With a market cap of $10.2 billion, The AES Corporation (AES) is a global power generation and utility company that provides affordable and sustainable energy through a diverse portfolio of thermal and renewable assets. It operates approximately 32,000 megawatts of generation capacity and distributes electricity to 2.7 million customers worldwide.

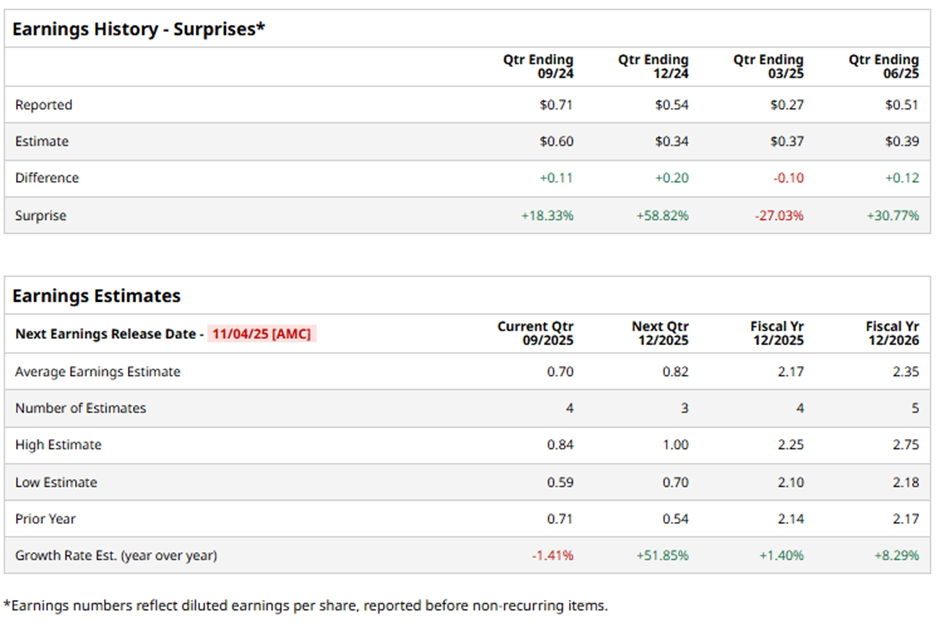

The Arlington, Virginia-based company is expected to unveil its fiscal Q3 2025 results after the market closes on Tuesday, Nov. 4. Before the event, analysts anticipate the power company to report an adjusted EPS of $0.70, down 1.4% from $0.71 in the year-ago quarter. The company has surpassed Wall Street's bottom-line estimates in three of the past four quarters while missing on another occasion.

For fiscal 2025, analysts expect AES to report adjusted EPS of $2.17, up 1.4% from $2.14 in fiscal 2024. Moreover, adjusted EPS is projected to rise 8.3% year-over-year to $2.35 in fiscal 2026.

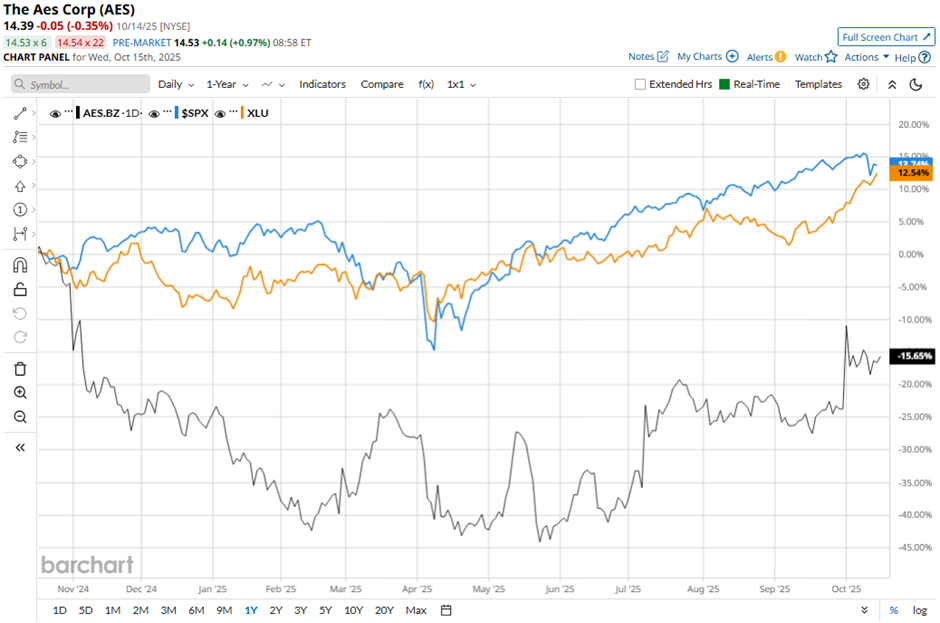

AES' shares have dipped 16.2% over the past 52 weeks, underperforming both the S&P 500 Index's ($SPX) 13.4% gain and the Utilities Select Sector SPDR Fund's (XLU) 14.1% increase over the same period.

Shares of AES rose marginally following its Q2 2025 report on Jul. 31 because adjusted EPS of $0.51 beat the consensus estimate, reflecting a 34.2% year-over-year increase driven by lower taxes and new renewable projects. Investors were also encouraged by AES signing 1.6 GW of new solar and wind PPAs with data center companies, boosting its total backlog to 12 GW, including 5.2 GW under construction.

Additionally, the company reaffirmed its 2025 adjusted EPS guidance of $2.10 - $2.26 and maintained its 7% - 9% annual growth target through 2027.

Analysts' consensus rating on AES stock is cautiously optimistic, with an overall "Moderate Buy" rating. Out of 12 analysts covering the stock, opinions include five "Strong Buys," five "Holds,"one "Moderate Sell," and one "Strong Sell." The average analyst price target for AES is $14.77, indicating a potential upside of 2.6% from the current levels.

.jpg?w=600)