/Unitedhealth%20Group%20Inc%20logo%20on%20phone-by%20rafapress%20via%20Shutterstock.jpg)

UnitedHealth Group (UNH), the nation's largest private health insurer, has had a challenging 2025. Shares are down 29% year to date (YTD), wiping out years of steady gains and eroding investor confidence in a company long seen as nearly impenetrable in terms of scale and execution. The stock has even dipped 43% from its 52-week high of $630.73.

Yet, beneath the current turbulence sits a company with unmatched reach, diversified business lines, and a renewed focus on operational discipline. UnitedHealth has faced crises before and rebounded. The key question for investors is whether today’s valuation reset presents a rare buying opportunity to buy this blue-chip stock. Let’s find out.

About UnitedHealth

Valued at $326.2 billion, UnitedHealth is one of the largest healthcare companies in the world and the biggest health insurer in the U.S. The company has two segments: UnitedHealthcare, which is the insurance arm, and Optum, which is the healthcare services and technology arm. Together, UnitedHealth blends insurance, medical care delivery, and healthcare data analytics, giving it a unique position across the entire U.S. healthcare ecosystem.

Growth Despite Pressure

UnitedHealth’s second-quarter results revealed a company in transition. Revenues are surging, reflecting the breadth of the business, but earnings remain under pressure as medical cost trends, ACA exchange headwinds, and Optum execution challenges weigh on profitability.

In Q2, UnitedHealth reported total revenue of nearly $111.6 billion, up 12.8% year-over-year (YoY). Growth came from both UnitedHealthcare and Optum, highlighting the company's broad reach across insurance, care delivery, and pharmaceutical services. However, adjusted earnings per share of $4.08 fell short of the year before, owing to rising medical expenditures and pricing misalignments.

Optum Health's revenues declined to $25.2 billion, a $1.8 billion decrease from the year before, due to Medicare funding cuts and contract modifications. Meanwhile, Optum Insight's revenues increased 6% YoY to $4.8 billion, driven by the ongoing recovery from last year's cyberattack. Still, development is slower than planned, resulting in a lower full-year forecast. The unit’s contract revenue backlog reached $32.1 billion, signaling strong demand. Management stated that Optum Rx remains a bright spot. Revenue increased 19% to $38.5 billion in the second quarter, boosted by specialty drugs and new customer additions.

Building Toward 2026 and Beyond

UnitedHealth is set to report its third-quarter earnings on Oct. 28. Analysts expect the company to report $113.9 billion in revenue, a 13% increase YoY, while earnings may fall to $2.29 per share.

Chairman Stephen Hemsley stressed that 2025 is a year of reset. Challenges are clear, as is the plan for overcoming them. Adjusted earnings per share are expected to be approximately $16 per share for the full year, with revenue reaching $448 billion, representing an 11% YoY increase. The full-year 2025 forecast includes $1 billion in potential additional settlements on top of the amounts already recorded.

Looking ahead, management expects moderate earnings growth in 2026 as stabilizing efforts take root. Management further anticipates a steeper turn toward greater profit growth in 2027 and beyond, driven by value-based care maturation, Optum Insight recovery, and continuing momentum at Optum Rx. Analysts expect the company’s earnings to decline by 41.3% to $16.2 per share in 2025, before increasing by 11.4% in 2026. With a forward P/E ratio of around 19x, the stock is trading lower than its five-year historical average of 25x.

Despite its challenges, UnitedHealth remains committed to returning to its shareholders. It offers a steady dividend yield of 2.46%, which exceeds the healthcare sector average of 1.58%. The company has hiked its dividend for the past 16 years and even increased its dividends by 5% in June. Its reasonable payout ratio of 50% is another feature appealing to dividend-seeking investors. The company remains committed to maintaining a balance between buybacks, the pending Amedisys acquisition, and a strong balance sheet.

What Does Wall Street Say About UNH Stock?

