Valued at a market cap of $65.7 billion, Air Products and Chemicals, Inc. (APD) is a top provider of atmospheric gases, process and specialty gases, equipment, and related services in the Americas, Asia, Europe, and internationally. The Allentown, Pennsylvania-based company is all geared to post its Q3 earnings on Thursday, Jul. 31, before the market opens.

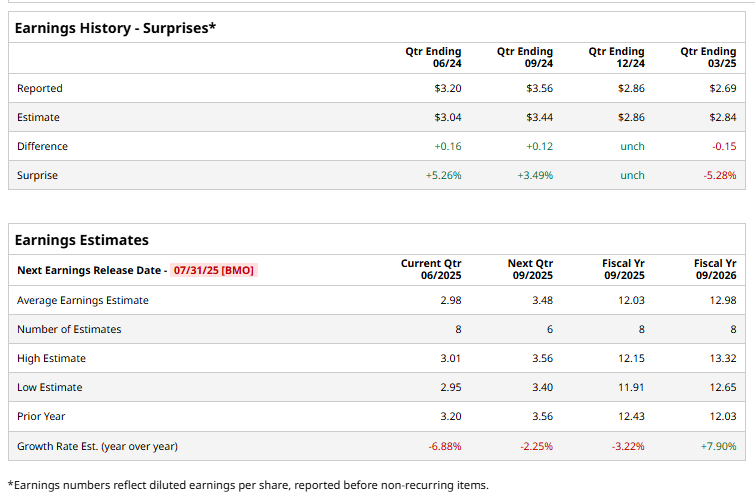

Ahead of the event, analysts expect APD to report an EPS of $2.98 per share, down 6.9% from $3.20 per share reported in the year-ago quarter. It has exceeded or met analysts' earnings estimates in three of the past four quarters, while missing in the last quarter.

For fiscal 2025, analysts expect APD to report an EPS of $12.03, down 3.2% from $12.43 in fiscal 2024. However, in fiscal 2026, its adjusted EPS is expected to grow 7.9% year-over-year to $12.98.

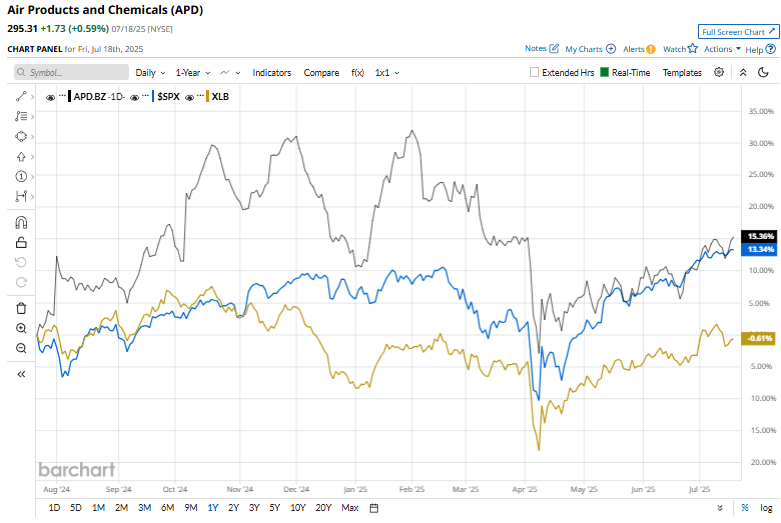

Over the past year, APD shares have surged 10.8%, trailing the S&P 500 Index’s ($SPX) 13.6% gains but surpassing the Materials Select Sector SPDR Fund’s (XLB) marginal fall over the same time frame.

On Jul. 18, APD shares soared marginally after the company announced a quarterly dividend of $1.79 per share, payable on November 10, 2025, to shareholders of record as of October 1, 2025. This continued dividend payout reflects Air Products' ongoing commitment to delivering value to its shareholders and maintaining a strong track record of consistent dividend distributions.

The consensus opinion on APD stock is moderately optimistic, with an overall “Moderate Buy” rating. Out of the 23 analysts covering the stock, 13 recommend a “Strong Buy,” one advises a “Moderate Buy,” eight suggest a “Hold,” and the remaining analyst gives a “Moderate Sell.” Its mean price target of $325 indicates a 10.1% upside potential from current price levels.