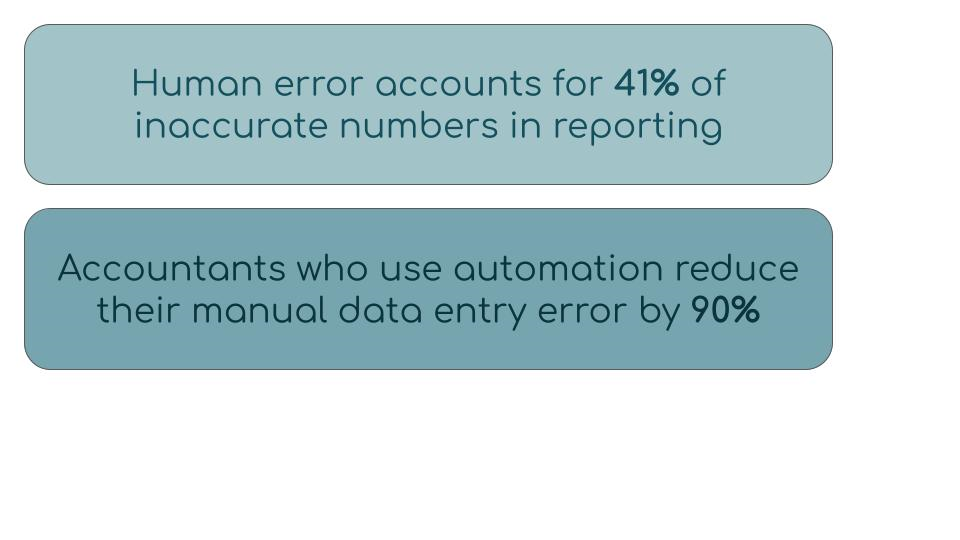

There are a few basic principles of smart budgeting. One of them is the automation of accounting processes and cash flow analysis. It significantly speeds up processes and saves time, reduces the likelihood of errors and improves the accuracy of results. According to a report by Sage [3], as early as 2020, 91% of accountants surveyed believed that new technologies benefit their business, increase productivity and give them more time to work directly with clients.

The use of modern technologies and methods to optimize finances allows not only to increase the efficiency of the use of available resources, but also to develop new business development strategies based on the data obtained. It is also important for companies to take into account a variety of factors affecting business processes, including external conditions and internal processes. This accounting allows clients to optimize current operations and develop new development strategies based on the obtained data. Using information about business goals and planning, it is possible to identify the most promising areas of development and develop appropriate action plans.

Financial management software development

Software development is a multifaceted process consisting of several stages. The first stage is planning. At this point are formalized the main problems that the application will solve and collected data to make a detailed plan. At the next stage the received data is analyzed in order to develop application's functions, tools and design. The design includes the concept of visual style and the design of interface elements. At the implementation stage, the product itself is created, which then needs to be tested and integrated. It is important to check that the application complies with the requirements, eliminate deficiencies and check the quality of the resulting product. One should not forget about the technical maintenance of the product after its implementation, and the need for further development - in today's IT world it is impossible to remain competitive without continuous improvement of the product and adjustment to market changes.

There are many technologies and platforms for software development. The choice of programming language will determine the speed of application development, its testing and changes, the speed of the product itself, the requirements for hardware and required software products. The choice of database type depends on the purpose of the application, the size and structure of the data, performance requirements and compatibility with other systems. Frameworks and libraries should be chosen based on the purpose, size and complexity of the project, as well as the experience of the developers. The use of cloud platforms is influenced by scalability, geographic distribution and availability, security and reliability requirements. The use of blockchain technology offers new opportunities but may be restricted by legislation. The use of mobile platforms depends on functional requirements and budget. When developing software, it is worth considering all of these issues at the planning stage.

-4.png)

Features of financial management applications for an organization

When developing financial management software, it is necessary to consider the specific needs of customers and target countries. They will depend on the type of business, size and structure of the company, specifics of financial activities, legislation, reporting requirements. Financial management should provide flexible customization of parameters and functionality according to the company's needs. Different levels of information protection are a prerequisite: from data encryption and access level to prevention of information leaks and protection from external threats. According to statistics [4] 43% of cyberattacks are directed at small businesses, with only 14% of companies managing to effectively mitigate risks.

It is worth considering that in most cases the application must provide different levels of security clearance to protect business data. It can also be profitable to offer training programs for company personnel.

It is necessary to work out the possibility of scaling the business without retooling the entire system. Consider that many organizations already use accounting systems and the ability to integrate with the most popular systems on the market will be a significant competitive advantage. Some companies may require specialized modules, for example, to work with government reporting in their area of business. Having the ability to quickly implement such adjustments can also make the application stand out favorably.

Benefits and potential of smart budgeting

Using a smart budget presents a number of significant advantages. The app automatically tracks expenses and income, which frees up time and simplifies the financial management process. It analyzes financial flows helping to identify areas to optimize and improve your financial situation. Smart Budget provides recommendations for optimizing spending, investing, and managing finances based on data analysis. The app also helps you form short and long-term financial goals, gives you the tools to achieve them. Through data analysis and recommendations, Smart Budget helps create a more sustainable financial platform. Data analysis allows you to make informed decisions based on real financial performance and trends, which reduces risk and ensures financial stability. In addition smart budgets often provide the ability to integrate with other financial management tools and bank accounts for more complete and accurate analysis.

Smart budgets have significant development potential. Integration with artificial intelligence and the use of machine learning will provide more accurate analytics and personalized recommendations. In addition such applications will offer more sophisticated analytical tools for forecasting and trend analysis to help make more informed financial decisions.

It is becoming evident that modern technology presents unique opportunities to optimize financial management. A smart budget is no longer just a set of tools but a powerful platform for making informed decisions, improving efficiency and ensuring financial sustainability. An important success criterion is software customization tailored to the specific needs of each organization. The future of financial management awaits more innovative solutions that improve the accuracy of forecasting and the implementation of smart budgeting is not only becoming an integral component of modern business but also laying the foundation in the long-term financial well-being of the company.

Sources:

[1] How To Build AI-Driven Financial Applications - A Product Owner's Guide, Mobidev (https://mobidev.biz)

[2] How Does Custom Financial Software Development Work?, RND Point (https://rndpoint.com)

[3] Report The Practice of Now 2020. Insight and practical advice for today's accountants and bookkeepers based on the latest independent research, Sage (https://sage.com)

[4] SMALL BUSINESS PLAYBOOK Cyberattacks now cost companies $200,000 on average, putting many out of business, CNBC (https://cnbc.com)