Nio Inc. (NYSE:NIO) was surging over 5% in the premarket Tuesday after a bullish Monday caused the stock to rally 3.91%.

The spike comes on the heels of a speech made by Chinese President Xi Jinping, in which he laid out the communist party’s agenda for the next five years, including a commitment to investing in technology. The news boosted a number of China’s home-based tech stocks, including Nio, a Tesla rival.

A bullish day in the general markets also helped Nio to close higher Monday and on Tuesday momentum appeared to be entering into the market, pushing the S&P 500 up over 2% in the premarket.

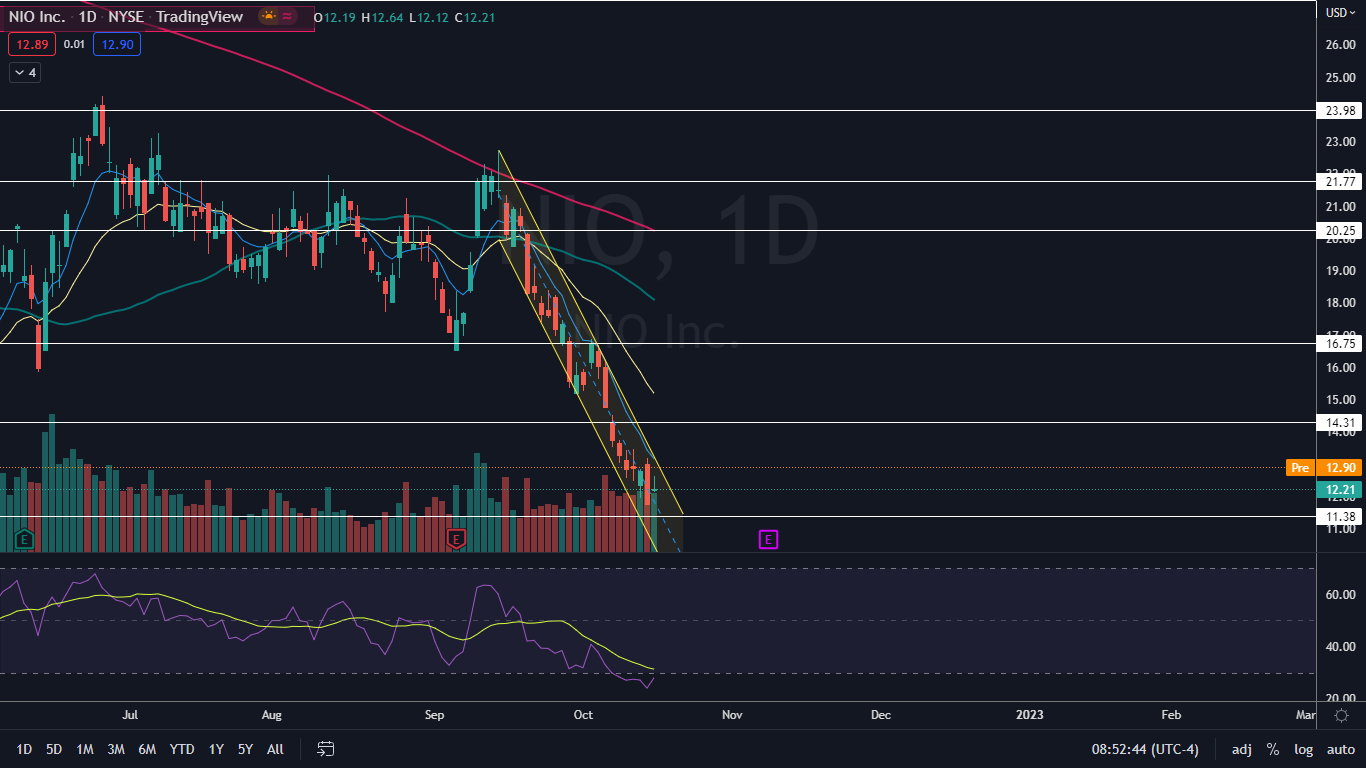

Although Nio has been trading in a downtrend since Sept. 15, when the stock attempted and failed to gain the 200-day simple moving average as support, a larger bounce looks to be on the horizon. Traders will be watching to see if Nio can pop up above Friday’s high-of-day, which could negate the current downtrend.

Want direct analysis? Find me in the BZ Pro lounge! Click here for a free trial.

The Nio Chart: Nio’s most recent lower high within the downtrend was formed on Oct. 12 at $13.46 and the most recent confirmed lower low was printed at the 11.73 mark on Monday. On Monday, Nio printed an inside bar, with all the price action taking place within Friday’s trading range.

- On Tuesday, Nio looked to be opening with a double inside bar on the daily chart. Bullish traders will want to see the stock break up from Friday’s mother bar on higher-than-average volume, which could indicate a bull cycle is on the horizon, although the overall trend is still bearish.

- Within the downtrend, Nio is trading in a falling channel pattern, which is considered bearish until the stock breaks up from the upper descending trendline of the formation. If Nio breaks up from Friday's mother bar, traders will want to see continuation push the stock up through the top of the channel.

- A bounce is the most likely scenario because Nio’s relative strength index (RSI) has been measuring in below 30% since Oct. 7. When a stock’s RSI falls below that level, it becomes oversold, which can be a buy signal for technical traders.

- Nio has resistance above at $14.31 and $16.75 and support below at $11.38 and the psychologically important $10 mark.

Image: NIO Office (Flickr/BFI Shadow)