/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)

The next big chapter in investing is already taking shape, and one company is right at the heart of it. Artificial intelligence (AI) is no longer just a buzzword; it’s quickly becoming the engine driving businesses, innovation, and the global economy. And if you ask Wall Street, this AI boom is still in its early innings.

Nvidia (NVDA), the powerhouse behind the chips fueling this revolution, has moved beyond being a mere player in the AI story to become the backbone of it. The company's recent deal with OpenAI is only fueling the optimism further.

On Sept. 22, Nvidia announced a landmark strategic partnership with OpenAI to deploy at least 10 gigawatts of Nvidia systems for OpenAI’s next-generation AI infrastructure. Nvidia intends to invest up to $100 billion in OpenAI progressively as each gigawatt is deployed, with the first gigawatt of Nvidia systems slated for deployment in the second half of 2026 on the Nvidia Vera Rubin platform.

So, for anyone wondering if they’ve already missed the boat, Nvidia’s run may just be getting started.

About Nvidia Stock

Nvidia is a global leader in accelerated computing and AI, renowned for pioneering the graphics processing unit (GPU) that revolutionized gaming, data centers, and AI-driven computing. Headquartered in Santa Clara, California, Nvidia’s technology now powers everything from high-performance gaming and cloud computing to autonomous vehicles and generative AI applications. With a market capitalization of roughly $4.45 trillion, Nvidia stands among the world’s most valuable companies, driven by its dominance in AI infrastructure and continued innovation in next-generation chip design.

Over the past year, NVDA stock has delivered a strong performance, climbing by 36%. Year-to-date (YTD), the stock has continued to show upward momentum, outperforming broad market indices as investors double down on AI bets. The stock has gained a little over 36% YTD, compared to the S&P 500 Index’s ($SPX) 11% returns. NVDA stock reached a fresh 52-week high of $195.62 on Oct. 10, reflecting market confidence in Nvidia's AI growth narrative and reinforcing its status as a high-conviction tech holding. Despite some occasional pullbacks, the overall trend has remained decidedly bullish.

Nvidia’s dominant position in AI and investor expectations for future growth have led it to a pronounced premium valuation compared to industry peers, trading at 44.69 times forward earnings. However, Nvidia’s valuation is below its own historical averages.

Nvidia's Steady Q2 Performance

Nvidia reported its fiscal second-quarter 2026 earnings on Aug. 27, delivering impressive financial results that underscore its leadership in AI infrastructure. The company posted $46.7 billion in revenue, marking a 56% year-over-year (YOY) increase. Nvidia also saw adjusted EPS of $1.05, a 54% YOY rise and surpassing analyst expectations.

A significant contributor to this growth was Nvidia’s Data Center segment, which generated $41.1 billion in revenue, up 56% YOY. The company’s Blackwell architecture played a pivotal role, with its Blackwell Data Center revenue growing 17% sequentially.

Additionally, Nvidia benefited from the release of previously reserved H20 inventory, amounting to $180 million, and approximately $650 million in unrestricted H20 sales to a customer outside of China.

Further, Nvidia provided guidance for Q3 2026, projecting $54 billion in revenue, plus or minus 2%. That figure excludes potential H20 sales to China, which remain uncertain due to export restrictions. The company also announced an additional $60 billion in share repurchase authorization, reflecting confidence in its long-term growth prospects.

Analysts tracking Nvidia project the company’s EPS to climb 44% YOY to $4.21 in fiscal 2026, then grow another 40% to $5.91 in fiscal 2027.

What Do Analysts Expect for Nvidia Stock?

Cantor Fitzgerald remains firmly bullish on Nvidia. Cantor analysts reaffirmed Nvidia as their top semiconductor pick after the company's new partnership with OpenAI, calling it a major step in cementing Nvidia’s role at the core of global AI infrastructure. While some investors worry about a potential “AI bubble,” Cantor dismissed those concerns, emphasizing that AI growth is still in its early stages. The firm reiterated its “Overweight” rating and $240 price target on NVDA stock.

