/AI%20(artificial%20intelligence)/Close-%20up%20of%20computer%20chip%20with%20AI%20sign%20by%20YAKOBCHUK%20V%20via%20Shutterstock.jpg)

Taiwan Semiconductor Manufacturing Company (TSMC) (TSM) delivered another quarter of solid growth powered by surging demand for its leading-edge process technologies. TSMC's third-quarter results emphasized the company's vital role in the global semiconductor ecosystem, as artificial intelligence (AI), high-performance computing (HPC), and next-generation smartphones drive structural demand for advanced chips.

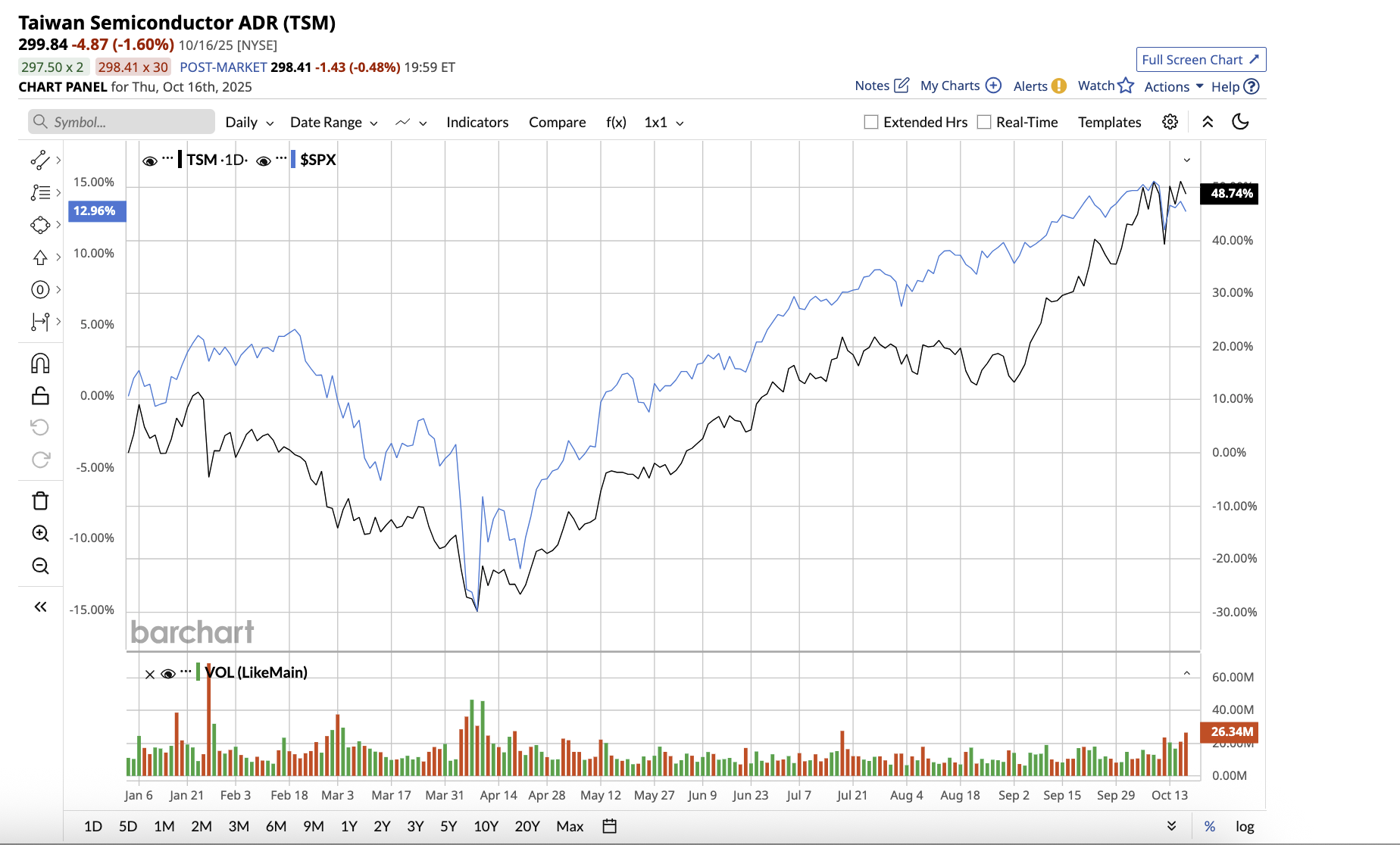

TSMC's stock has risen 52% year to date but is down 3.6% from its 52-week high of $311.37. Should you seize this opportunity to buy TSMC stock on the dip?

