/Advanced%20Micro%20Devices%20Inc_%20logo%20and%20chart%20data-by%20Poetra_%20RH%20via%20Shutterstock.jpg)

Santa Clara, California-based Advanced Micro Devices, Inc. (AMD) produces semiconductor products and devices. Valued at $390.4 billion by market cap, the company offers products such as microprocessors, embedded microprocessors, chipsets, graphics, video, and multimedia products, and supplies them to third-party foundries, as well as providing assembly, testing, and packaging services. The semiconductor giant is expected to announce its fiscal third-quarter earnings for 2025 after the market closes on Tuesday, Nov. 4.

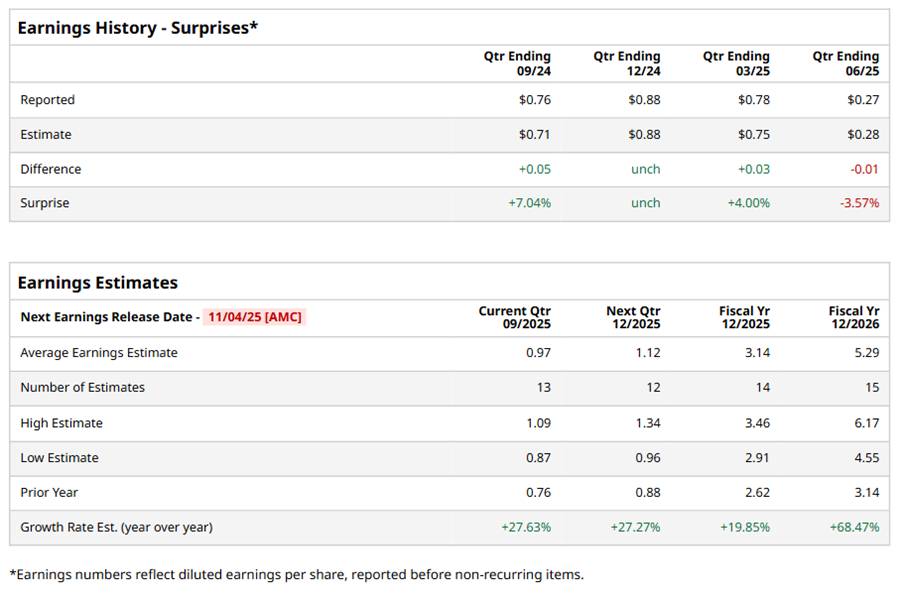

Ahead of the event, analysts expect AMD to report a profit of $0.97 per share on a diluted basis, up 27.6% from $0.76 per share in the year-ago quarter. The company beat or matched the consensus estimates in three of the last four quarters while missing the forecast on another occasion.

For the full year, analysts expect AMD to report EPS of $3.14, up 19.9% from $2.62 in fiscal 2024. Its EPS is expected to rise 68.5% year over year to $5.29 in fiscal 2026.

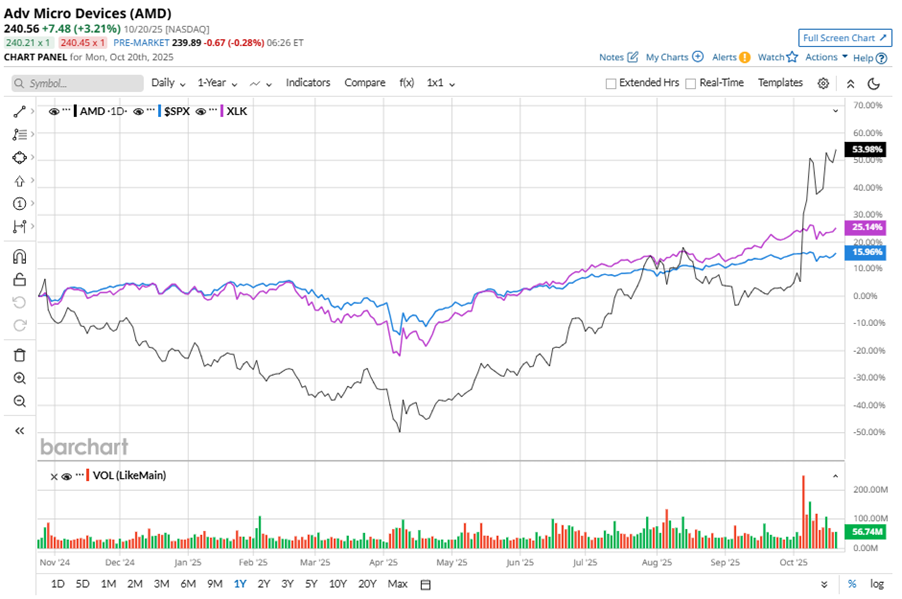

AMD stock has notably outperformed the S&P 500 Index’s ($SPX) 14.8% gains over the past 52 weeks, with shares up 54.2% during this period. Similarly, it outperformed the Technology Select Sector SPDR Fund’s (XLK) 24.8% gains over the same time frame.

AMD's strong performance can be attributed to record sales of Ryzen and EPYC processors, as well as robust demand in the gaming segment. Revenue exceeded expectations, driven by significant growth in the AI, data center, and GPU segments. The company's roadmap includes expanding its AI data center business, with potential for significant revenue growth. AMD anticipates further growth with the launch of its MI350 GPU line and the development of the next-generation MI400 series. Strategic investments in hardware and software capabilities, including recent acquisitions, are strengthening AMD's AI ecosystem. The company's involvement in sovereign AI initiatives worldwide is also contributing to its growth.

On Aug. 5, AMD reported its Q2 results, and its shares closed down more than 6% in the following trading session. Its adjusted EPS of $0.48 exceeded Wall Street expectations of $0.47. The company’s revenue was $7.7 billion, beating Wall Street's $7.4 billion forecast. For Q3, AMD expects revenue in the range of $8.4 billion to $9 billion.

Analysts’ consensus opinion on AMD stock is bullish, with a “Strong Buy” rating overall. Out of 44 analysts covering the stock, 30 advise a “Strong Buy” rating, two suggest a “Moderate Buy,” and 12 give a “Hold.” AMD’s average analyst price target is $252.35, indicating a potential upside of 4.9% from the current levels.