Redbox Entertainment Inc. (RDBX) in New York City operates a network of more than 38,000 self-service kiosks across the United States, wherein customers can rent or purchase DVDs or Blu-ray discs. It also operates a film distribution label subsidiary Redbox Entertainment, LLC, ad-supported transaction service Redbox Free On Demand, and ad-supported television service Redbox Free Live TV, among others.

RDBX went public through a reverse merger on Oct. 25, 2021, with blank-check company Seaport Global Acquisition Corp. The merged company had an enterprise value of $693 million. RDBX raised $209 million in cash from the business combination, which it planned to use to reduce existing debt and fund business expansion, content acquisition, and marketing initiatives.

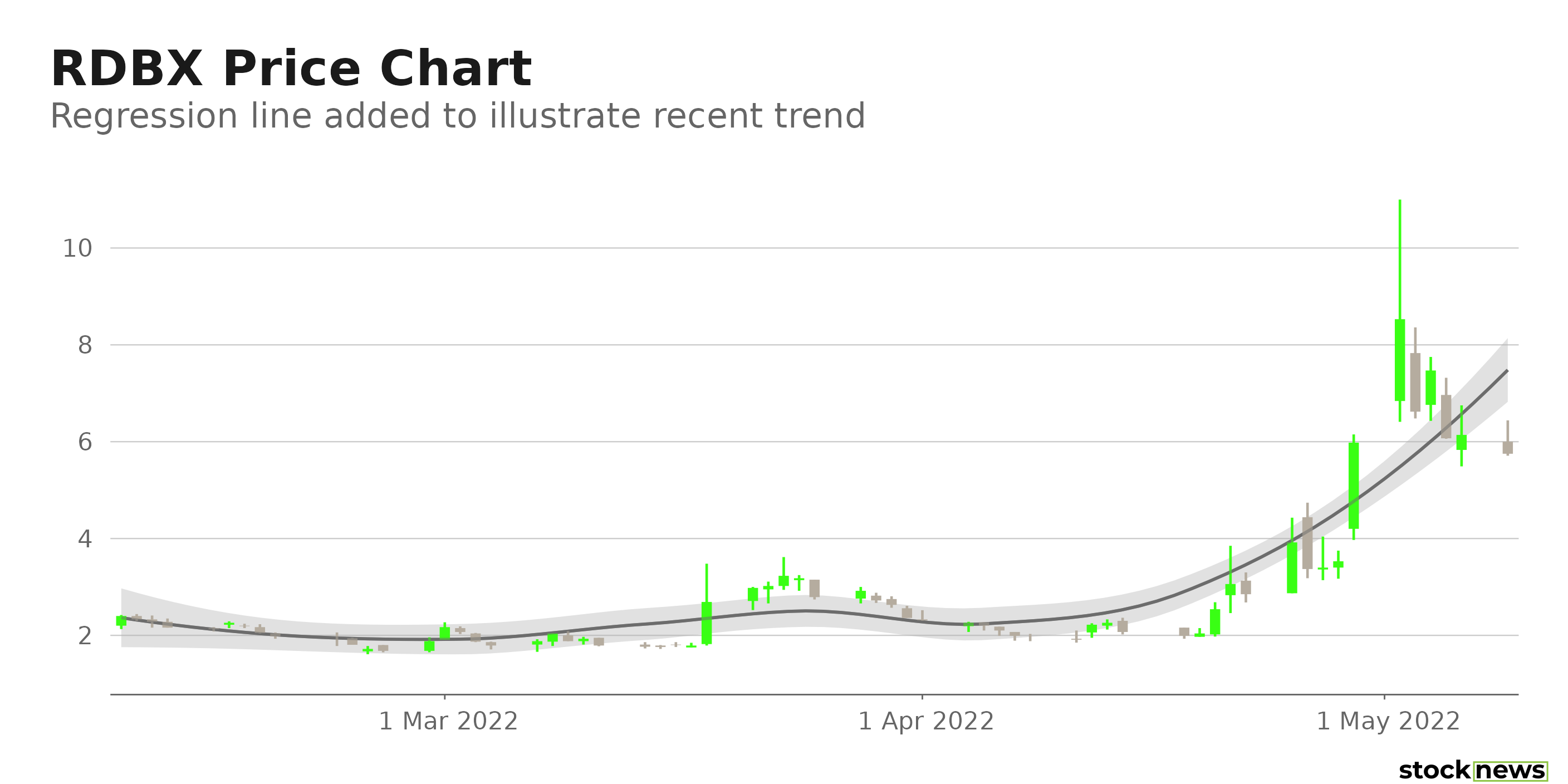

However, RDBX stock has declined 48.4% in price since its stock market debut. Nevertheless, the company’s shares have gained 211% over the past month amid increased retail investor attention. In fact, meme investors are betting on RDBX as “the ultimate penny stock squeeze play.”

Here is what could shape RDBX’s performance in the near term:

Poor Financials

For the year ended Dec. 31, 2021, RDBX’s revenues declined 47.2% year-over-year to $288.54 million. Its gross margin came in at $173.40 million, down 46.7% from the same period last year. Its adjusted EBITDA loss amounted to $15.15 million, compared to a $113.78 million profit reported in the prior year. Also, its loss before taxes and net loss worsened 84.6% and 102.5% from the year-ago values to $174.79 million and $140.76 million, respectively.

Doubt Regarding Going Concern Operations

RDBX’s business was adversely impacted by the COVID-19 pandemic last year and further exacerbated by the spread of the Omicron variant. RDBX’s retail footprint declined slightly in its fiscal 2021. Its total number of locations fell 3.2% year-over-year to 32,586 as of Dec. 31, 2021. Furthermore, its total number of kiosks fell 4.3% from the same period last year to 38,379.

RDBX’s history of recurring losses, accumulated deficit, and negative working capital has caused management to raise substantial doubt over the company’s ability to continue operating as a going concern. Given its poor cash flows and negative profit margins, RDBX might find it difficult to raise additional capital to finance its operations or refinance its corporate debt.

