Airbnb on Monday filed for a $1 billion initial public offering, which is expected to price in December.

Financials: Airbnb reports nearly a $700 million net loss on $2.5 billion in revenue for the first nine months of 2020, versus a $322 million net loss on $3.7 billion in revenue for the year earlier period. But it also reports $219 million in profits for the third quarter of 2020, as bookings rebounded.

What Airbnb is saying:

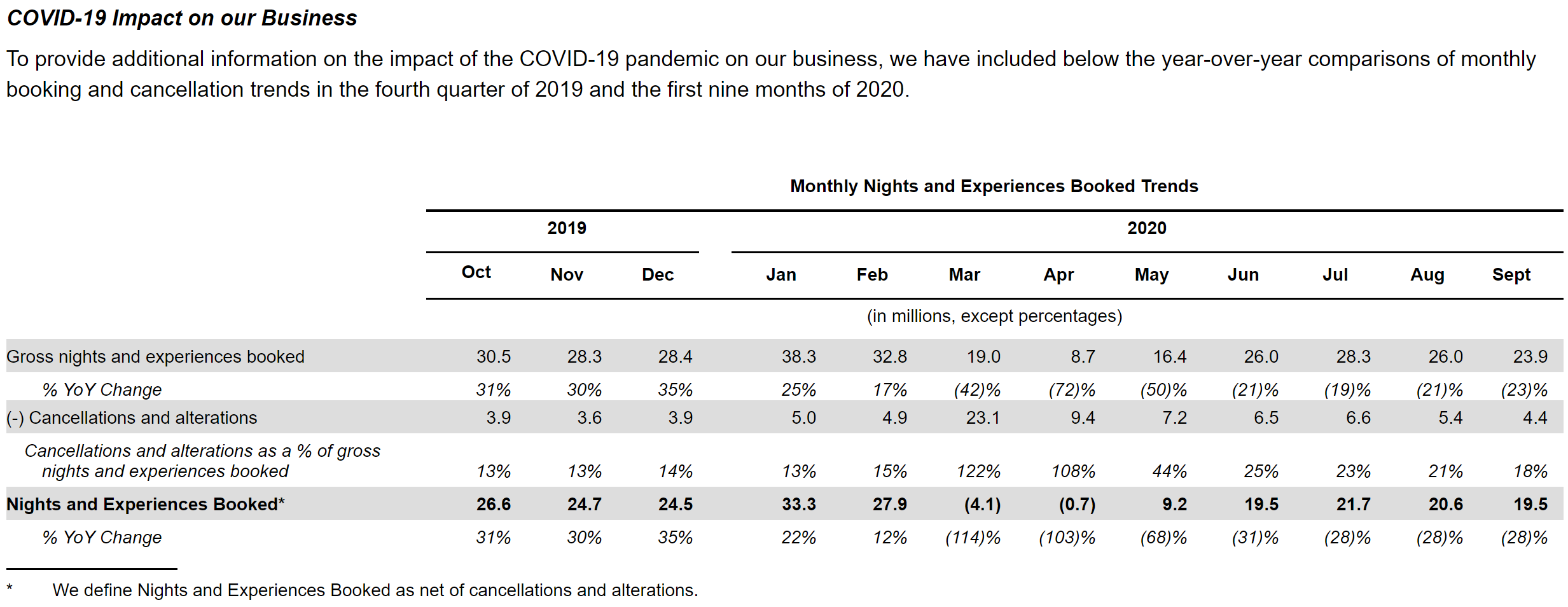

The company also provided more granular detail of what it says was the pandemic's impact on its business:

Investors: Airbnb raised approximately $6.4 billion from venture capital and private equity firms. It was valued at $31 billion in a late 2017 round, but at only $18 billion when it secured an emergency equity and debt round in the pandemic's early days.

- Major shareholders include Silver Lake, Sequoia Capital, Sixth Street, Founders Fund, Accel, DST Global and Greystar Real Estate.

- The company had around $4.5 billion of cash on its balance sheet, though the end of September.

IPO details: Airbnb plans to list on the Nasdaq under ticker symbol ABNB, with Morgan Stanley and Goldman Sachs as lead managers.

- It's unclear if Airbnb plans to raise around $1 billion, or if that's just a placeholder figure that will be fleshed out more in an amended filing.

Coming attractions: Other big tech companies expected to file for IPOs this week include Affirm, Roblox and Wish.