/Airbnb%20Inc%20phone%20app%20by%20-%20Tada%20Images%20via%20Shutterstock.jpg)

San Francisco, California-based Airbnb, Inc. (ABNB) provides a marketplace that connects hosts and guests online or through mobile devices to book rooms, spaces, and experiences. With a market cap of $79.1 billion, Airbnb operates across various countries in the Americas, the Indo-Pacific, Africa, Europe, and the Middle East.

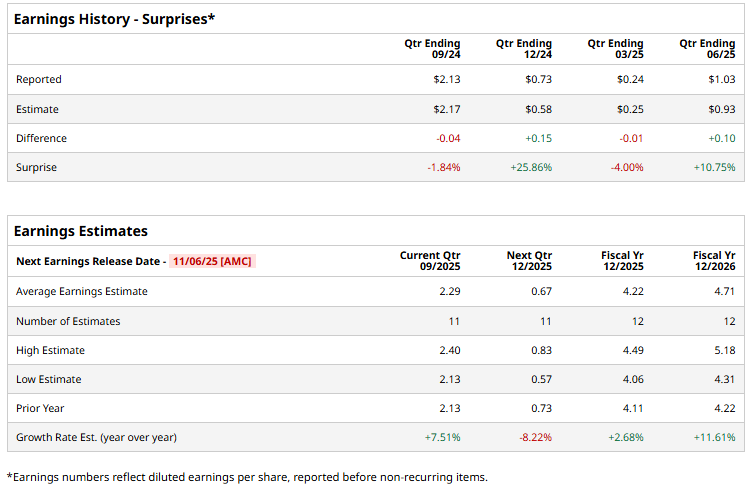

The travel-tech giant is set to unveil its Q3 results after the market closes on Thursday, Nov. 6. Ahead of the event, analysts expect ABNB to report a non-GAAP profit of $2.29 per share, up 7.5% from $2.13 per share reported in the year-ago quarter. While the company has surpassed Wall Street’s earnings projections twice over the past four quarters, it has missed the estimates on two other occasions.

For the full fiscal 2025, ABNB is expected to deliver an adjusted EPS of $4.22, up 2.7% from $4.11 reported in 2024. In fiscal 2026, its earnings are expected to further grow 11.6% year-over-year to $4.71 per share.

ABNB stock prices have declined 6.3% over the past 52 weeks, notably underperforming the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 20.8% surge and the S&P 500 Index’s ($SPX) 15.1% returns during the same time frame.

Despite reporting better-than-expected financials, Airbnb’s stock prices plummeted 8% in the trading session following the release of its Q2 results on Aug. 6. Despite global economic uncertainty early in the quarter, travel demand picked up, and nights booked on Airbnb accelerated from April to July. The company’s topline for the quarter grew 12.7% year-over-year to $3.1 billion, beating the Street’s expectations by 2%. Further, its EPS soared 19.8% year-over-year to $1.03, surpassing the consensus estimates by 10.8%.

However, analysts and investor sentiments were impacted by the company’s dim Q3 guidance. Airbnb expects to observe a notable slowdown in topline growth and margin pressure in the coming quarters.

Analysts remain cautious about the stock’s prospects. ABNB has a consensus “Hold” rating overall. Of the 42 analysts covering the stock, opinions include 12 “Strong Buys,” one “Moderate Buy,” 23 “Holds,” one “Moderate Sell,” and five “Strong Buys.” Its mean price target of $142.09 suggests a 10.5% upside potential from current price levels.