/Agilent%20Technologies%20Inc_%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

Agilent Technologies, Inc. (A) is a leading company in laboratory instrumentation, software, services and consumables, serving the life-sciences, diagnostics and applied chemical markets. The company has evolved into a specialist in analytical and testing solutions for research, biotech, environmental, food-safety and clinical laboratories. Headquartered in Santa Clara, California, the company has a market cap of $41.6 billion. The company is set to release its fiscal fourth-quarter earnings soon.

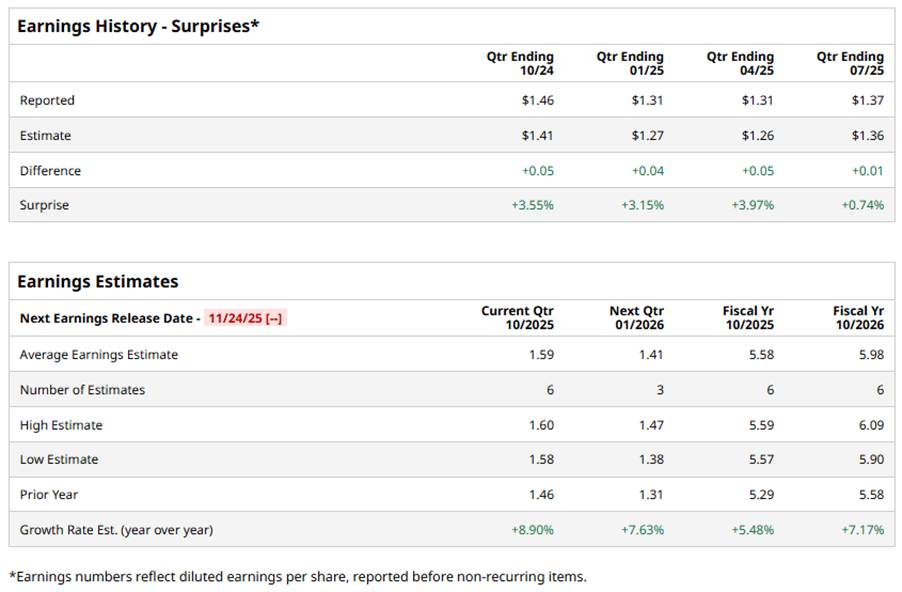

Ahead of the event, analysts expect Agilent Technologies to report a profit of $1.59 per share on a diluted basis, up 8.9% from $1.46 per share in the year-ago quarter. The company has consistently surpassed Wall Street’s EPS estimates in all of its last four quarterly reports.

For the current year, analysts expect Agilent Technologies to report EPS of $5.58, up 5.5% from $5.29 in fiscal 2024. Moreover, its EPS is expected to rise by roughly 7.2% year over year (YoY) to $5.98 in fiscal 2026.

Shares of Agilent Technologies have increased 12.6% over the past year, trailing the S&P 500’s ($SPX) 18.4% gains but far outpacing the Health Care Select Sector SPDR Fund’s (XLV) 1.5% dip over the same time frame.

Agilent’s share price has been trending upward thanks to a mix of solid earnings beats, positive guidance, and heightened investor confidence. In its last reported quarter (Q3 2025), the company posted revenue growth of 10.1% YoY and outperformed analyst expectations. Also, non-GAAP EPS stood at $1.37, up 4% annually and surpassed the consensus estimate. Agilent is well-positioned in the life-sciences/diagnostics segment, a space expected to grow strongly, providing the stock with a structural tailwind.

Analysts’ consensus opinion on the stock is fairly bullish, with a “Moderate Buy” rating overall. Among the 16 analysts covering the stock, nine are recommending a “Strong Buy,” while the remaining seven suggest a “Hold” for the stock. A’s average analyst price target is $151.92, indicating an upside of 3.6% from the current levels.