The AES Corporation (AES) is a global energy company headquartered in Arlington, Virginia, operating in over 15 countries. Boasting a market cap of $9.5 billion, AES manages a diverse energy portfolio that includes regulated utilities, renewable power, advanced energy storage, and thermal generation. The company is widely recognized as a leader in battery-based storage solutions and ranks among the world’s top solar developers, playing a key role in accelerating the global transition to clean, reliable energy. The energy titan is set to announce its fiscal Q2 earnings after the market closes on Thursday, July 31.

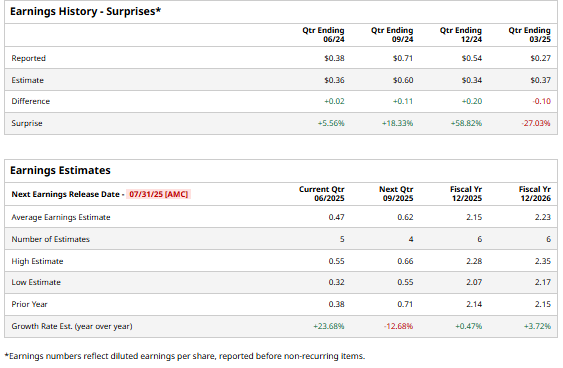

Ahead of this event, analysts expect this utility company to report a profit of $0.47 per share, up 23.7% from $0.38 per share in the year-ago quarter. The company has surpassed Wall Street’s earnings estimates in three of the last four quarters, while missing in the previous quarter.

For fiscal 2025, analysts expect AES to report a profit of $2.15 per share, up marginally from $2.14 from fiscal 2024. Furthermore, its EPS is expected to grow 3.7% year over year to $2.23 in fiscal 2026.

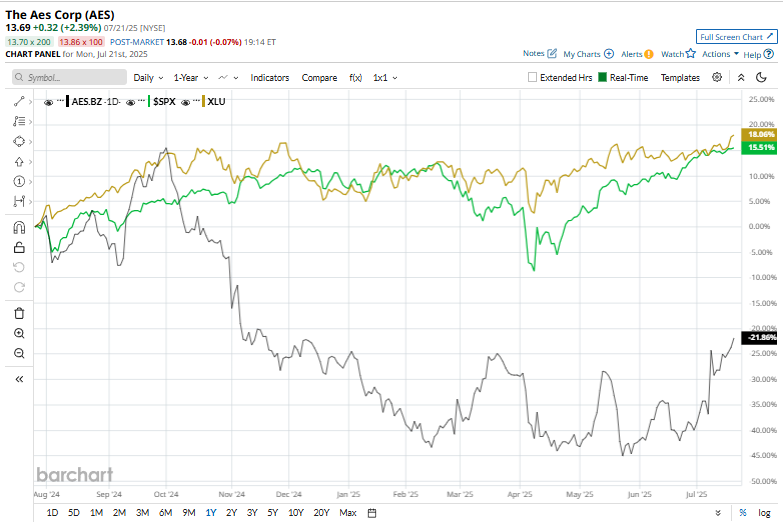

Shares of AES have declined 19.9% over the past 52 weeks, notably underperforming both the S&P 500 Index's ($SPX) 14.5% gain, and the Utilities Select Sector SPDR Fund’s (XLU) 19.8% rise over the same time frame.

On July 9, shares of AES surged nearly 20%, making it the top gainer in the S&P 500, following reports of strong private equity interest in acquiring the company. Firms like Brookfield Asset Management and BlackRock’s Global Energy Partners are reportedly eyeing AES, attracted by its strategic position as a key clean-energy supplier to hyperscalers like Meta Platforms, Inc. (META), Microsoft Corporation (MSFT), and Amazon.com, Inc. (AMZN). AES has reportedly signed contracts totaling 10.1 GW of renewable energy with these AI-driven data center operators.

Wall Street analysts are moderately optimistic about AES’ stock, with a "Moderate Buy" rating overall. Among 11 analysts covering the stock, six recommend "Strong Buy," three suggest “Hold,” one gives a “Moderate Sell,” and one advises a “Strong Sell” rating. The mean price target for AES is $14, which indicates a 2.3% potential upside from the current price levels.