/Adobe%20Inc%20logo%20on%20computer-by%20DANIEL%20CONSTANTE%20via%20Shutterstock.jpg)

San Jose, California-based Adobe Inc. (ADBE) is a leader in digital media and digital experience solutions, empowering individuals and businesses to create, manage, and optimize content across all platforms. Valued at a market cap of $149.8 billion, the company is best known for its industry-defining products, including Photoshop, Illustrator, Premiere Pro, Acrobat, and Adobe Express. It is expected to announce its fiscal Q4 earnings for 2025 on Wednesday, Dec. 10.

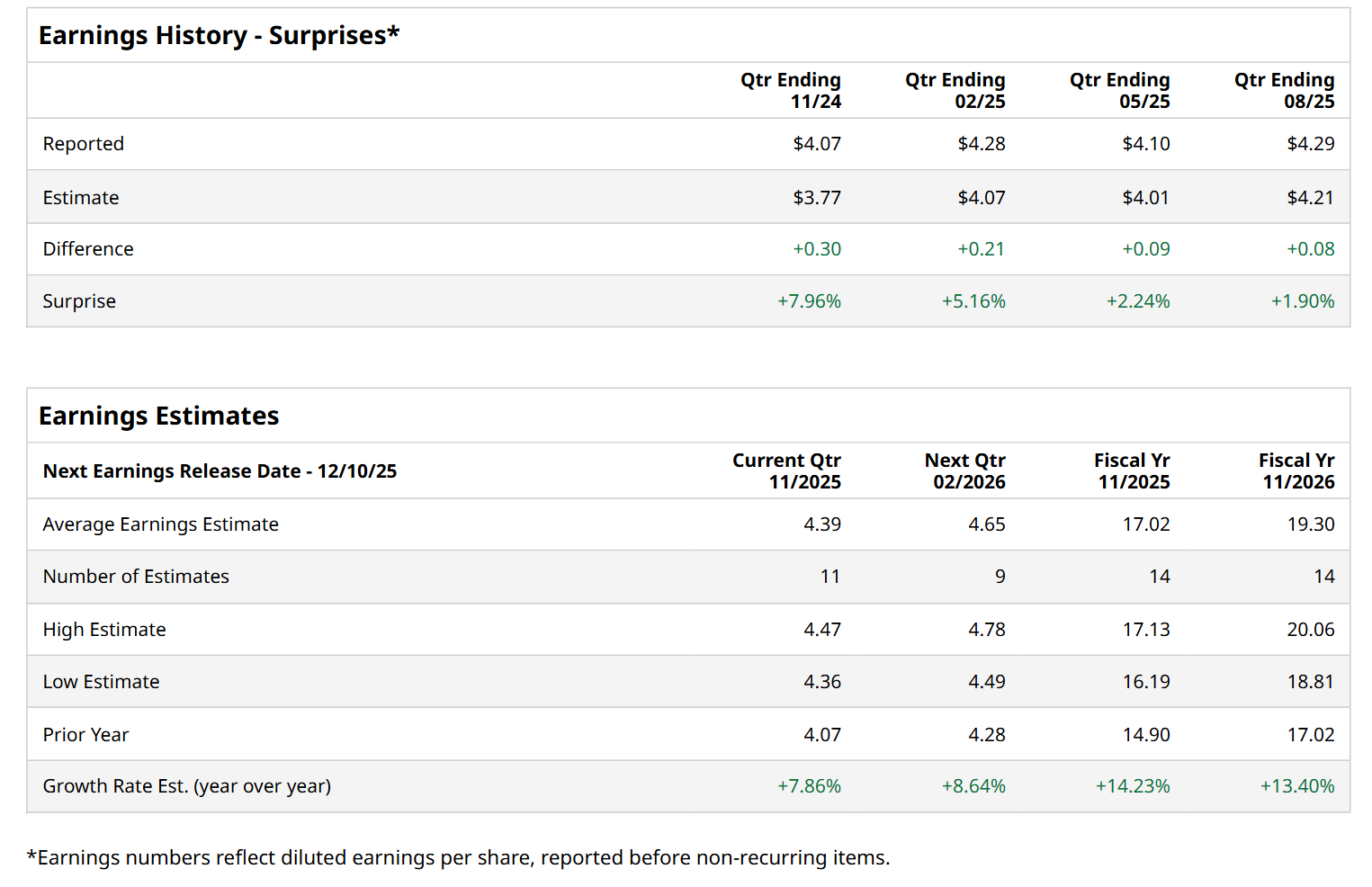

Before this event, analysts expect this photo and video editing software provider to report a profit of $4.39 per share, up 7.9% from $4.07 per share in the year-ago quarter. The company has a promising trajectory of consistently beating Wall Street’s bottom-line estimates in each of the last four quarters. Its earnings of $4.29 per share in the previous quarter outpaced the consensus estimates by 1.9%.

For fiscal 2025, analysts expect Adobe to report a profit of $17.02 per share, representing a 14.2% increase from $14.90 per share in fiscal 2024. Furthermore, its EPS is expected to grow 13.4% year-over-year to $19.30 in fiscal 2026.

Adobe has declined 25.2% over the past 52 weeks, significantly underperforming both the S&P 500 Index's ($SPX) 18.3% return and the Technology Select Sector SPDR Fund’s (XLK) 31.2% uptick over the same time frame.

On Sep. 11, ADBE delivered better-than-expected Q3 results. Due to an 11.8% rise in subscription revenue, the company’s total revenue improved 10.7% from the year-ago quarter to $6 billion, surpassing consensus estimates by 1.5%. Moreover, its adjusted EPS of $5.31 grew 14.2% year-over-year, topping analyst expectations by 2.7%. Additionally, noting this strong momentum, the company raised its fiscal 2025 revenue and EPS guidance. Yet, its shares plunged marginally in the following trading session.

Wall Street analysts are moderately optimistic about Adobe’s stock, with an overall "Moderate Buy" rating. Among 37 analysts covering the stock, 22 recommend "Strong Buy," two indicate "Moderate Buy," 11 suggest "Hold,” and two advise "Strong Sell.” The mean price target for Adobe is $467.91, implying a 30% potential upside from the current levels.