TSMC: AI Demand Is Explosive

In the third quarter ended Sept. 30, total revenue surged 40.8% year-over-year to $33.1 billion. This growth was driven primarily by robust orders for the company’s 3-nanometer (N3) and 5-nanometer (N5) process technologies, which together accounted for the vast majority of wafer revenue. Gross margin increased to 59.5% due to cost savings and higher capacity utilization, while earnings per share increased 39% year over year. Advanced nodes (7-nanometer and lower) accounted for 74% of wafer revenue, confirming TSMC's ongoing leadership in cutting-edge semiconductor production.

TSMC’s business mix reveals how AI demand is altering its revenue base. The HPC segment remained stable, accounting for 57% of overall revenue, boosted by continuous AI infrastructure expenditures. Smartphone revenue rebounded sharply, climbing 19% quarter over quarter, contributing 30% to total sales, boosted by new product releases and a comeback in device demand.

Other end markets, such as Internet of Things (IoT) and automotive, grew 20% and 18%, respectively, while traditional consumer electronics (TCE) decreased 20%, led by weakness in discretionary spending categories.

During the Q4 earnings call, CEO Dr. C.C. Wei stated that AI-related demand will remain the primary growth driver through 2025 and beyond. He claimed that “the explosive growth in token volume demonstrated increasing consumer AI model adoption, which means more and more computation is needed,” resulting in increased demand for TSMC’s most advanced nodes. Wei also noted that that enterprise AI, consumer AI, and the growing sovereign AI market are all driving long-term growth.

Investing for AI-Led Growth

TSMC is accelerating its global manufacturing plan to satisfy rising AI and semiconductor demand. In the U.S., it is expediting the ramp-up of the Arizona fabs and considering further land acquisitions to create a full gigafab cluster for AI and smartphone chips. In Europe, TSMC has begun construction on its Dresden, Germany, fab with government assistance, while Taiwan remains its primary base, with sustained investments in 2-nanometer and sophisticated packaging facilities.

TSMC has reduced its capital expenditure range for 2025 to $40 billion to $42 billion, with about 70% allocated to advanced process technologies and up to 20% for specialty technologies, packaging, and testing. This aggressive investment highlights the company’s belief in the AI megatrend, which continues to drive structural demand for advanced chips.

Management stressed that larger capital expenditures lead to stronger future growth, and the company remains dedicated to profitable expansion and a sustainable, rising dividend. Despite these significant investments, TSMC ended the quarter with a strong balance sheet, totaling $90 billion in cash and marketable securities.

Looking ahead, TSMC anticipates fourth-quarter 2025 revenue of $32.2 billion to $33.4 billion, a 22% year-over-year rise at the midpoint. This estimate is based on an exchange rate of 1 U.S. dollar to 30.6 NT dollars. The company projected a gross margin of 59% to 61%, demonstrating resilience in the face of rising offshore manufacturing costs and currency headwinds.

TSMC enters 2026 with unrivaled strength. Its next-generation 2-nanometer technology is about to enter commercial production, and advanced packaging will grow rapidly in both Taiwan and the U.S. Analysts covering the stock estimate 40% growth in revenue by 2025, as well as a 46.3% increase in profitability. Furthermore, analysts anticipate that revenue and earnings will increase by 19.4% and 19.2% in 2026, respectively. Given its position as the world’s top contract chipmaker, TSMC is a reasonable AI stock to buy now, trading at 24 times forward earnings.

What Is Wall Street’s Take on TSMC Stock?

