Software giant Adobe Inc. (NASDAQ:ADBE) emphasized AI as its “biggest opportunity” in decades, playing a central role across product adoption and revenue growth.

Check out the current price of ADBE stock here.

AI Represents A ‘Tectonic Shift’

During the company’s third-quarter earnings call on Thursday, CEO Shantanu Narayen said that “AI represents a tectonic technology shift and presents the biggest opportunity for Adobe in decades.” He added that the company's strategy is to embed generative AI across flagship applications while rolling out new AI-first products.

The company said annualized recurring revenue influenced by AI has surpassed $5 billion, as CFO Dan Durn highlights that “ARR from our new AI-first products… has already achieved our end-of-year target of over $250 million.” Narayen added during the call, “We want AI infused in every dollar of revenue.”

Adobe notes that its Firefly creative AI tools have now generated more than 29 billion images, video generations rose nearly 40% from the prior quarter, and Acrobat AI Assistant engagement increased about 50%.

Narayen framed Adobe's future around its continued ability to monetize artificial intelligence, saying, “Our opportunity is to enable every individual and every business to tell their story with the magic of Adobe and the power of AI.”

Stock Climbs On Record Q3 Performance

The company released its third quarter results on Thursday, reporting $5.99 billion in revenue, up 10.72% year-over-year, compared to $5.41 billion a year ago, and ahead of Street estimates at $5.91. It posted a profit of $5.31 per share, which was again ahead of consensus estimates at $5.18.

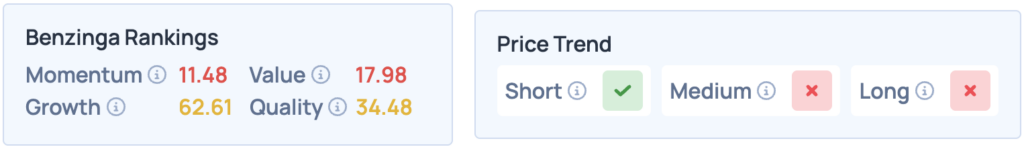

The stock was up 0.11% on Thursday, closing at $350.55, and is up 3.46% pre-market, following its earnings announcement. According to Benzinga’s Edge Stock Rankings, it ranks poorly across most metrics, but has a favorable price trend in the short term. Click here for deeper insights into the stock, its peers and competitors.

Read More:

Photo courtesy: Mats Wiklund / Shutterstock.