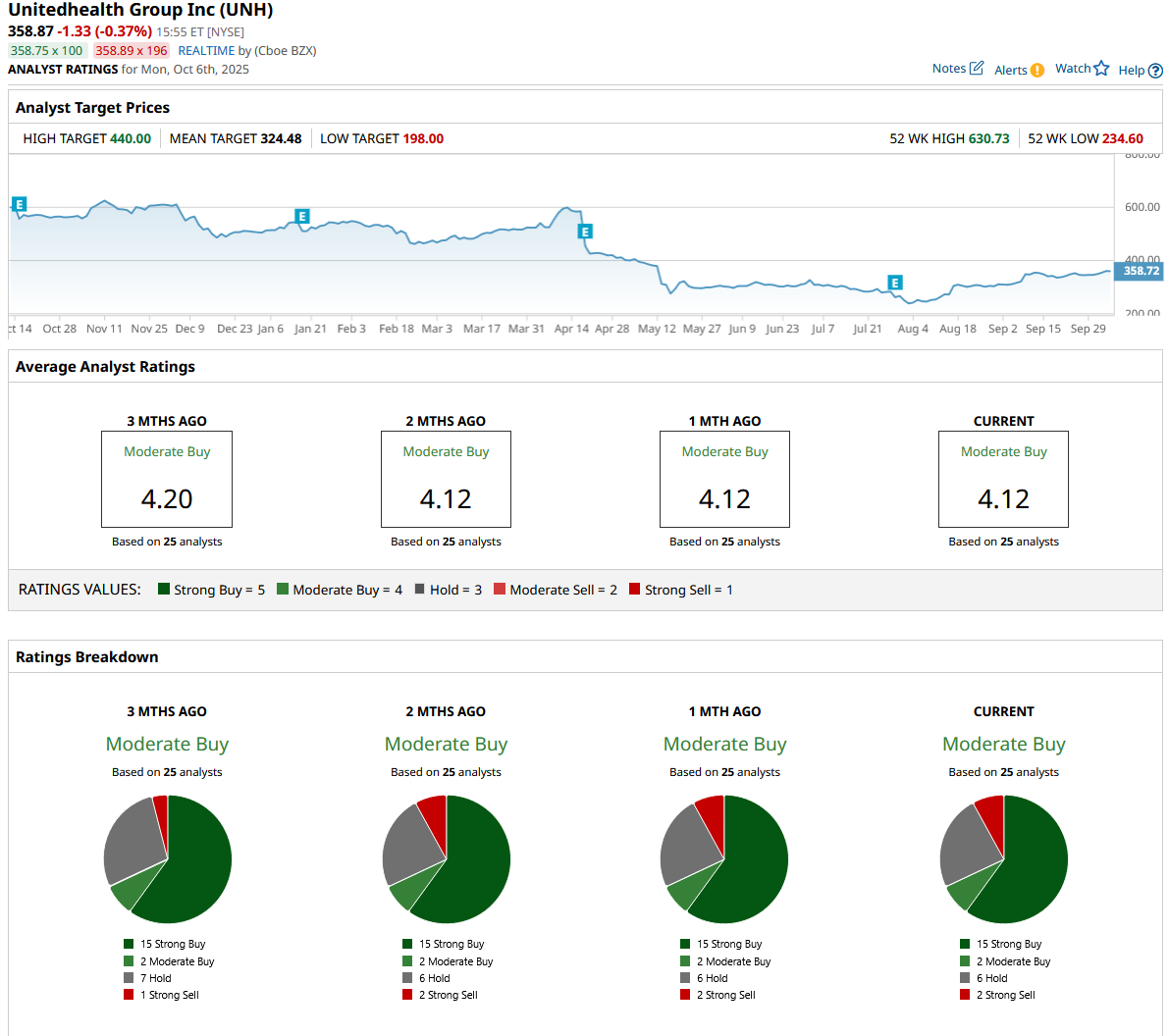

Overall, UNH stock is a “Moderate Buy” on Wall Street. Of the 25 analysts that cover the stock, 15 rate it a “Strong Buy,” two say it is a “Moderate Buy,” six rate it a “Hold,” and two say it is a “Strong Sell.” The stock has surpassed its average analyst target price of $324.48. But the Street-high estimate of $440 implies UNH stock can rally as much as 23% over the next 12 months.

The path laid out by management suggests a gradual turnaround: 2026 as a foundation year, 2027 as the start of renewed growth, and beyond that a steady climb. For long-term investors, the message is one of cautious patience that UnitedHealth is pulling back to move forward. However, risk-averse investors may want to avoid the stock until its near-term issues are resolved and the company's fundamentals stabilize.