Cantor projects that Nvidia could eventually reach a $10 trillion market cap, citing massive demand for processing power driven by test-time scaling and multimodal AI advancements. Cantor also noted that cloud providers and governments are racing to expand AI infrastructure, requiring fresh financing models and partnerships, and Nvidia’s efforts to support emerging Tier 2 cloud players could further ignite innovation and competition across the sector.

Late last month, KeyBanc also raised its price target on Nvidia to $250 from $230, maintaining an “Overweight” rating. KeyBanc cited strong growth in AI chip demand and robust financial performance. The firm highlighted increased Chip-on-Wafer-on Substrate (CoWoS) supply for the year, revised for 2025 to 530,000 interposers, representing 40% YOY growth.

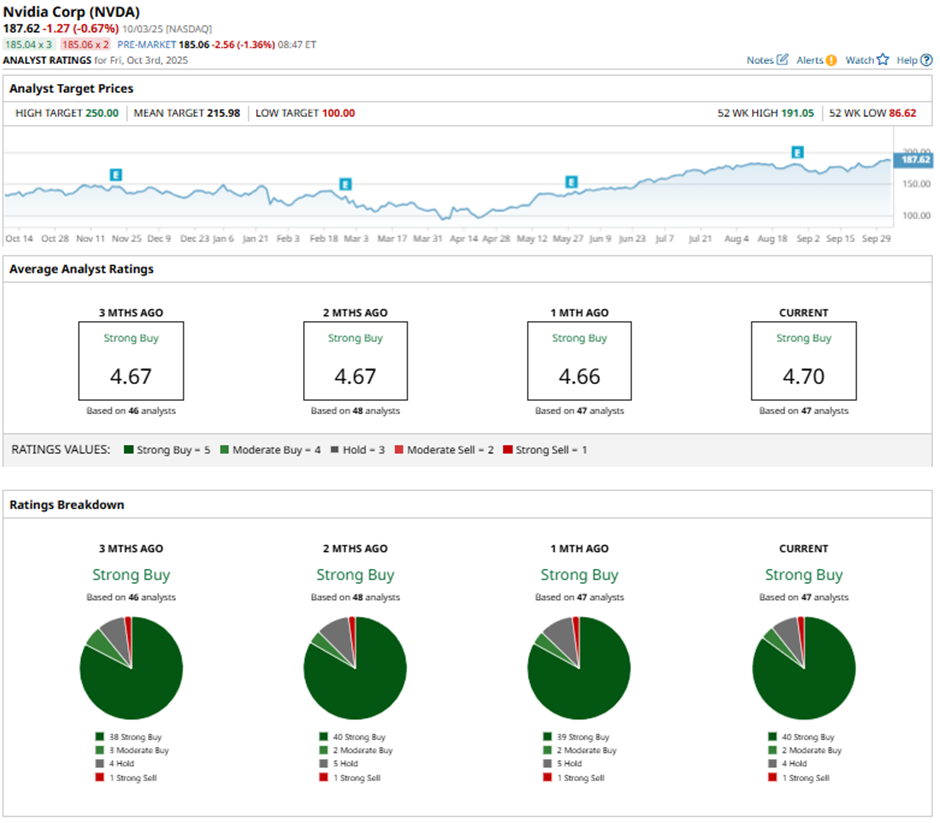

Wall Street’s bullishness is evident in Nvidia having a consensus “Strong Buy” rating. Of the 47 analysts covering the stock, 40 advise a “Strong Buy,” two suggest a “Moderate Buy,” four analysts are on the sidelines with a “Hold” rating, and one analyst offers a “Strong Sell” rating.

The average analyst price target for NVDA stock is $218.53, indicating potential upside of 19% from current levels. The Street-high target price of $300 suggests that NVDA could rally as much as 64% from here.