Potential Short Squeeze

Since mid-March, investors have been heavily shorting RDBX. As of April 15, 1.20 million RDBX shares have been sold short, marking a 20% increase from March 15. Its current short-interest ratio is 0.4. And approximately 13.59% of RDBX’s total floating shares are currently held short.

Consensus Rating and Price Target Indicate Potential Downside

Among the four Wall Street analysts that rated RDBX, three rated it Buy, while one rated it Hold. However, the 12-month median price target of $5.33 indicates a 13.2% potential downside from Friday’s closing price of $6.14.

POWR Ratings Reflect Bleak Prospects

RDBX has an overall F rating, which equates to a Strong Sell in our proprietary POWR Ratings system. The POWR Ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

RDBX has an F grade for Sentiment and a D for Quality. Analysts expect RDBX’s loss per share to widen 314.2% year-over-year to $2.40, which is in sync with the Sentiment grade. Also, the company’s negative profit margins justify the Quality grade.

Among the eight stocks in the F-rated Entertainment – Movies/Studios industry, RDBX is ranked at last.

Beyond what I have stated above, view RDBX’s ratings for Growth, Momentum, Value, and Stability here.

Bottom Line

RDBX has been gaining momentum due primarily to increased meme investor attention because its poor financials and bleak growth prospects do not support its current valuation. The stock’s EV/EBITDA multiple is negative 11.27. Amid a resurgence of COVID-19 cases and aggressive interest rate hikes, the company’s growth prospects remain bleak for the near term. Thus, we think RDBX is best avoided now.

RDBX shares were trading at $5.77 per share on Monday morning, down $0.37 (-6.03%). Year-to-date, RDBX has declined -22.13%, versus a -15.26% rise in the benchmark S&P 500 index during the same period.

About the Author: Aditi Ganguly

Aditi is an experienced content developer and financial writer who is passionate about helping investors understand the do’s and don'ts of investing. She has a keen interest in the stock market and has a fundamental approach when analyzing equities.

After Surging More Than 200% in the Past Month, is Redbox Still a Buy? StockNews.com

._Patrick_s_Day_Parade_94380.jpg?w=600)