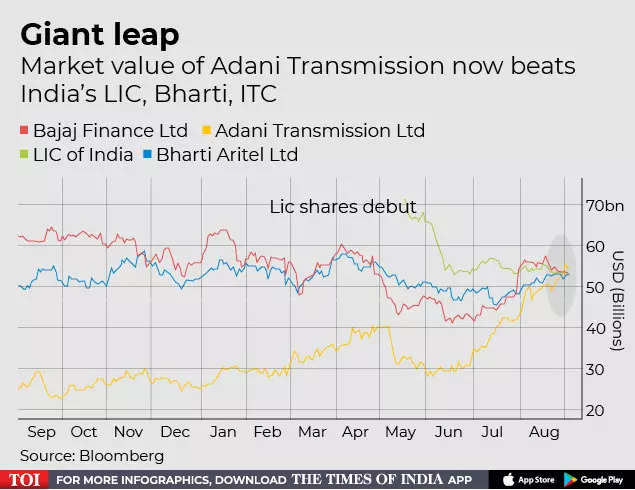

Adani Transmission has blown past entrenched corporate giants to become India’s 10th-largest listed firm by market value as part of a broader runaway rally in Adani Group stocks.

Shares of the New Delhi-based power utility have climbed almost 125% this year, boosting its market capitalization to Rs 4.4 lakh crore ($55.2 billion) in Mumbai on Friday. Its valuation surpassed Life Insurance Corp of India -- the country’s largest insurer -- and cigarettes-to-cookies maker ITC.

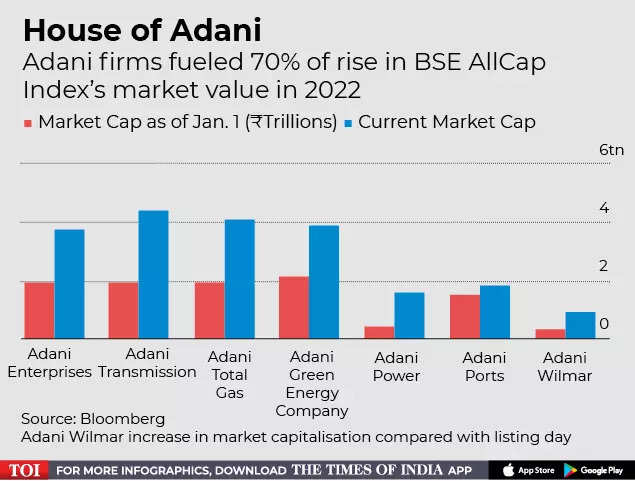

Adani Transmission’s pole-vault up the market capitalization table underpins the broader trend among Adani’s seven listed firms that have fueled a blistering $64 billion surge in the tycoon’s wealth.

With shares of some of his firms gaining over 1,000% since the beginning of 2020, Adani has speedily emerged as the world’s third-richest person with a net worth of almost $141 billion, despite concerns by some analysts around his empire’s debt-fueled expansion and diversification.

There’s also a general sense of puzzlement around why the tycoon’s businesses are trading at far higher valuation ratios than local and global peers, seemingly beyond what their business prospects would justify.

Adani Transmission is trading at more than 300 times its one-year forward earnings, making it the most expensive stock in the sector globally, including American Electric Power Company and Duke Energy Corp, according to data compiled by Bloomberg.

The utility firm’s shares may have been partially buoyed by investor hopes that the Indian government’s attempts to transform the country’s power sector will benefit the nation’s only pure-play, private-sector listed firm in this business. Adani Transmission will be a key beneficiary once changes in electricity distribution are implemented, Lavina Quadros, an analyst at Jefferies India, wrote in a note last month.

But those benefits from reforms are yet to trickle in. Adani Transmission reported a more than 15% drop in profit to 10 billion rupees for the year through March, while revenue surged 13.4%, data compiled by Bloomberg show. Profit for the latest quarter ended June 30 also slipped 57%.

Some analysts question the sustainability of this rally across Adani Group firms.

“Among the biggest foreign investors in some Adani firms are a few Mauritius-based funds, having 95% of their assets in these companies,” according to Bloomberg Intelligence strategist Nitin Chanduka. “Such concentrated positions and negligible onshore ownership, could create asymmetric risk-reward for investors.”