With a market cap of $9.5 billion, Albemarle Corporation (ALB) is a global leader in specialty chemicals with strong positions in high-growth markets such as energy storage, mobility, and advanced materials. Operating through its Energy Storage, Specialties, and Ketjen segments, the company serves diverse industries including automotive, electronics, pharmaceuticals, and clean energy.

Shares of the Charlotte, North Carolina-based company have underperformed the broader market over the past 52 weeks. ALB stock has risen 2.3% over this time frame, while the broader S&P 500 Index ($SPX) has gained 19.7%. Moreover, Albemarle stock has dipped 9.7% on a YTD basis, compared to SPX's 8.8% return.

Looking closer, the specialty chemicals company stock has slightly outpaced the Materials Select Sector SPDR Fund's (XLB) marginal increase over the past 52 weeks.

Despite Albemarle’s better-than-expected Q2 2025 adjusted EPS of $0.11 and revenue of $1.3 billion on Jul. 30, shares fell 1.5% the next day due to lingering concerns over the lithium market. Lithium prices have plunged more than 90% in the past two years, pressuring margins and driving Albemarle to cut jobs, cancel projects, including a key U.S. refinery and lower its annual capital expenditure guidance to $650 million - $750 million.

For the fiscal year ending in December 2025, analysts expect ALB's loss per share to improve 11.5% year-over-year to $2.07. The company's earnings surprise history is mixed. It beat the consensus estimates in two of the last four quarters while missing on two other occasions.

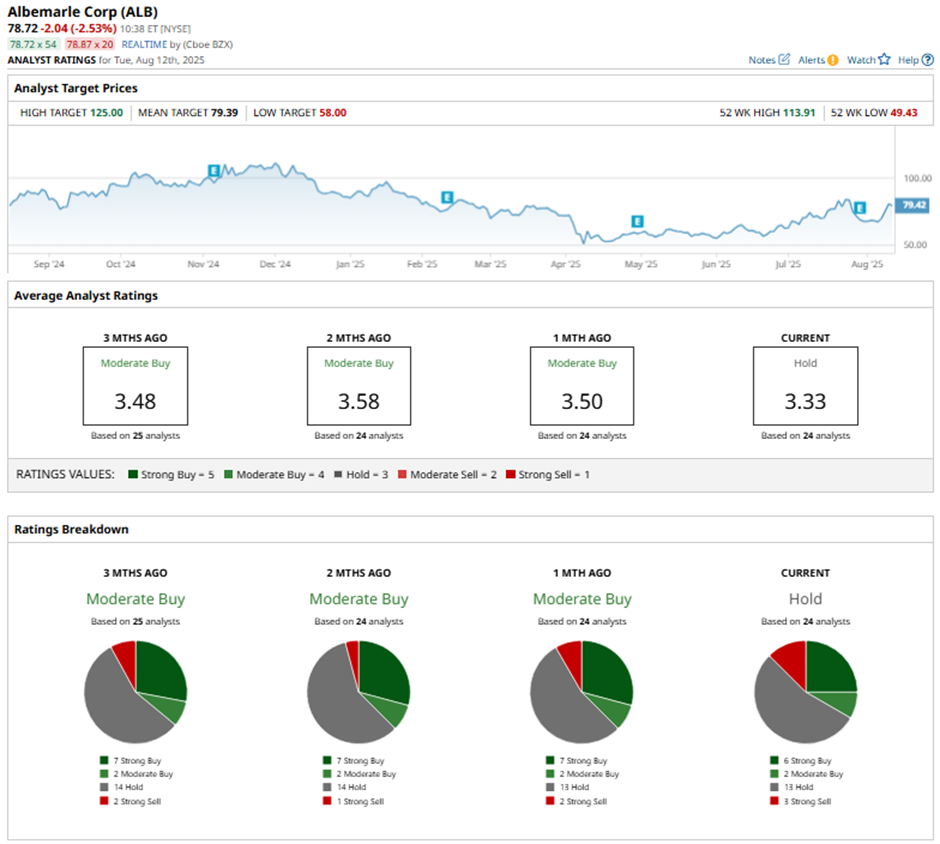

Among the 24 analysts covering the stock, the consensus rating is a “Hold.” That’s based on six “Strong Buy” ratings, two “Moderate Buys,” 13 “Holds,” and three “Strong Sells.”

This configuration is slightly less bullish than three months ago, with seven “Strong Buy” ratings on the stock.

On Aug. 1, Scotiabank raised Albemarle’s price target to $70 with a “Sector Perform" rating.

As of writing, the stock is trading below the mean price target of $79.39. The Street-high price target of $125 implies a potential upside of 58.8% from the current price levels.