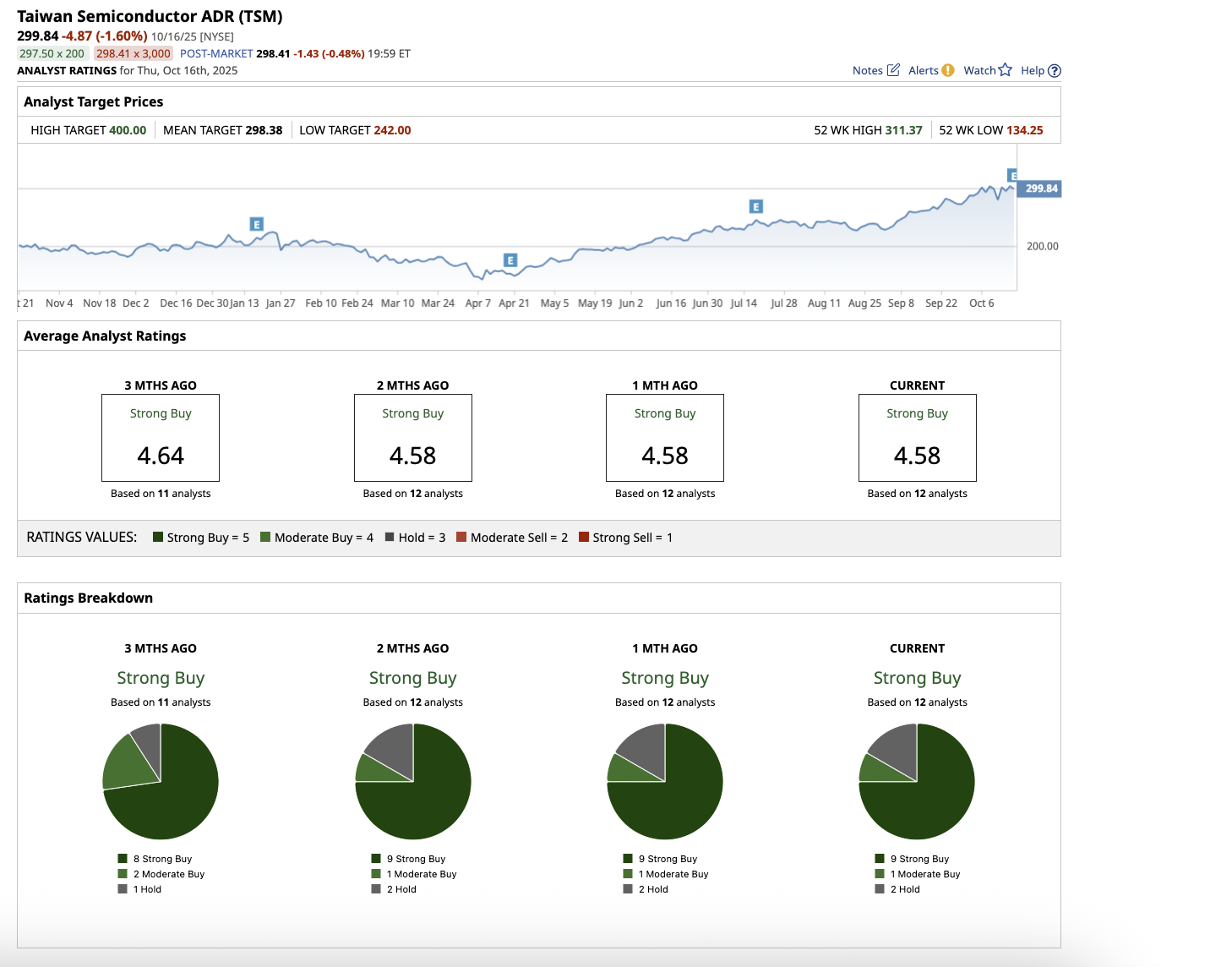

Overall, Wall Street remains strongly bullish on TSM stock. Out of the 12 analysts that cover the stock, nine rate it a “Strong Buy,” one says it is a “Moderate Buy,” and two rate it a “Hold.” The stock has surpassed its average price target of $298.38. However, its high target price of $400 implies potential upside of 33.4% in the next 12 months.

The Key Takeaway

TSMC is on track to meet its long-term goal of being the most efficient and cost-effective chip manufacturer in every geography where it operates. By combining unrivaled scale, process innovation, and a disciplined capacity planning system, the firm is well-positioned to benefit from the structural growth generated by AI, HPC, and next-generation computing, making it an excellent buy-and-hold semiconductor stock for the long term.